Indian Exchange Highlights: 3 Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

In the last week, the Indian market has been flat, but it has seen a remarkable 45% rise over the past 12 months with earnings forecasted to grow by 17% annually. In this context of robust growth, stocks with strong insider ownership can be particularly appealing as they often signal confidence from those closest to the company’s operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34.2% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.4% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 31.6% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 32.5% | 22.2% |

| Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 32.2% |

| Rajratan Global Wire (BSE:517522) | 18.3% | 35.8% |

| KEI Industries (BSE:517569) | 19.2% | 22.4% |

| Aether Industries (NSEI:AETHER) | 31.1% | 45.9% |

Here's a peek at a few of the choices from the screener.

Info Edge (India) (NSEI:NAUKRI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Info Edge (India) Limited is an online classifieds company focusing on recruitment, matrimony, real estate, and education services both in India and internationally, with a market cap of ₹1.05 trillion.

Operations: The company's revenue primarily comes from its Recruitment Solutions segment, generating ₹19.05 billion, followed by the 99acres Real Estate platform with ₹3.67 billion.

Insider Ownership: 37.7%

Revenue Growth Forecast: 13% p.a.

Info Edge (India) demonstrates strong growth potential with earnings forecasted to outpace the Indian market at 23.6% annually, despite a relatively low projected return on equity of 4.6%. Recent insider activity indicates more shares have been sold than bought in the past three months, suggesting caution. The company recently approved a final dividend of INR 12 per share and plans to invest INR 4.2 Crores in Nexstem India Private Limited, indicating ongoing strategic expansion efforts.

- Click here and access our complete growth analysis report to understand the dynamics of Info Edge (India).

- According our valuation report, there's an indication that Info Edge (India)'s share price might be on the expensive side.

One97 Communications (NSEI:PAYTM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: One97 Communications Limited offers payment, commerce and cloud, and financial services to consumers and merchants in India with a market cap of ₹4.63 billion.

Operations: The company generates revenue primarily from data processing, amounting to ₹91.38 billion.

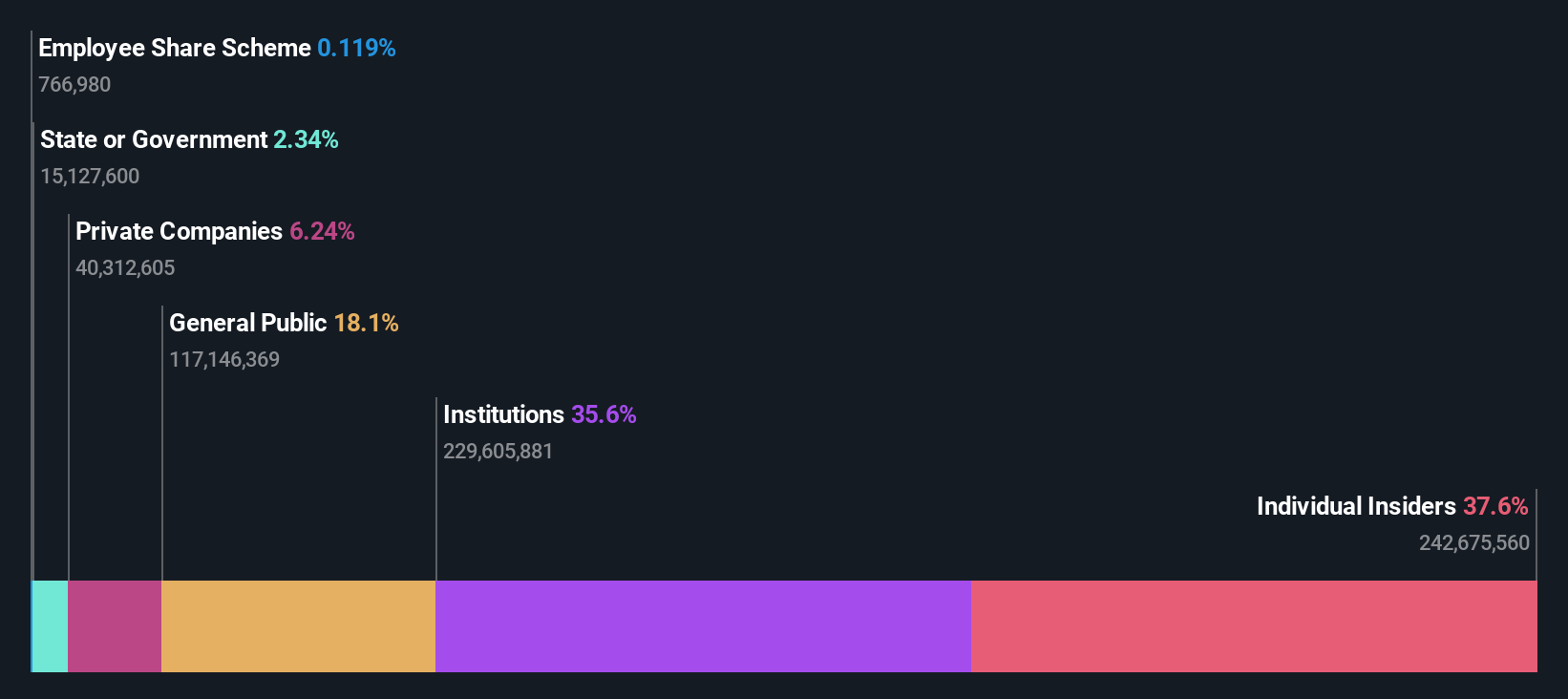

Insider Ownership: 20.7%

Revenue Growth Forecast: 12.1% p.a.

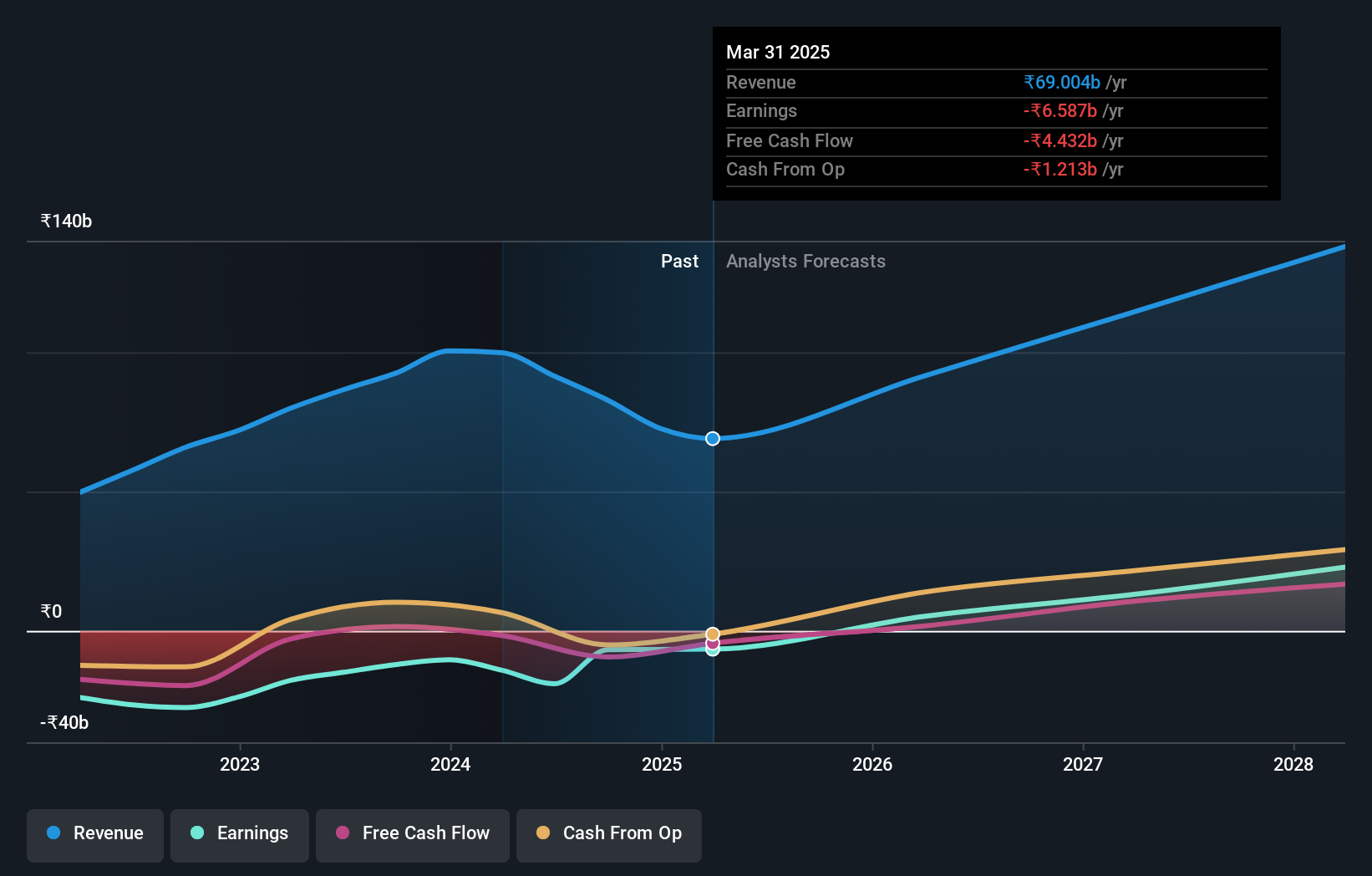

One97 Communications is focusing on core payments and financial services, highlighted by the sale of its entertainment ticketing business to Zomato for ₹20.48 billion. Despite recent penalties related to stamp duty issues, these have minimal operational impact. The company's revenue is expected to grow at 12.1% annually, surpassing the Indian market's average growth rate of 10.1%. However, profitability remains a challenge with forecasts indicating continued losses over the next three years amidst volatile share prices.

- Navigate through the intricacies of One97 Communications with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, One97 Communications' share price might be too optimistic.

Tega Industries (NSEI:TEGA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Tega Industries Limited designs, manufactures, and installs process equipment and accessories for the mineral processing, mining, and material handling industries with a market cap of ₹129.23 billion.

Operations: The company's revenue is derived from Equipments, contributing ₹1.98 billion, and Consumables, accounting for ₹13.71 billion.

Insider Ownership: 19%

Revenue Growth Forecast: 17% p.a.

Tega Industries is poised for growth with revenue projected to increase by 17% annually, outpacing the Indian market's 10.1%. Earnings are expected to grow significantly at 24.7% per year, indicating robust financial health. Recent earnings reports show strong performance with net income rising from ₹213.91 million to ₹367.44 million year-over-year. Despite changes in auditors, insider ownership remains stable without significant recent trading activity, supporting confidence in long-term prospects amidst high return on equity forecasts of 21.6%.

- Unlock comprehensive insights into our analysis of Tega Industries stock in this growth report.

- Our valuation report here indicates Tega Industries may be overvalued.

Where To Now?

- Investigate our full lineup of 92 Fast Growing Indian Companies With High Insider Ownership right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Tega Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:TEGA

Tega Industries

Designs, manufactures, and installs process equipment and accessories for the mineral processing, mining, and material handling industries.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives