- India

- /

- Construction

- /

- NSEI:TECHNOE

Techno Electric & Engineering Company Limited's (NSE:TECHNOE) Shares Climb 35% But Its Business Is Yet to Catch Up

Techno Electric & Engineering Company Limited (NSE:TECHNOE) shareholders would be excited to see that the share price has had a great month, posting a 35% gain and recovering from prior weakness. The annual gain comes to 180% following the latest surge, making investors sit up and take notice.

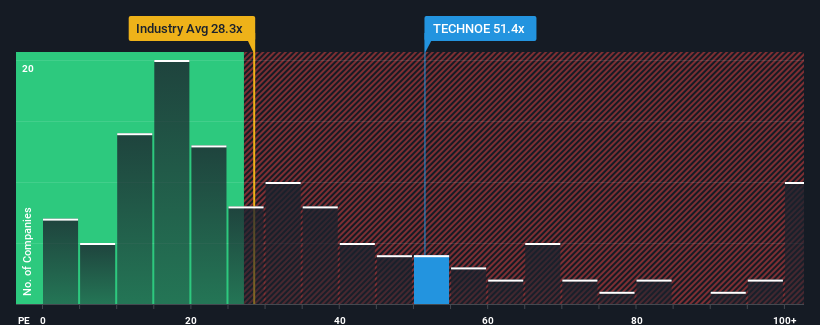

Following the firm bounce in price, given close to half the companies in India have price-to-earnings ratios (or "P/E's") below 31x, you may consider Techno Electric & Engineering as a stock to avoid entirely with its 51.4x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Techno Electric & Engineering as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Techno Electric & Engineering

Is There Enough Growth For Techno Electric & Engineering?

The only time you'd be truly comfortable seeing a P/E as steep as Techno Electric & Engineering's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 31% last year. As a result, it also grew EPS by 16% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 25% as estimated by the four analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 24%, which is not materially different.

In light of this, it's curious that Techno Electric & Engineering's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Techno Electric & Engineering's P/E

Techno Electric & Engineering's P/E is flying high just like its stock has during the last month. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Techno Electric & Engineering's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Techno Electric & Engineering that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Techno Electric & Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TECHNOE

Techno Electric & Engineering

Provides engineering, procurement, and construction (EPC) services to the power generation, transmission, and distribution sectors in India.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.