Stock Analysis

The Indian stock market has shown robust performance, with a notable 2.7% rise over the last week and an impressive 45% increase over the past year. In this thriving market environment, dividend stocks that offer yields between 3% and 4.4% can be particularly attractive to investors looking for consistent income combined with potential capital growth.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Balmer Lawrie Investments (BSE:532485) | 4.12% | ★★★★★★ |

| Bhansali Engineering Polymers (BSE:500052) | 3.88% | ★★★★★★ |

| D. B (NSEI:DBCORP) | 4.05% | ★★★★★☆ |

| Castrol India (BSE:500870) | 3.68% | ★★★★★☆ |

| ITC (NSEI:ITC) | 3.19% | ★★★★★☆ |

| HCL Technologies (NSEI:HCLTECH) | 3.63% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 8.22% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.69% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.48% | ★★★★★☆ |

| Redington (NSEI:REDINGTON) | 3.33% | ★★★★★☆ |

Click here to see the full list of 19 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Oil and Natural Gas (NSEI:ONGC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Oil and Natural Gas Corporation Limited (NSEI: ONGC) is a major player in the exploration, development, and production of crude oil and natural gas both in India and globally, with a market capitalization of approximately ₹3.46 trillion.

Operations: Oil and Natural Gas Corporation Limited generates revenue primarily through its refining and marketing segment in India, which brought in ₹56.75 billion, alongside its exploration and production segments with ₹4.39 billion from onshore operations and ₹9.43 billion from offshore activities.

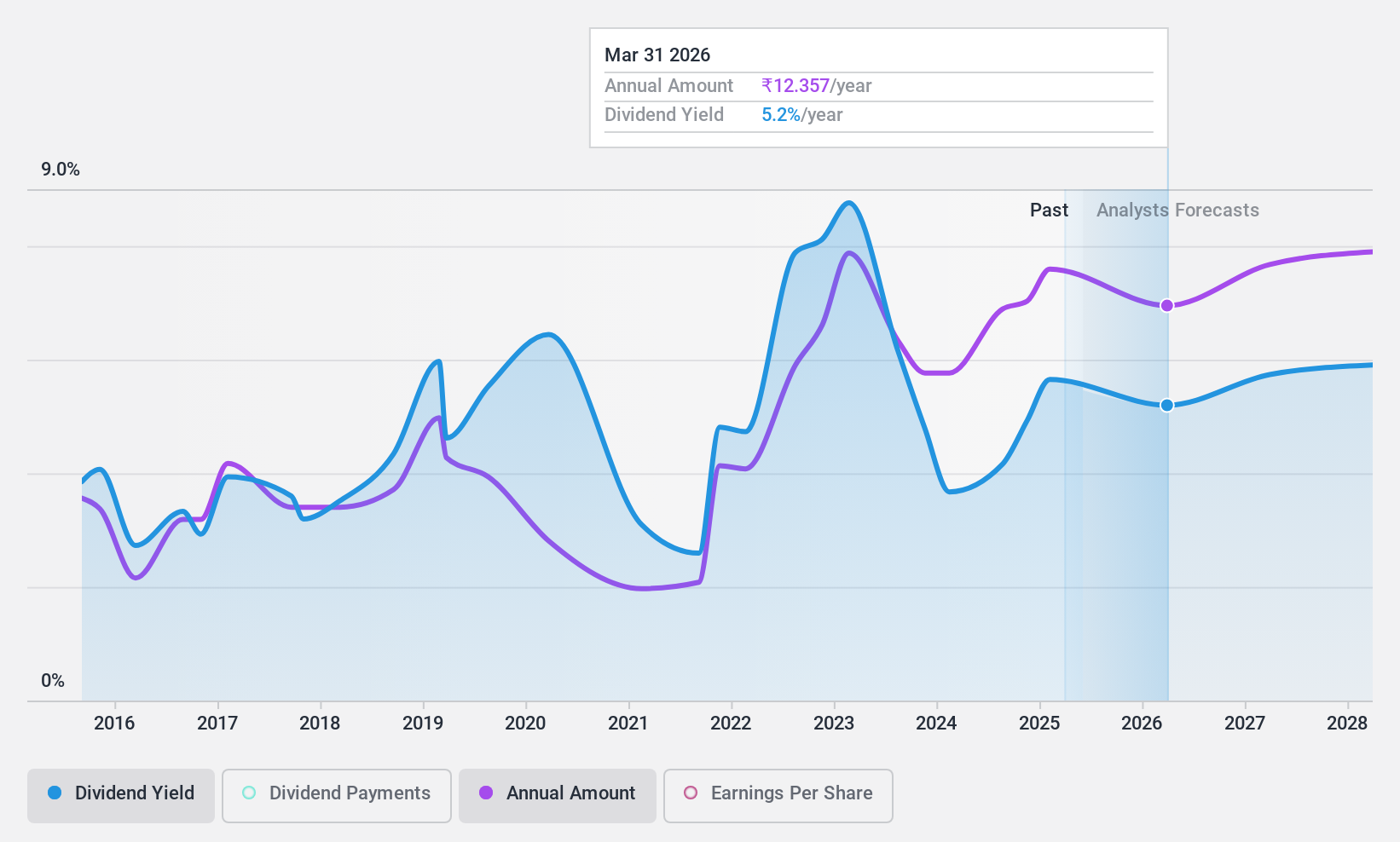

Dividend Yield: 4.4%

ONGC offers a dividend yield of 4.45%, ranking in the top 25% of Indian dividend payers. Despite a low payout ratio of 31.3% and cash payout ratio of 32.5%, ensuring dividends are well covered by earnings and cash flows, its dividend history has been marked by instability over the past decade, with significant fluctuations including annual drops over 20%. Additionally, while ONGC's earnings have increased significantly this year (up 38.9%), its involvement in potential acquisitions like the $500 million deal for renewable assets indicates strategic shifts towards sustainable energy investments, which could impact future financial flexibility and dividend sustainability.

- Take a closer look at Oil and Natural Gas' potential here in our dividend report.

- Our valuation report here indicates Oil and Natural Gas may be overvalued.

Petronet LNG (NSEI:PETRONET)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Petronet LNG Limited is a company based in India that specializes in the import, storage, regasification, and supply of liquefied natural gas (LNG), with a market capitalization of approximately ₹485.85 billion.

Operations: Petronet LNG Limited generates revenue primarily through its natural gas business, which amounted to ₹52.73 billion.

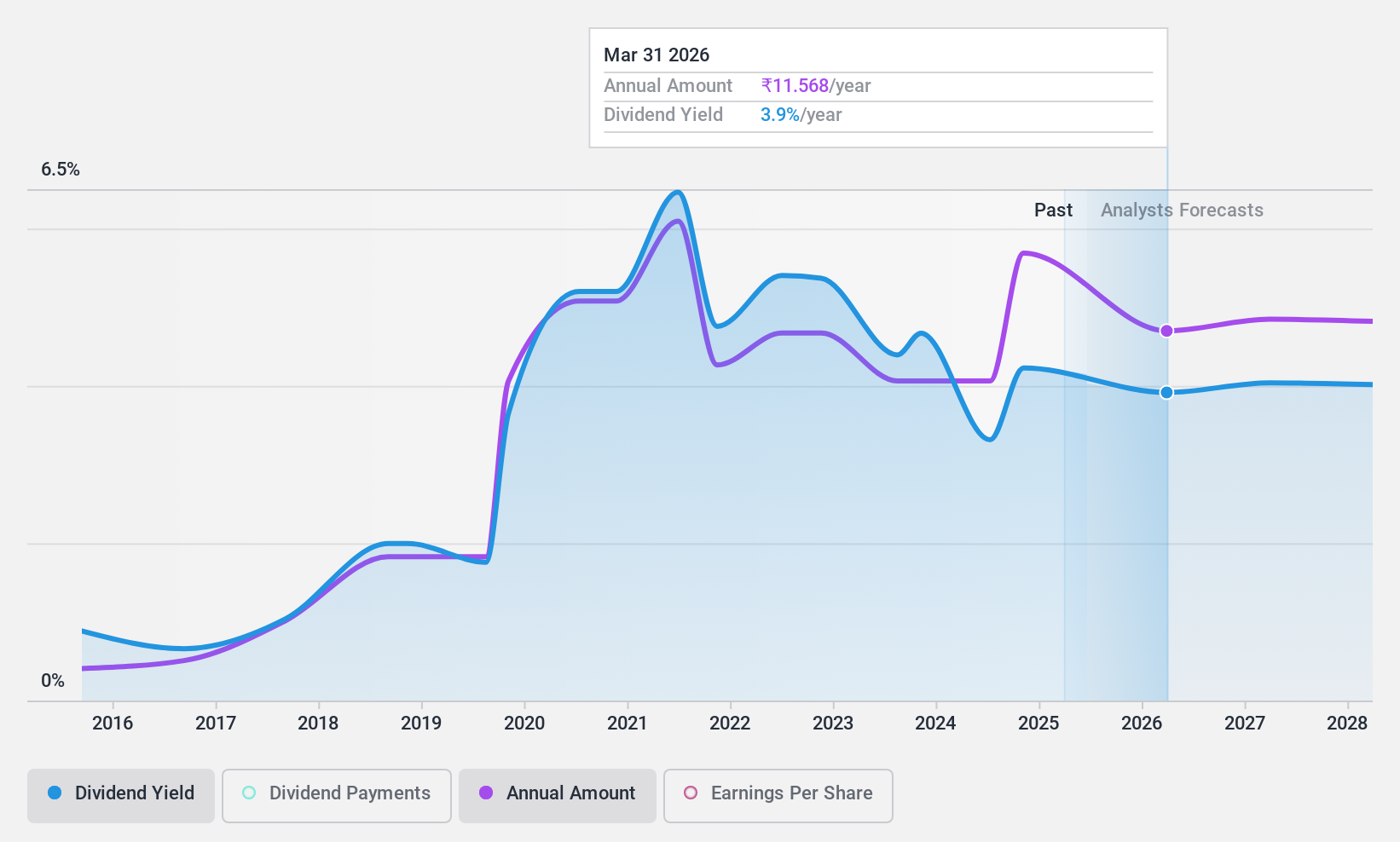

Dividend Yield: 3.1%

Petronet LNG exhibits a mixed scenario for dividend-focused investors. With a Price-To-Earnings ratio of 13.3x, it stands below the broader Indian market average of 32.2x, indicating potential value. The company's earnings have expanded by 8.9% annually over the last five years, supporting some growth context. However, dividends have shown volatility over the past decade despite recent increases and a declaration of an INR 3 per share final dividend on May 22, 2024. Dividends are well-covered by both earnings and cash flows with payout ratios at 12.8% and 37.2%, respectively, suggesting financial prudence in its distribution policies despite past inconsistencies in payment stability.

- Get an in-depth perspective on Petronet LNG's performance by reading our dividend report here.

- Our valuation report unveils the possibility Petronet LNG's shares may be trading at a premium.

Swaraj Engines (NSEI:SWARAJENG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Swaraj Engines Limited, based in India, specializes in manufacturing and selling diesel engines, diesel engine components, and spare parts for tractors, with a market capitalization of approximately ₹33.96 billion.

Operations: Swaraj Engines Limited generates revenue primarily from the sale of diesel engines, engine components, and tractor spare parts, totaling ₹14.19 billion.

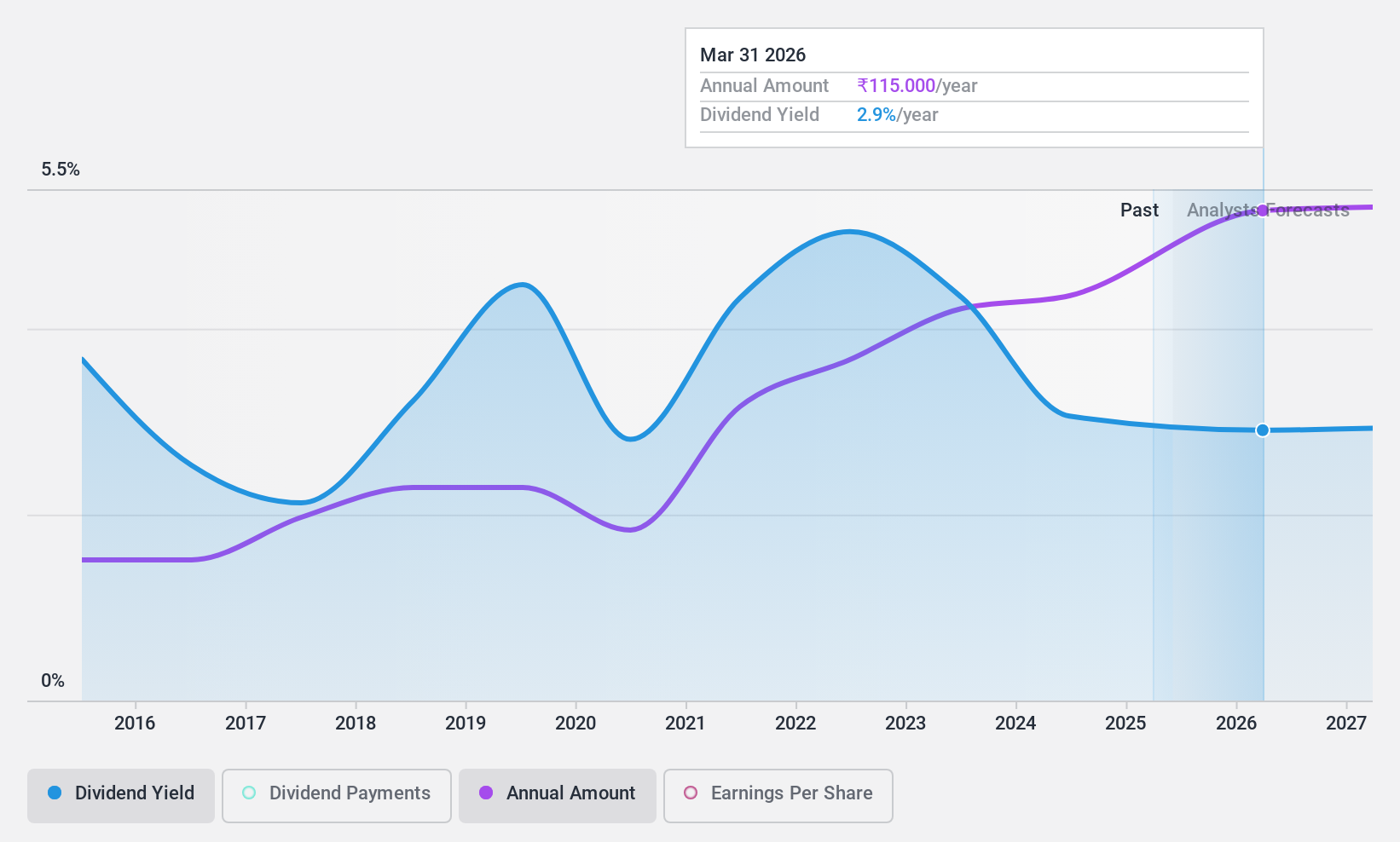

Dividend Yield: 3.4%

Swaraj Engines offers a dividend yield of 3.4%, ranking it among the top quarter of Indian dividend stocks, yet its sustainability is questionable with a cash payout ratio of 122% and coverage issues reflected by earnings and cash flows. Despite growing earnings at 15.4% annually over five years, dividends have been inconsistent over the last decade. Recently, Swaraj announced a significant dividend increase to ₹95 per share for FY2024, although this is subject to shareholder approval at the upcoming AGM on July 18, 2024.

- Unlock comprehensive insights into our analysis of Swaraj Engines stock in this dividend report.

- According our valuation report, there's an indication that Swaraj Engines' share price might be on the cheaper side.

Key Takeaways

- Explore the 19 names from our Top Dividend Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Swaraj Engines is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:SWARAJENG

Swaraj Engines

Manufactures and sells diesel engines, diesel engine components, and spare parts for tractors in India.

Flawless balance sheet average dividend payer.