- India

- /

- Electrical

- /

- NSEI:SERVOTECH

Servotech Renewable Power System Limited's (NSE:SERVOTECH) Stock Retreats 25% But Revenues Haven't Escaped The Attention Of Investors

Unfortunately for some shareholders, the Servotech Renewable Power System Limited (NSE:SERVOTECH) share price has dived 25% in the last thirty days, prolonging recent pain. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 22%.

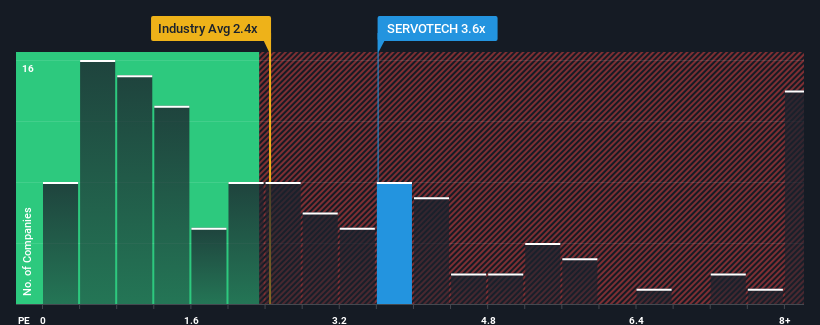

Although its price has dipped substantially, when almost half of the companies in India's Electrical industry have price-to-sales ratios (or "P/S") below 2.4x, you may still consider Servotech Renewable Power System as a stock probably not worth researching with its 3.6x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Servotech Renewable Power System

What Does Servotech Renewable Power System's P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, Servotech Renewable Power System has been doing very well. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Servotech Renewable Power System's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Servotech Renewable Power System's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 97% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 31% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this in consideration, it's not hard to understand why Servotech Renewable Power System's P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Final Word

Servotech Renewable Power System's P/S remain high even after its stock plunged. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Servotech Renewable Power System maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for Servotech Renewable Power System that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SERVOTECH

Servotech Renewable Power System

Manufactures and sells light-emitting diode (LED) lights, electric vehicle (EV) chargers, and solar power products in India and internationally.

Excellent balance sheet with poor track record.

Similar Companies

Market Insights

Community Narratives