- India

- /

- Electrical

- /

- NSEI:SERVOTECH

Is Now The Time To Put Servotech Renewable Power System (NSE:SERVOTECH) On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Servotech Renewable Power System (NSE:SERVOTECH). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Servotech Renewable Power System's Improving Profits

Over the last three years, Servotech Renewable Power System has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. As a result, we'll zoom in on growth over the last year, instead. In impressive fashion, Servotech Renewable Power System's EPS grew from ₹0.55 to ₹1.54, over the previous 12 months. It's not often a company can achieve year-on-year growth of 180%. That could be a sign that the business has reached a true inflection point.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Servotech Renewable Power System shareholders can take confidence from the fact that EBIT margins are up from 4.9% to 7.2%, and revenue is growing. That's great to see, on both counts.

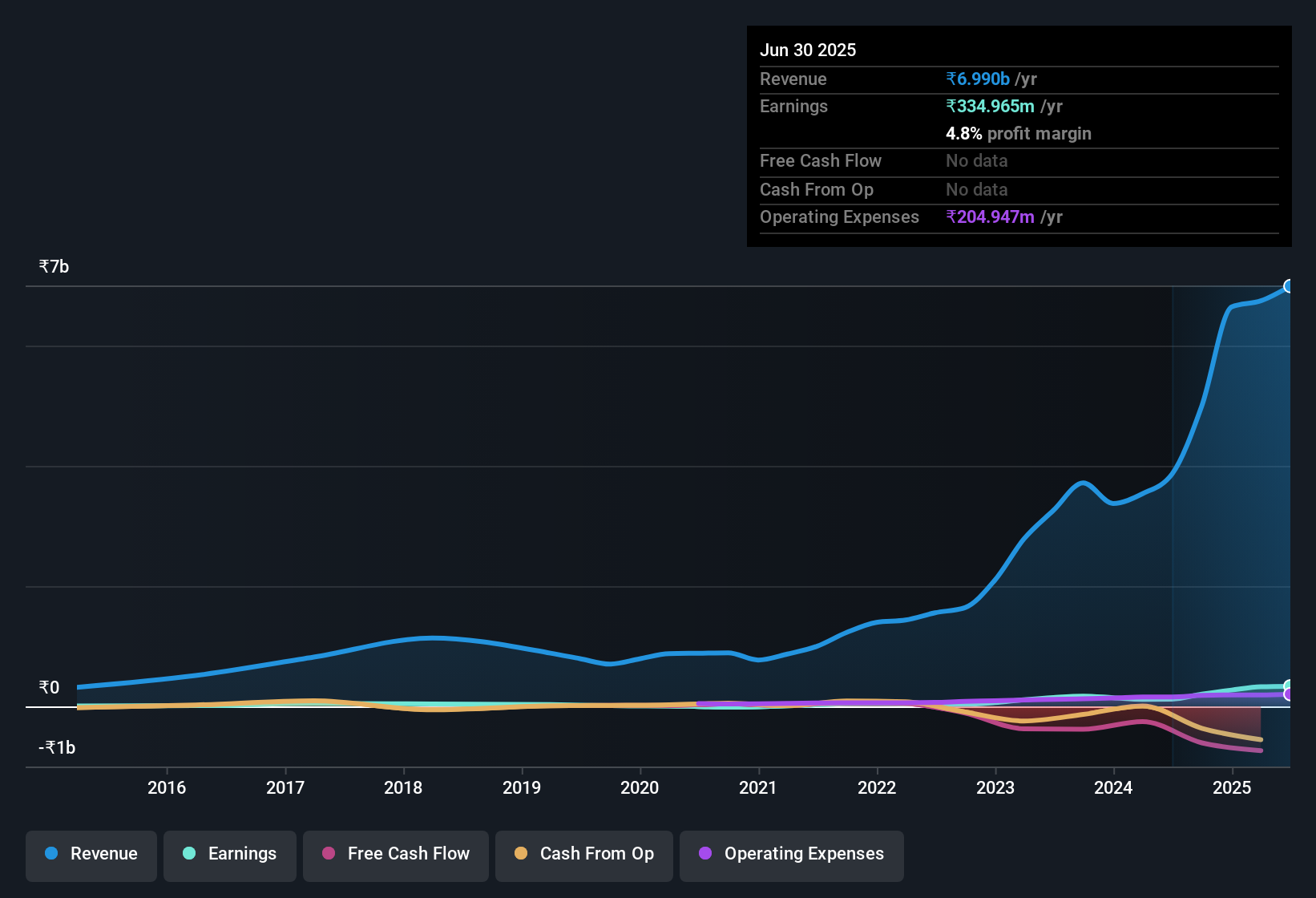

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

See our latest analysis for Servotech Renewable Power System

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Servotech Renewable Power System Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So we're pleased to report that Servotech Renewable Power System insiders own a meaningful share of the business. Actually, with 46% of the company to their names, insiders are profoundly invested in the business. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. In terms of absolute value, insiders have ₹14b invested in the business, at the current share price. So there's plenty there to keep them focused!

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. A brief analysis of the CEO compensation suggests they are. The median total compensation for CEOs of companies similar in size to Servotech Renewable Power System, with market caps between ₹18b and ₹71b, is around ₹25m.

Servotech Renewable Power System's CEO took home a total compensation package of ₹8.4m in the year prior to March 2024. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is Servotech Renewable Power System Worth Keeping An Eye On?

Servotech Renewable Power System's earnings per share have been soaring, with growth rates sky high. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The drastic earnings growth indicates the business is going from strength to strength. Hopefully a trend that continues well into the future. Servotech Renewable Power System certainly ticks a few boxes, so we think it's probably well worth further consideration. Another important measure of business quality not discussed here, is return on equity (ROE). Click on this link to see how Servotech Renewable Power System shapes up to industry peers, when it comes to ROE.

Although Servotech Renewable Power System certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Indian companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SERVOTECH

Servotech Renewable Power System

Manufactures and sells light-emitting diode (LED) lights, electric vehicle (EV) chargers, and solar power products in India and internationally.

Excellent balance sheet with poor track record.

Similar Companies

Market Insights

Community Narratives