Stock Analysis

- India

- /

- Construction

- /

- NSEI:SALASAR

Here's Why Salasar Techno Engineering (NSE:SALASAR) Has A Meaningful Debt Burden

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Salasar Techno Engineering Limited (NSE:SALASAR) makes use of debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Salasar Techno Engineering

What Is Salasar Techno Engineering's Debt?

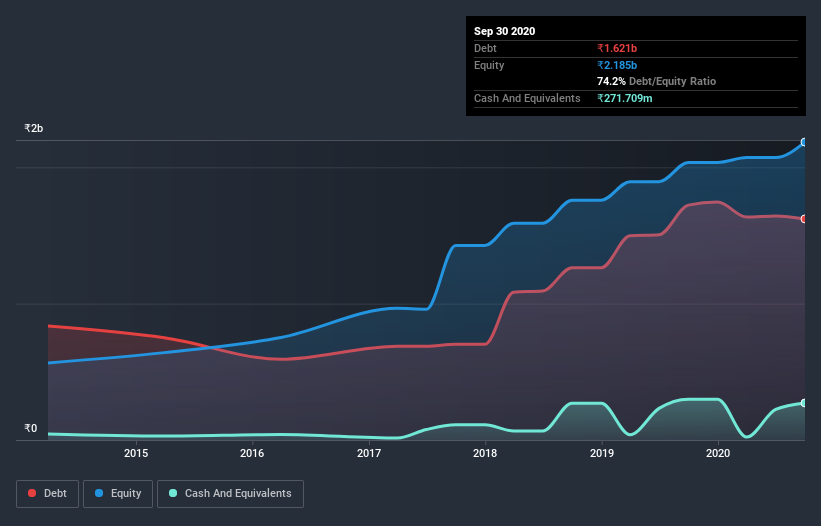

As you can see below, Salasar Techno Engineering had ₹1.61b of debt at September 2020, down from ₹1.72b a year prior. On the flip side, it has ₹271.7m in cash leading to net debt of about ₹1.34b.

How Healthy Is Salasar Techno Engineering's Balance Sheet?

The latest balance sheet data shows that Salasar Techno Engineering had liabilities of ₹2.39b due within a year, and liabilities of ₹101.4m falling due after that. Offsetting these obligations, it had cash of ₹271.7m as well as receivables valued at ₹2.22b due within 12 months. So these liquid assets roughly match the total liabilities.

Having regard to Salasar Techno Engineering's size, it seems that its liquid assets are well balanced with its total liabilities. So it's very unlikely that the ₹2.71b company is short on cash, but still worth keeping an eye on the balance sheet.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Salasar Techno Engineering has a debt to EBITDA ratio of 3.4 and its EBIT covered its interest expense 2.6 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Even worse, Salasar Techno Engineering saw its EBIT tank 49% over the last 12 months. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Salasar Techno Engineering will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Salasar Techno Engineering burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both Salasar Techno Engineering's conversion of EBIT to free cash flow and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. But on the bright side, its level of total liabilities is a good sign, and makes us more optimistic. Looking at the bigger picture, it seems clear to us that Salasar Techno Engineering's use of debt is creating risks for the company. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Salasar Techno Engineering (of which 1 is potentially serious!) you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you’re looking to trade Salasar Techno Engineering, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Salasar Techno Engineering is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:SALASAR

Salasar Techno Engineering

Manufactures and sells galvanized and non-galvanized steel structures in India and internationally.

Proven track record with adequate balance sheet.