Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that NRB Bearings Limited (NSE:NRBBEARING) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for NRB Bearings

What Is NRB Bearings's Debt?

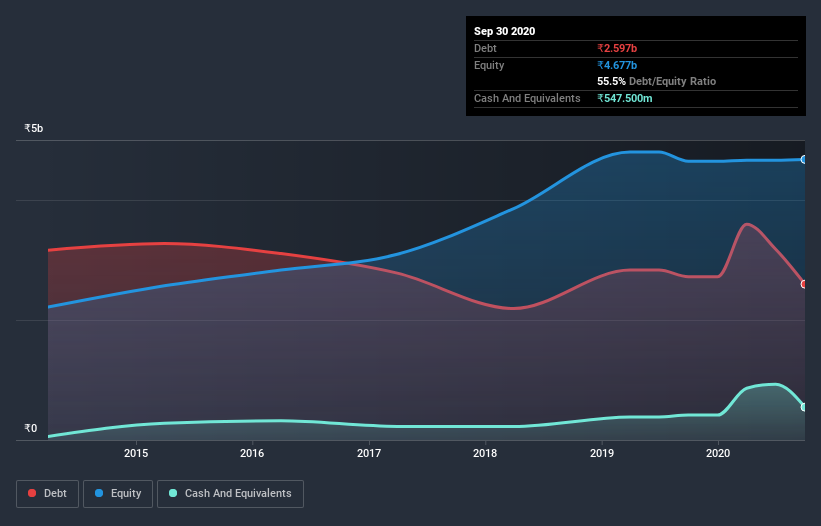

The image below, which you can click on for greater detail, shows that NRB Bearings had debt of ₹2.58b at the end of September 2020, a reduction from ₹2.72b over a year. However, it also had ₹547.5m in cash, and so its net debt is ₹2.04b.

How Strong Is NRB Bearings's Balance Sheet?

The latest balance sheet data shows that NRB Bearings had liabilities of ₹3.25b due within a year, and liabilities of ₹1.15b falling due after that. On the other hand, it had cash of ₹547.5m and ₹1.94b worth of receivables due within a year. So it has liabilities totalling ₹1.90b more than its cash and near-term receivables, combined.

While this might seem like a lot, it is not so bad since NRB Bearings has a market capitalization of ₹7.28b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While we wouldn't worry about NRB Bearings's net debt to EBITDA ratio of 4.1, we think its super-low interest cover of 0.98 times is a sign of high leverage. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. Worse, NRB Bearings's EBIT was down 75% over the last year. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if NRB Bearings can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, NRB Bearings created free cash flow amounting to 20% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

To be frank both NRB Bearings's interest cover and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. Having said that, its ability to handle its total liabilities isn't such a worry. Overall, it seems to us that NRB Bearings's balance sheet is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 5 warning signs we've spotted with NRB Bearings (including 2 which is shouldn't be ignored) .

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade NRB Bearings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if NRB Bearings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:NRBBEARING

NRB Bearings

Manufactures and sells ball and roller bearings for original equipment manufacturers in India and internationally.

Flawless balance sheet with solid track record and pays a dividend.