- India

- /

- Construction

- /

- NSEI:JKIL

J. Kumar Infraprojects Limited (NSE:JKIL) Held Back By Insufficient Growth Even After Shares Climb 29%

The J. Kumar Infraprojects Limited (NSE:JKIL) share price has done very well over the last month, posting an excellent gain of 29%. The annual gain comes to 178% following the latest surge, making investors sit up and take notice.

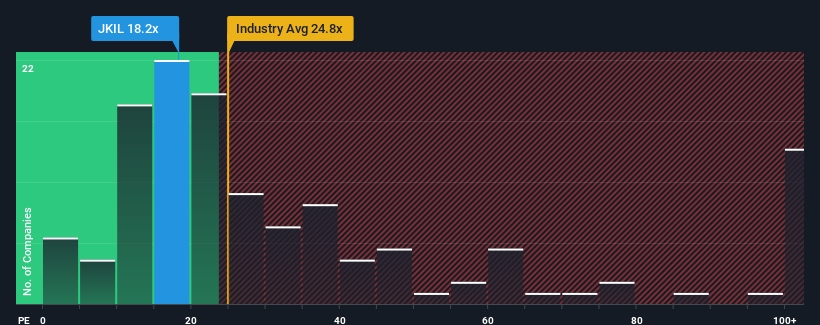

Even after such a large jump in price, J. Kumar Infraprojects' price-to-earnings (or "P/E") ratio of 18.2x might still make it look like a buy right now compared to the market in India, where around half of the companies have P/E ratios above 31x and even P/E's above 61x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

J. Kumar Infraprojects' earnings growth of late has been pretty similar to most other companies. One possibility is that the P/E is low because investors think this modest earnings performance may begin to slide. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

View our latest analysis for J. Kumar Infraprojects

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, J. Kumar Infraprojects would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 21%. The strong recent performance means it was also able to grow EPS by 418% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 17% over the next year. With the market predicted to deliver 25% growth , the company is positioned for a weaker earnings result.

With this information, we can see why J. Kumar Infraprojects is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From J. Kumar Infraprojects' P/E?

J. Kumar Infraprojects' stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of J. Kumar Infraprojects' analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for J. Kumar Infraprojects that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JKIL

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success