Jain Irrigation Systems Limited's (NSE:JISLJALEQS) Price Is Right But Growth Is Lacking

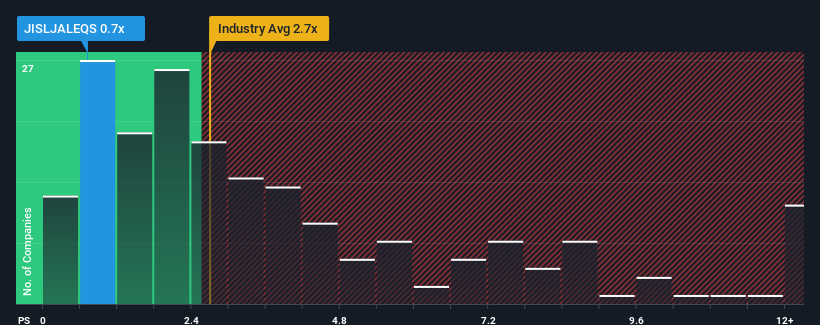

With a price-to-sales (or "P/S") ratio of 0.7x Jain Irrigation Systems Limited (NSE:JISLJALEQS) may be sending bullish signals at the moment, given that almost half of all the Machinery companies in India have P/S ratios greater than 2.7x and even P/S higher than 6x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Jain Irrigation Systems

How Jain Irrigation Systems Has Been Performing

As an illustration, revenue has deteriorated at Jain Irrigation Systems over the last year, which is not ideal at all. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Jain Irrigation Systems' earnings, revenue and cash flow.How Is Jain Irrigation Systems' Revenue Growth Trending?

Jain Irrigation Systems' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 14%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 13% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

This is in contrast to the rest of the industry, which is expected to grow by 13% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Jain Irrigation Systems' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

In line with expectations, Jain Irrigation Systems maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Jain Irrigation Systems that you should be aware of.

If you're unsure about the strength of Jain Irrigation Systems' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JISLJALEQS

Jain Irrigation Systems

Manufactures and sells micro-irrigation systems in India, Europe, North America, and internationally.

Proven track record with mediocre balance sheet.

Market Insights

Community Narratives