- India

- /

- Construction

- /

- NSEI:IRB

IRB Infrastructure Developers And 2 Other Stocks On Indian Exchange With Estimated Undervaluation

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has dropped 1.0%. In contrast to the last week, the market is up 39% over the past year, with earnings forecasted to grow by 17% annually. In such a fluctuating environment, identifying undervalued stocks like IRB Infrastructure Developers and others can offer potential opportunities for investors looking for growth at a reasonable price.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Everest Kanto Cylinder (NSEI:EKC) | ₹186.90 | ₹306.02 | 38.9% |

| Prataap Snacks (NSEI:DIAMONDYD) | ₹824.60 | ₹1509.79 | 45.4% |

| Apollo Pipes (BSE:531761) | ₹642.20 | ₹1153.92 | 44.3% |

| Krsnaa Diagnostics (NSEI:KRSNAA) | ₹749.60 | ₹1165.33 | 35.7% |

| Venus Pipes and Tubes (NSEI:VENUSPIPES) | ₹2245.10 | ₹4449.31 | 49.5% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹465.40 | ₹762.32 | 38.9% |

| RITES (NSEI:RITES) | ₹661.85 | ₹1039.32 | 36.3% |

| Titagarh Rail Systems (NSEI:TITAGARH) | ₹1400.15 | ₹2188.27 | 36% |

| Patel Engineering (BSE:531120) | ₹57.03 | ₹94.02 | 39.3% |

| Artemis Medicare Services (NSEI:ARTEMISMED) | ₹276.75 | ₹445.15 | 37.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

IRB Infrastructure Developers (NSEI:IRB)

Overview: IRB Infrastructure Developers Limited operates in the infrastructure development sector in India with a market capitalization of ₹373.87 billion.

Operations: Revenue segments include ₹51.92 billion from Construction and ₹24.16 billion from BOT/TOT Projects.

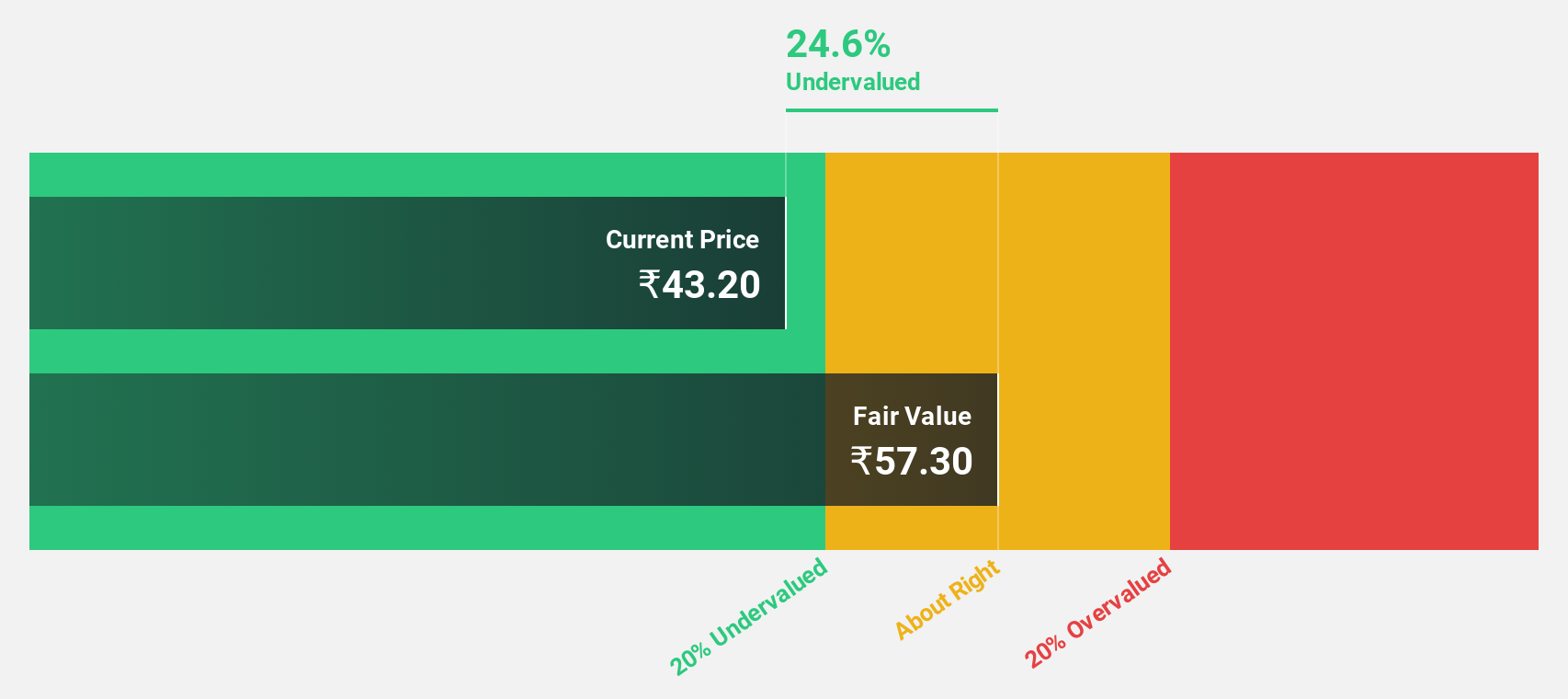

Estimated Discount To Fair Value: 34.5%

IRB Infrastructure Developers is trading at ₹61.91, significantly below its estimated fair value of ₹94.5, indicating it may be undervalued based on discounted cash flow analysis. Despite a low forecasted return on equity (8.3%), the company’s earnings are expected to grow significantly at 32% per year, outpacing the Indian market's 17%. Recent earnings reports show revenue and net income growth, but interest payments are not well covered by earnings, posing a risk.

- Our earnings growth report unveils the potential for significant increases in IRB Infrastructure Developers' future results.

- Get an in-depth perspective on IRB Infrastructure Developers' balance sheet by reading our health report here.

Kalpataru Projects International (NSEI:KPIL)

Overview: Kalpataru Projects International Limited offers EPC services across various sectors including power transmission and distribution, buildings and factories, water, railways, oil and gas, and urban infrastructure both in India and globally, with a market cap of ₹227.08 billion.

Operations: The company's revenue segments include ₹194.92 billion from Engineering, Procurement and Construction (EPC) and ₹2.81 billion from Development Projects.

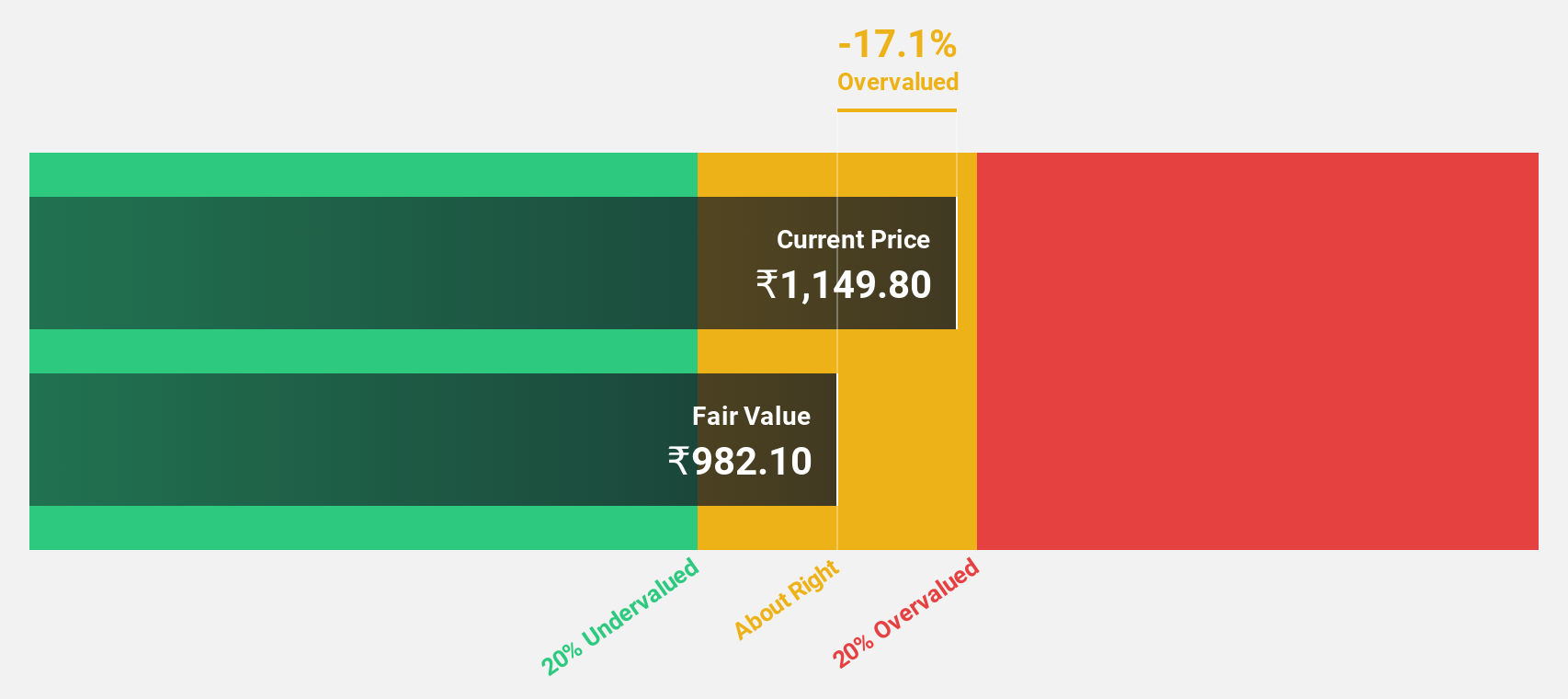

Estimated Discount To Fair Value: 21.1%

Kalpataru Projects International is trading at ₹1397.9, significantly below its estimated fair value of ₹1771.98, suggesting it may be undervalued based on discounted cash flow analysis. Despite recent regulatory fines totaling INR 2.227 million and other enforcement actions, the company’s earnings are forecast to grow significantly at 29% per year, outpacing the Indian market's 17%. However, interest payments are not well covered by earnings and the dividend track record remains unstable.

- In light of our recent growth report, it seems possible that Kalpataru Projects International's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Kalpataru Projects International's balance sheet health report.

Piramal Pharma (NSEI:PPLPHARMA)

Overview: Piramal Pharma Limited operates as a pharmaceutical company in North America, Europe, Japan, India, and internationally with a market cap of ₹300.03 billion.

Operations: The company's revenue segment includes Pharma, which generated ₹83.73 billion.

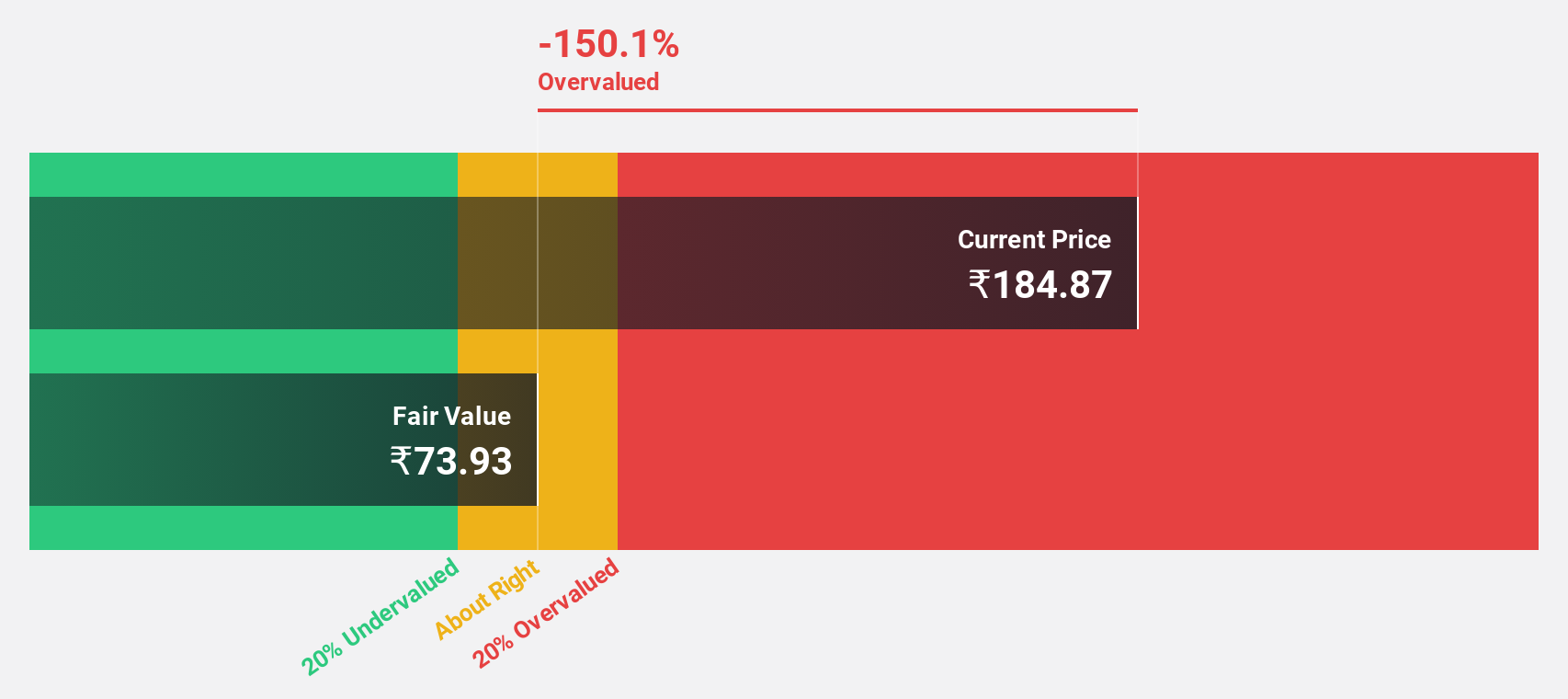

Estimated Discount To Fair Value: 21.8%

Piramal Pharma, trading at ₹226.31, is significantly undervalued with an estimated fair value of ₹289.56. Despite a net loss of INR 886.4 million for Q1 2024 and recent regulatory penalties totaling over INR 68 million, the company's earnings are forecast to grow substantially at 73.5% annually over the next three years, outpacing the Indian market's growth rate. However, interest payments remain poorly covered by earnings and return on equity is projected to be low at 7.6%.

- According our earnings growth report, there's an indication that Piramal Pharma might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Piramal Pharma.

Turning Ideas Into Actions

- Take a closer look at our Undervalued Indian Stocks Based On Cash Flows list of 27 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:IRB

IRB Infrastructure Developers

Engages in the infrastructure development business in India.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives