- India

- /

- Construction

- /

- NSEI:IRB

After Leaping 58% IRB Infrastructure Developers Limited (NSE:IRB) Shares Are Not Flying Under The Radar

IRB Infrastructure Developers Limited (NSE:IRB) shares have continued their recent momentum with a 58% gain in the last month alone. The annual gain comes to 135% following the latest surge, making investors sit up and take notice.

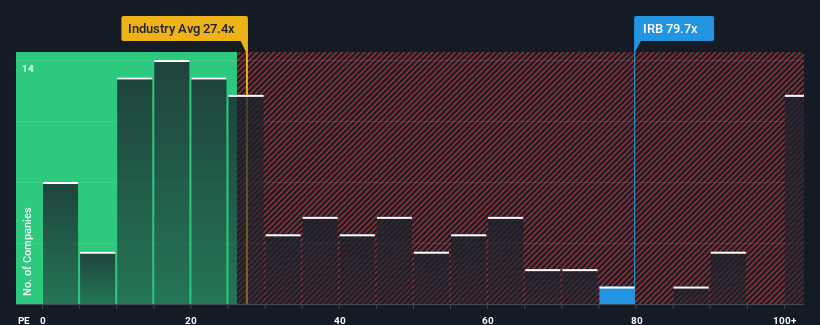

Since its price has surged higher, given close to half the companies in India have price-to-earnings ratios (or "P/E's") below 31x, you may consider IRB Infrastructure Developers as a stock to avoid entirely with its 79.7x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

IRB Infrastructure Developers could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for IRB Infrastructure Developers

Is There Enough Growth For IRB Infrastructure Developers?

The only time you'd be truly comfortable seeing a P/E as steep as IRB Infrastructure Developers' is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 35%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 10% overall rise in EPS. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 33% per annum as estimated by the five analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 20% per annum, which is noticeably less attractive.

In light of this, it's understandable that IRB Infrastructure Developers' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From IRB Infrastructure Developers' P/E?

IRB Infrastructure Developers' P/E is flying high just like its stock has during the last month. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that IRB Infrastructure Developers maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 3 warning signs for IRB Infrastructure Developers (1 is a bit unpleasant!) that we have uncovered.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:IRB

IRB Infrastructure Developers

Engages in the infrastructure development business in India.

Very undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026