Grindwell Norton (NSE:GRINDWELL) Seems To Use Debt Rather Sparingly

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Grindwell Norton Limited (NSE:GRINDWELL) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Grindwell Norton

What Is Grindwell Norton's Net Debt?

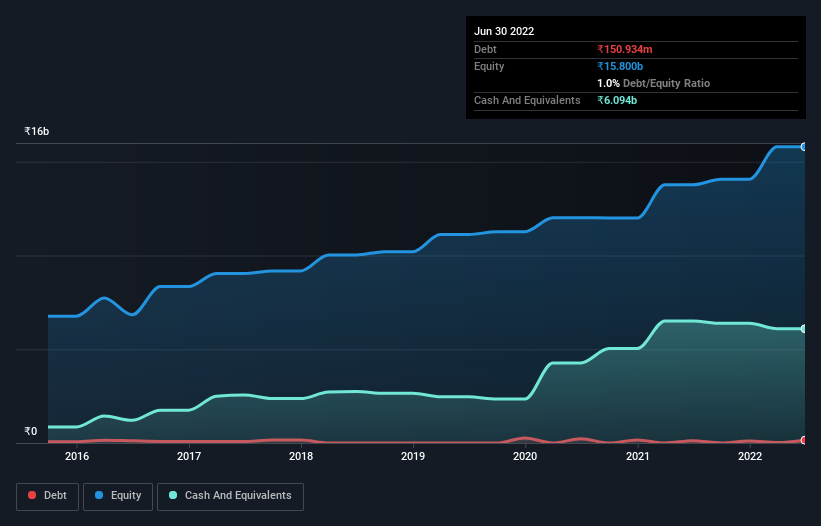

You can click the graphic below for the historical numbers, but it shows that as of March 2022 Grindwell Norton had ₹150.9m of debt, an increase on ₹121.5m, over one year. However, it does have ₹6.09b in cash offsetting this, leading to net cash of ₹5.94b.

How Strong Is Grindwell Norton's Balance Sheet?

The latest balance sheet data shows that Grindwell Norton had liabilities of ₹4.83b due within a year, and liabilities of ₹508.4m falling due after that. On the other hand, it had cash of ₹6.09b and ₹2.47b worth of receivables due within a year. So it actually has ₹3.23b more liquid assets than total liabilities.

This state of affairs indicates that Grindwell Norton's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the ₹209.8b company is short on cash, but still worth keeping an eye on the balance sheet. Simply put, the fact that Grindwell Norton has more cash than debt is arguably a good indication that it can manage its debt safely.

And we also note warmly that Grindwell Norton grew its EBIT by 16% last year, making its debt load easier to handle. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Grindwell Norton's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Grindwell Norton has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the most recent three years, Grindwell Norton recorded free cash flow worth 69% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that Grindwell Norton has net cash of ₹5.94b, as well as more liquid assets than liabilities. And it impressed us with free cash flow of ₹610m, being 69% of its EBIT. So is Grindwell Norton's debt a risk? It doesn't seem so to us. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 1 warning sign with Grindwell Norton , and understanding them should be part of your investment process.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GRINDWELL

Grindwell Norton

Manufactures and sells abrasives, ceramics, and plastic products in India and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives