Greaves Cotton (NSE:GREAVESCOT) Is Increasing Its Dividend To ₹2.00

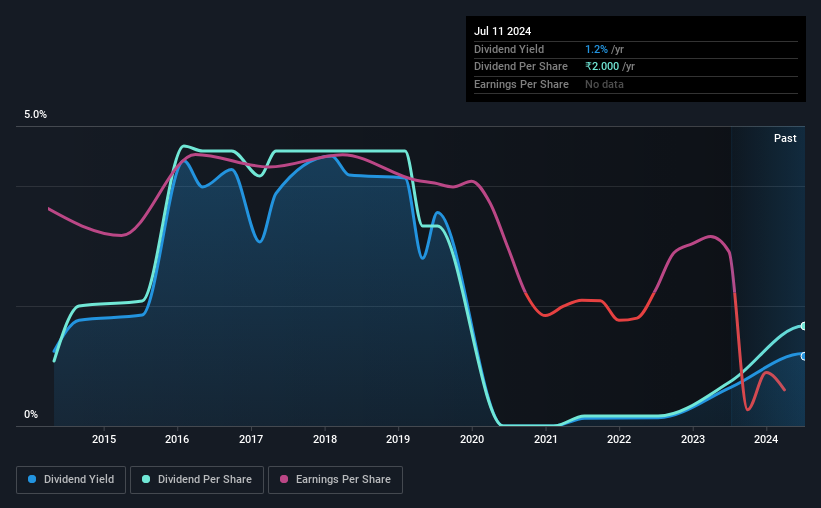

The board of Greaves Cotton Limited (NSE:GREAVESCOT) has announced that it will be paying its dividend of ₹2.00 on the 6th of September, an increased payment from last year's comparable dividend. This takes the dividend yield to 1.2%, which shareholders will be pleased with.

View our latest analysis for Greaves Cotton

Greaves Cotton's Distributions May Be Difficult To Sustain

If the payments aren't sustainable, a high yield for a few years won't matter that much. Even in the absence of profits, Greaves Cotton is paying a dividend. The company is also yet to generate cash flow, so the dividend sustainability is definitely questionable.

Over the next year, EPS might fall by 56.8% based on recent performance. This means the company won't be turning a profit, which could place managers in the tough spot of having to choose between suspending the dividend or putting more pressure on the balance sheet.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. The annual payment during the last 10 years was ₹1.30 in 2014, and the most recent fiscal year payment was ₹2.00. This implies that the company grew its distributions at a yearly rate of about 4.4% over that duration. We're glad to see the dividend has risen, but with a limited rate of growth and fluctuations in the payments the total shareholder return may be limited.

The Dividend Has Limited Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Over the past five years, it looks as though Greaves Cotton's EPS has declined at around 57% a year. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in.

Greaves Cotton's Dividend Doesn't Look Great

In summary, investors will like to be receiving a higher dividend, but we have some questions about whether it can be sustained over the long term. The company isn't making enough to be paying as much as it is, and the other factors don't look particularly promising either. Overall, this doesn't get us very excited from an income standpoint.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. To that end, Greaves Cotton has 3 warning signs (and 2 which shouldn't be ignored) we think you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:GREAVESCOT

Greaves Cotton

Operates engineering and mobility retail business in India, the Middle East, Africa, Southeast Asia, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives