- India

- /

- Construction

- /

- NSEI:GVPIL

GE Power India Limited's (NSE:GEPIL) Stock Has Shown Weakness Lately But Financial Prospects Look Decent: Is The Market Wrong?

With its stock down 37% over the past three months, it is easy to disregard GE Power India (NSE:GEPIL). But if you pay close attention, you might find that its key financial indicators look quite decent, which could mean that the stock could potentially rise in the long-term given how markets usually reward more resilient long-term fundamentals. In this article, we decided to focus on GE Power India's ROE.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

View our latest analysis for GE Power India

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for GE Power India is:

15% = ₹1.4b ÷ ₹9.2b (Based on the trailing twelve months to September 2020).

The 'return' is the profit over the last twelve months. One way to conceptualize this is that for each ₹1 of shareholders' capital it has, the company made ₹0.15 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

GE Power India's Earnings Growth And 15% ROE

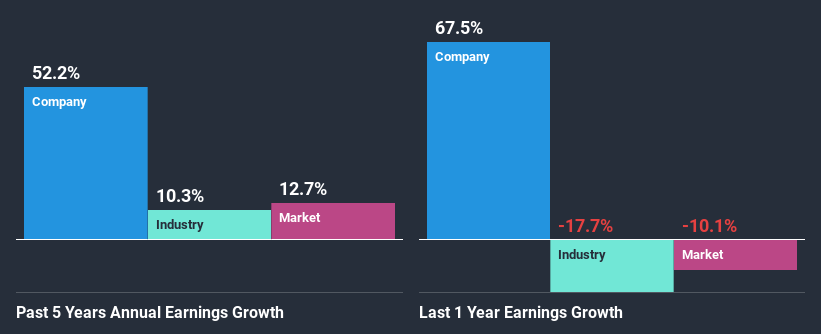

When you first look at it, GE Power India's ROE doesn't look that attractive. However, the fact that the its ROE is quite higher to the industry average of 7.1% doesn't go unnoticed by us. Particularly, the substantial 52% net income growth seen by GE Power India over the past five years is impressive . Bear in mind, the company does have a moderately low ROE. It is just that the industry ROE is lower. Therefore, the growth in earnings could also be the result of other factors. E.g the company has a low payout ratio or could belong to a high growth industry.

We then compared GE Power India's net income growth with the industry and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 10% in the same period.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if GE Power India is trading on a high P/E or a low P/E, relative to its industry.

Is GE Power India Using Its Retained Earnings Effectively?

GE Power India's significant three-year median payout ratio of 53% (where it is retaining only 47% of its income) suggests that the company has been able to achieve a high growth in earnings despite returning most of its income to shareholders.

Moreover, GE Power India is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years.

Conclusion

Overall, we feel that GE Power India certainly does have some positive factors to consider. Specifically, its respectable ROE which likely led to the considerable growth in earnings. Yet, the company is retaining a small portion of its profits. Which means that the company has been able to grow its earnings in spite of it, so that's not too bad. So far, we've only made a quick discussion around the company's earnings growth. To gain further insights into GE Power India's past profit growth, check out this visualization of past earnings, revenue and cash flows.

If you’re looking to trade GE Power India, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:GVPIL

GE Power India

Engages in the engineering, procurement, manufacturing, construction, maintenance, and servicing of power plants and power equipment in India and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives