Can Mixed Fundamentals Have A Negative Impact on Everest Industries Limited (NSE:EVERESTIND) Current Share Price Momentum?

Everest Industries (NSE:EVERESTIND) has had a great run on the share market with its stock up by a significant 50% over the last three months. But the company's key financial indicators appear to be differing across the board and that makes us question whether or not the company's current share price momentum can be maintained. Particularly, we will be paying attention to Everest Industries' ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

View our latest analysis for Everest Industries

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Everest Industries is:

7.0% = ₹344m ÷ ₹4.9b (Based on the trailing twelve months to September 2020).

The 'return' is the yearly profit. So, this means that for every ₹1 of its shareholder's investments, the company generates a profit of ₹0.07.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Everest Industries' Earnings Growth And 7.0% ROE

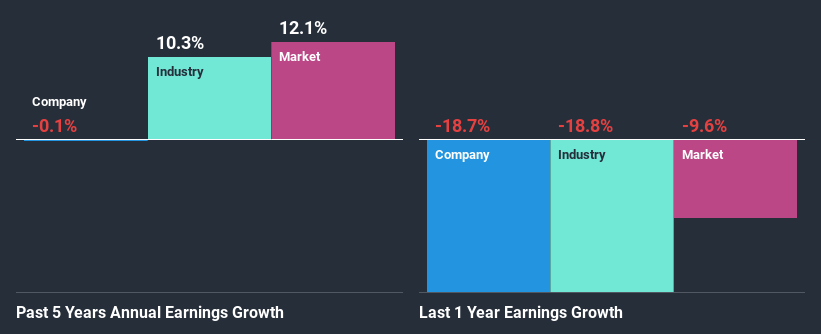

As you can see, Everest Industries' ROE looks pretty weak. Further, we noted that the company's ROE is similar to the industry average of 8.0%. Thus, the low ROE provides some context to Everest Industries' flat net income growth over the past five years.

We then compared Everest Industries' net income growth with the industry and found that the average industry growth rate was 10% in the same period.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Everest Industries is trading on a high P/E or a low P/E, relative to its industry.

Is Everest Industries Making Efficient Use Of Its Profits?

Everest Industries has a low three-year median payout ratio of 19% (or a retention ratio of 81%) but the negligible earnings growth number doesn't reflect this as high growth usually follows high profit retention.

Moreover, Everest Industries has been paying dividends for at least ten years or more suggesting that management must have perceived that the shareholders prefer dividends over earnings growth.

Summary

On the whole, we feel that the performance shown by Everest Industries can be open to many interpretations. While the company does have a high rate of profit retention, its low rate of return is probably hampering its earnings growth. So far, we've only made a quick discussion around the company's earnings growth. So it may be worth checking this free detailed graph of Everest Industries' past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

If you’re looking to trade Everest Industries, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Everest Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:EVERESTIND

Everest Industries

Manufactures and trades in building products for residential, commercial, and industrial sectors in India and internationally.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives