- India

- /

- Electrical

- /

- NSEI:DIACABS

What You Can Learn From Diamond Power Infrastructure Limited's (NSE:DIACABS) P/S After Its 26% Share Price Crash

Unfortunately for some shareholders, the Diamond Power Infrastructure Limited (NSE:DIACABS) share price has dived 26% in the last thirty days, prolonging recent pain. The good news is that in the last year, the stock has shone bright like a diamond, gaining 188%.

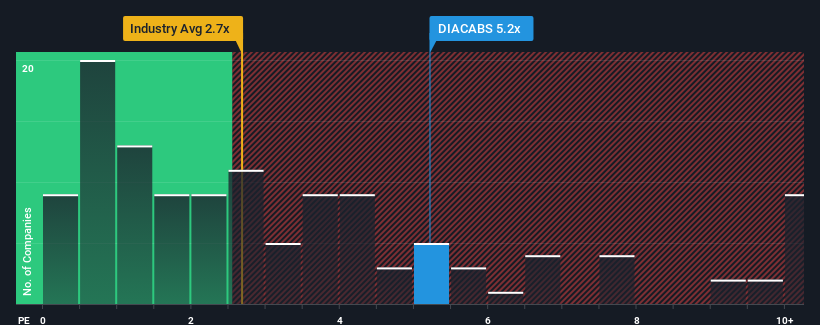

Although its price has dipped substantially, given around half the companies in India's Electrical industry have price-to-sales ratios (or "P/S") below 2.7x, you may still consider Diamond Power Infrastructure as a stock to avoid entirely with its 5.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Diamond Power Infrastructure

How Diamond Power Infrastructure Has Been Performing

With revenue growth that's exceedingly strong of late, Diamond Power Infrastructure has been doing very well. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Diamond Power Infrastructure, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Diamond Power Infrastructure would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an explosive gain to the company's top line. Spectacularly, three year revenue growth has also set the world alight, thanks to the last 12 months of incredible growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 32% shows it's noticeably more attractive.

In light of this, it's understandable that Diamond Power Infrastructure's P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

Even after such a strong price drop, Diamond Power Infrastructure's P/S still exceeds the industry median significantly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It's no surprise that Diamond Power Infrastructure can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 3 warning signs for Diamond Power Infrastructure (2 are a bit unpleasant!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DIACABS

Diamond Power Infrastructure

Manufactures and sells power transmission equipment.

Acceptable track record with low risk.

Market Insights

Community Narratives