- India

- /

- Electrical

- /

- NSEI:CGPOWER

The CG Power and Industrial Solutions (NSE:CGPOWER) Share Price Is Up 292% And Shareholders Are Boasting About It

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But if you pick the right stock, you can make a lot more than 100%. Take, for example CG Power and Industrial Solutions Limited (NSE:CGPOWER). Its share price is already up an impressive 292% in the last twelve months. On top of that, the share price is up 39% in about a quarter. But this could be related to the strong market, which is up 22% in the last three months. In contrast, the longer term returns are negative, since the share price is 56% lower than it was three years ago.

View our latest analysis for CG Power and Industrial Solutions

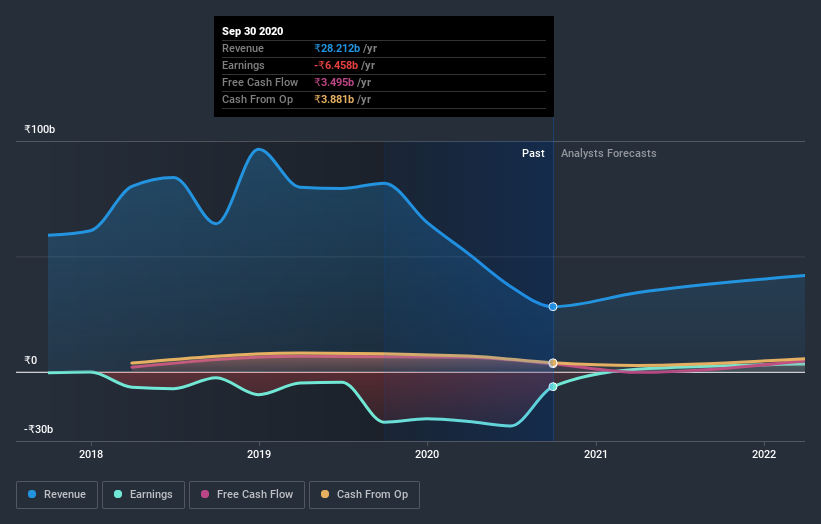

Given that CG Power and Industrial Solutions didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

CG Power and Industrial Solutions actually shrunk its revenue over the last year, with a reduction of 65%. We're a little surprised to see the share price pop 292% in the last year. It just goes to show the market doesn't always pay attention to the reported numbers. Of course, it could be that the market expected this revenue drop.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at CG Power and Industrial Solutions' financial health with this free report on its balance sheet.

A Different Perspective

It's good to see that CG Power and Industrial Solutions has rewarded shareholders with a total shareholder return of 292% in the last twelve months. Notably the five-year annualised TSR loss of 12% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for CG Power and Industrial Solutions (of which 2 are potentially serious!) you should know about.

But note: CG Power and Industrial Solutions may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you decide to trade CG Power and Industrial Solutions, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:CGPOWER

CG Power and Industrial Solutions

Provides various solutions in India and internationally.

Exceptional growth potential with flawless balance sheet.