Stock Analysis

- India

- /

- Aerospace & Defense

- /

- NSEI:BEL

Here's Why We Think Bharat Electronics (NSE:BEL) Is Well Worth Watching

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Bharat Electronics (NSE:BEL). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Bharat Electronics

Bharat Electronics's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. Bharat Electronics managed to grow EPS by 14% per year, over three years. That's a pretty good rate, if the company can sustain it.

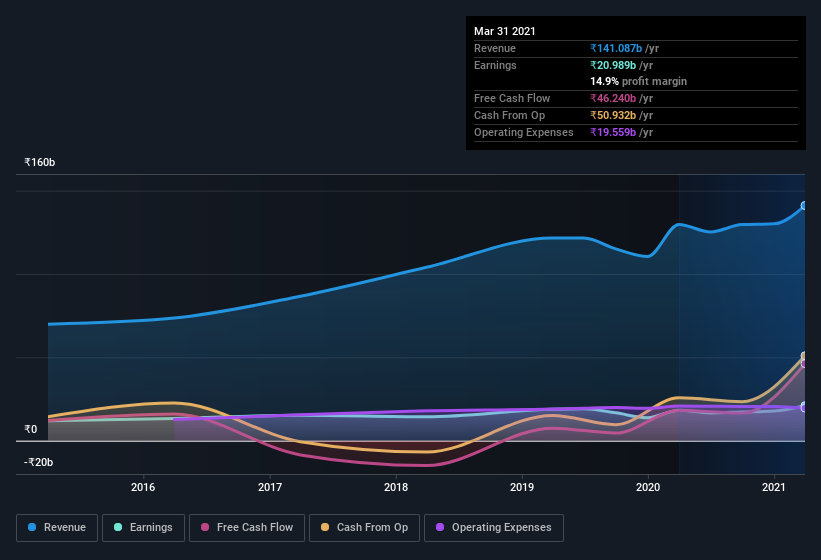

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Bharat Electronics's EBIT margins were flat over the last year, revenue grew by a solid 8.8% to ₹141b. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Bharat Electronics's forecast profits?

Are Bharat Electronics Insiders Aligned With All Shareholders?

As a general rule, I think it worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. For companies with market capitalizations between ₹297b and ₹890b, like Bharat Electronics, the median CEO pay is around ₹52m.

The Bharat Electronics CEO received total compensation of just ₹7.1m in the year to . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does Bharat Electronics Deserve A Spot On Your Watchlist?

One positive for Bharat Electronics is that it is growing EPS. That's nice to see. On top of that, my faith in the board of directors is strengthened by the fact of the reasonable CEO pay. So I do think the stock deserves further research, if not instant addition to your watchlist. We don't want to rain on the parade too much, but we did also find 2 warning signs for Bharat Electronics that you need to be mindful of.

Although Bharat Electronics certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Bharat Electronics, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Bharat Electronics is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:BEL

Bharat Electronics

Designs, manufactures, and supplies electronic equipment and systems for the defense and civilian markets in India.

Flawless balance sheet with solid track record and pays a dividend.