Stock Analysis

Examining Three Indian Exchange Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

In the past year, the Indian market has seen a robust increase of 46%, though it has remained flat over the last seven days. With earnings expected to grow by 16% per annum, companies with high insider ownership can be particularly appealing as they often indicate a strong commitment from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

| Pitti Engineering (BSE:513519) | 33.6% | 28.0% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 33.5% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 37.8% | 22.7% |

| Jupiter Wagons (NSEI:JWL) | 11.1% | 27.2% |

| Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

| JNK India (NSEI:JNKINDIA) | 23.8% | 31.8% |

| Chalet Hotels (NSEI:CHALET) | 13.1% | 27.6% |

| Kirloskar Pneumatic (BSE:505283) | 30.6% | 27.7% |

Here's a peek at a few of the choices from the screener.

Astral (NSEI:ASTRAL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Astral Limited operates in the manufacturing and marketing of pipes, water tanks, and adhesives and sealants both in India and internationally, with a market capitalization of approximately ₹610.76 billion.

Operations: The company generates ₹41.42 billion from plumbing and ₹14.99 billion from paints and adhesives.

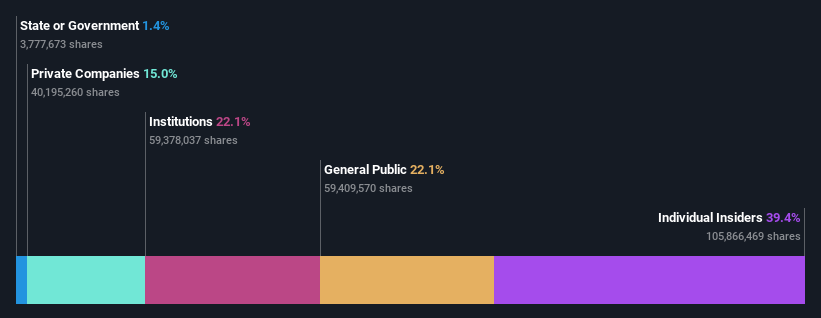

Insider Ownership: 39.4%

Earnings Growth Forecast: 23% p.a.

Astral Limited has demonstrated robust financial performance with a consistent increase in earnings, reporting a 19.1% annual growth over the past five years and an expected acceleration to 23% per year going forward. This growth outpaces the Indian market's average, reflecting strong revenue projections of 17.4% annually against a market rate of 9.6%. However, insider transactions have not shown significant buying activity recently, indicating potential caution among those closest to the company's operations.

- Click to explore a detailed breakdown of our findings in Astral's earnings growth report.

- Our valuation report here indicates Astral may be overvalued.

Info Edge (India) (NSEI:NAUKRI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Info Edge (India) Limited is an online classifieds company focusing on recruitment, matrimony, real estate, and education services both in India and internationally, with a market capitalization of approximately ₹823.70 billion.

Operations: The company generates revenue primarily through Recruitment Solutions and 99acres for Real Estate, earning ₹187.99 billion and ₹3.51 billion respectively.

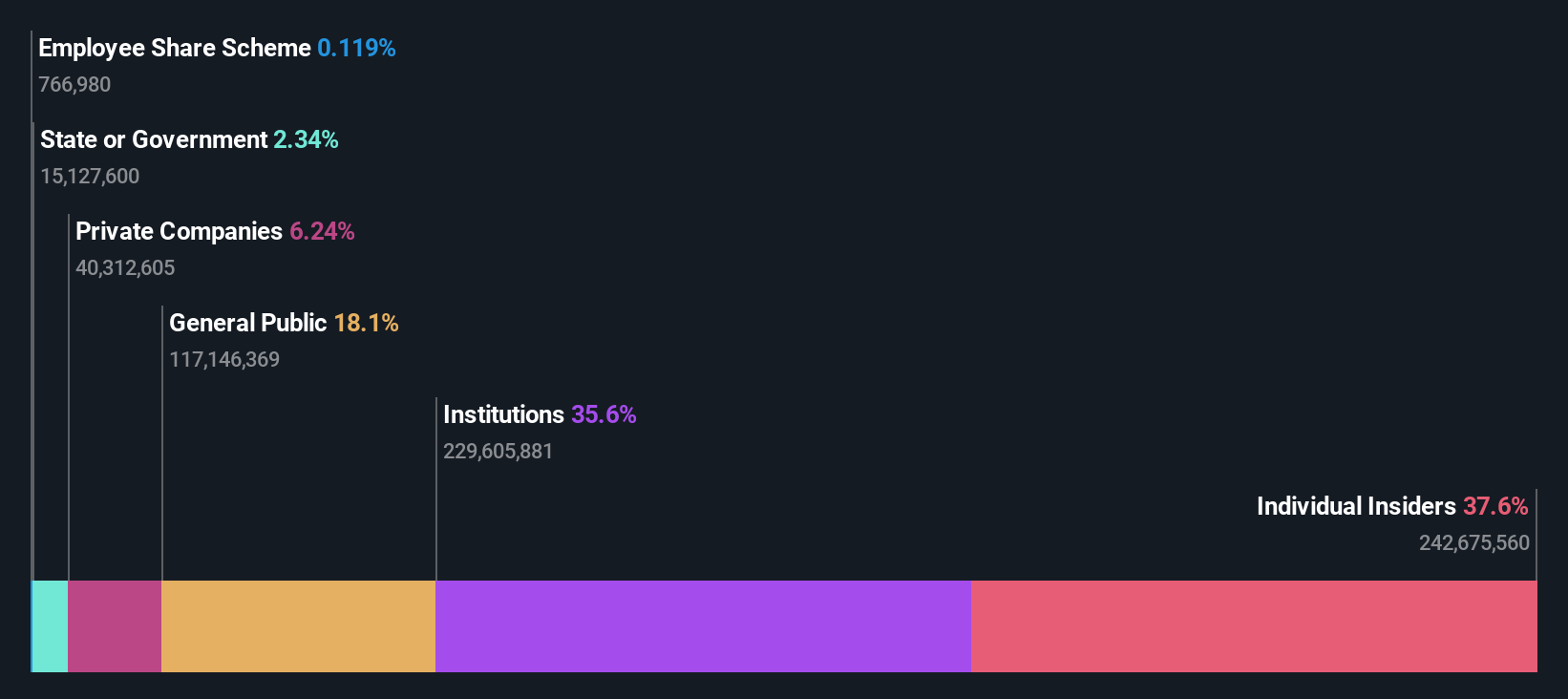

Insider Ownership: 37.9%

Earnings Growth Forecast: 24.3% p.a.

Info Edge (India) has shown promising growth with its earnings forecast to increase by 24.34% annually, outpacing the Indian market's average of 15.9%. Despite this, the company's Return on Equity is expected to remain low at 5.9% in three years. Insider activity has been relatively stable with more shares bought than sold recently, although no substantial purchases were made in the last quarter. The firm became profitable this year and announced a dividend increase, reflecting its improving financial health.

- Take a closer look at Info Edge (India)'s potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Info Edge (India) shares in the market.

Solara Active Pharma Sciences (NSEI:SOLARA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Solara Active Pharma Sciences Limited is engaged in the manufacturing and distribution of active pharmaceutical ingredients (APIs) in India, with a market capitalization of ₹21.72 billion.

Operations: The company's revenue from active pharmaceutical ingredients (APIs) totals ₹12.89 billion.

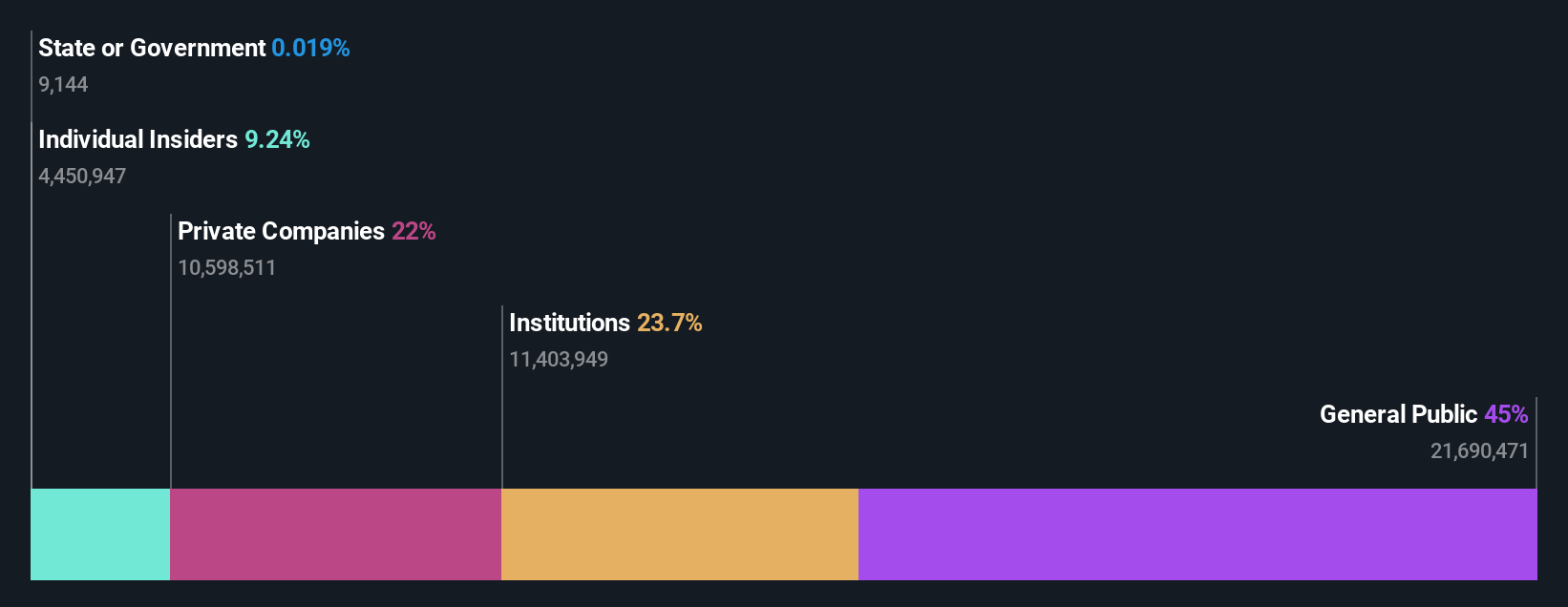

Insider Ownership: 10.4%

Earnings Growth Forecast: 141.2% p.a.

Solara Active Pharma Sciences, despite recent financial struggles including a net loss in Q4 2024, is poised for recovery with expected revenue growth of INR 15 billion and a return to profitability within three years. The company has recently completed a significant equity offering of INR 4.5 billion, which may dilute shareholder value but also funds expansion, like its new FDA-compliant facility in Visakhapatnam. This facility underscores Solara's commitment to compliance and market expansion, aligning with its strategic growth plans despite current volatility.

- Click here to discover the nuances of Solara Active Pharma Sciences with our detailed analytical future growth report.

- Our valuation report unveils the possibility Solara Active Pharma Sciences' shares may be trading at a discount.

Summing It All Up

- Access the full spectrum of 83 Fast Growing Indian Companies With High Insider Ownership by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Solara Active Pharma Sciences is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:SOLARA

Solara Active Pharma Sciences

Manufactures, produces, processes, formulates, sells, imports, merchandises, distributes, trades in, and deals in active pharmaceutical ingredients (API) in India.

Undervalued with reasonable growth potential.