Stock Analysis

Ujjivan Small Finance Bank (NSE:UJJIVANSFB) Share Prices Have Dropped 25% In The Last Year

While it may not be enough for some shareholders, we think it is good to see the Ujjivan Small Finance Bank Limited (NSE:UJJIVANSFB) share price up 22% in a single quarter. But that doesn't change the fact that the returns over the last year have been less than pleasing. After all, the share price is down 25% in the last year, significantly under-performing the market.

Check out our latest analysis for Ujjivan Small Finance Bank

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate twelve months during which the Ujjivan Small Finance Bank share price fell, it actually saw its earnings per share (EPS) improve by 3.3%. It's quite possible that growth expectations may have been unreasonable in the past.

By glancing at these numbers, we'd posit that the the market had expectations of much higher growth, last year. But looking to other metrics might better explain the share price change.

Ujjivan Small Finance Bank's revenue is actually up 7.9% over the last year. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

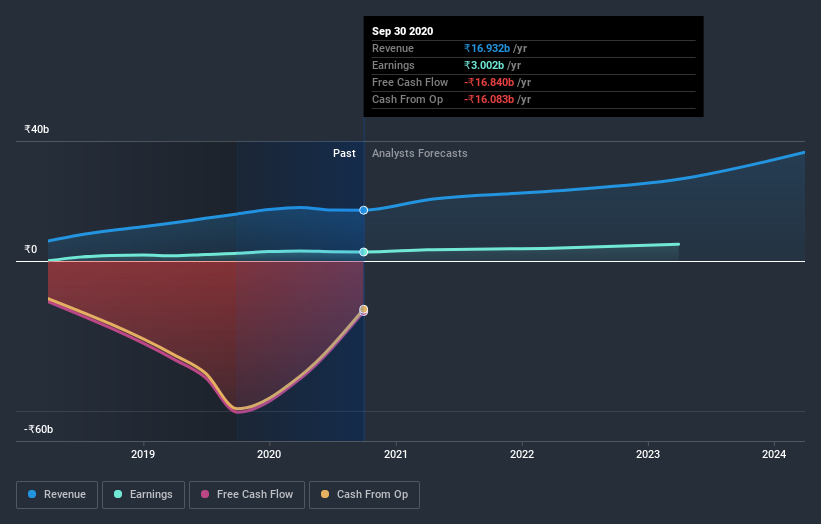

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. You can see what analysts are predicting for Ujjivan Small Finance Bank in this interactive graph of future profit estimates.

A Different Perspective

Given that the market gained 22% in the last year, Ujjivan Small Finance Bank shareholders might be miffed that they lost 25%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. It's great to see a nice little 22% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Ujjivan Small Finance Bank you should be aware of, and 1 of them is significant.

But note: Ujjivan Small Finance Bank may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you decide to trade Ujjivan Small Finance Bank, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Ujjivan Small Finance Bank is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:UJJIVANSFB

Ujjivan Small Finance Bank

Provides various banking and financial services in India.

Very undervalued with excellent balance sheet and pays a dividend.