- India

- /

- Auto Components

- /

- NSEI:MUNJALAU

Munjal Auto Industries Limited's (NSE:MUNJALAU) CEO Compensation Is Looking A Bit Stretched At The Moment

In the past three years, the share price of Munjal Auto Industries Limited (NSE:MUNJALAU) has struggled to generate growth for its shareholders. Per share earnings growth is also poor, despite revenues growing. Shareholders will have a chance to take their concerns to the board at the next AGM on 14 September 2021 and vote on resolutions including executive compensation, which studies show may have an impact on company performance. Here's our take on why we think shareholders might be hesitant about approving a raise at the moment.

View our latest analysis for Munjal Auto Industries

Comparing Munjal Auto Industries Limited's CEO Compensation With the industry

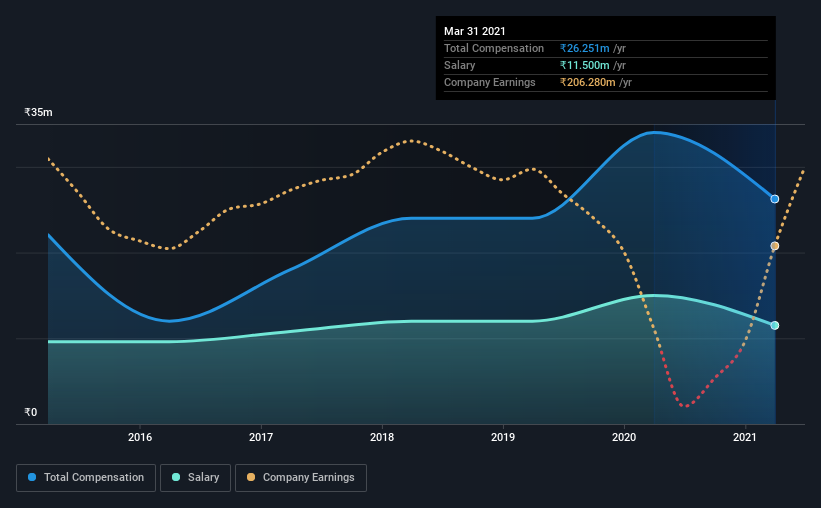

According to our data, Munjal Auto Industries Limited has a market capitalization of ₹5.7b, and paid its CEO total annual compensation worth ₹26m over the year to March 2021. Notably, that's a decrease of 23% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at ₹12m.

In comparison with other companies in the industry with market capitalizations under ₹15b, the reported median total CEO compensation was ₹7.9m. Hence, we can conclude that Sudhir Kumar Munjal is remunerated higher than the industry median.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | ₹12m | ₹15m | 44% |

| Other | ₹15m | ₹19m | 56% |

| Total Compensation | ₹26m | ₹34m | 100% |

Speaking on an industry level, nearly 74% of total compensation represents salary, while the remainder of 26% is other remuneration. It's interesting to note that Munjal Auto Industries allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Munjal Auto Industries Limited's Growth Numbers

Munjal Auto Industries Limited has reduced its earnings per share by 1.7% a year over the last three years. It achieved revenue growth of 105% over the last year.

Investors would be a bit wary of companies that have lower EPS But on the other hand, revenue growth is strong, suggesting a brighter future. It's hard to reach a conclusion about business performance right now. This may be one to watch. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Munjal Auto Industries Limited Been A Good Investment?

With a three year total loss of 7.0% for the shareholders, Munjal Auto Industries Limited would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

The company's earnings haven't grown and possibly because of that, the stock has performed poorly, resulting in a loss for the company's shareholders. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 2 warning signs for Munjal Auto Industries (1 doesn't sit too well with us!) that you should be aware of before investing here.

Switching gears from Munjal Auto Industries, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading Munjal Auto Industries or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:MUNJALAU

Munjal Auto Industries

Manufactures and sells auto components for motor vehicles in India.

Low risk and slightly overvalued.

Market Insights

Community Narratives