- India

- /

- Auto Components

- /

- NSEI:MODIRUBBER

We Think That There Are More Issues For Modi Rubber (NSE:MODIRUBBER) Than Just Sluggish Earnings

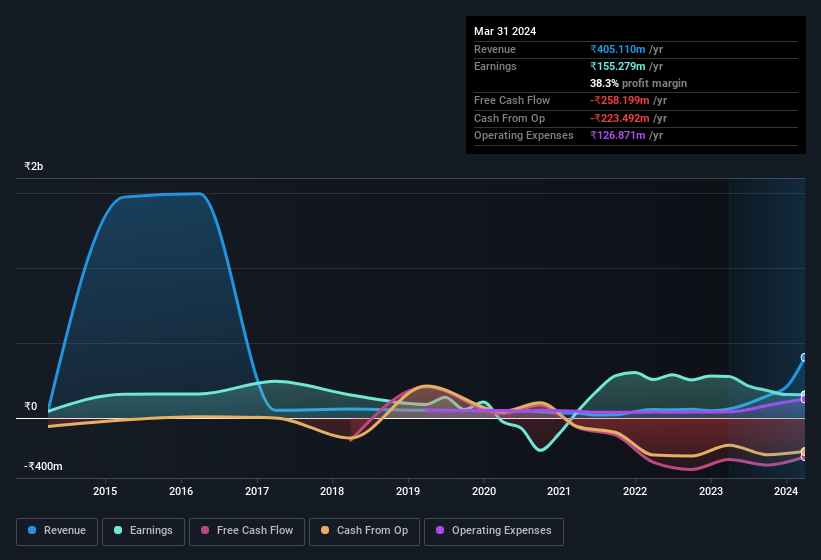

The market wasn't impressed with the soft earnings from Modi Rubber Limited (NSE:MODIRUBBER) recently. Our analysis has found some reasons to be concerned, beyond the weak headline numbers.

See our latest analysis for Modi Rubber

Operating Revenue Or Not?

At most companies, some revenue streams, such as government grants, are accounted for as non-operating revenue, while the core business is said to produce operating revenue. Oftentimes, non-operating revenue spikes are not repeated, so it makes sense to be cautious where non-operating revenue has made a very large contribution to total profit. Importantly, the non-operating revenue often comes without associated ongoing costs, so it can boost profit by letting it fall straight to the bottom line, making the operating business seem better than it really is. It's worth noting that Modi Rubber saw a big increase in non-operating revenue over the last year. In fact, our data indicates that non-operating revenue increased from ₹6.75m to ₹377.5m. If that non-operating revenue fails to manifest in the current year, then there's a real risk the bottom line profit result will be impacted negatively. Sometimes, you can get a better idea of the underlying earnings potential of a company by excluding unusual boosts to non-operating revenue.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Modi Rubber.

Our Take On Modi Rubber's Profit Performance

Since Modi Rubber saw a big increase in its non-operating revenue over the last twelve months, we'd be very cautious about relying too heavily on the statutory profit number, which would have benefitted from this potentially unsustainable change. For this reason, we think that Modi Rubber's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. But the good news is that its EPS growth over the last three years has been very impressive. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. So while earnings quality is important, it's equally important to consider the risks facing Modi Rubber at this point in time. For example - Modi Rubber has 3 warning signs we think you should be aware of.

This note has only looked at a single factor that sheds light on the nature of Modi Rubber's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MODIRUBBER

Modi Rubber

Manufactures and sells automobile tyres, tubes, and flaps in India.

Moderate risk with mediocre balance sheet.

Market Insights

Community Narratives