- India

- /

- Auto Components

- /

- NSEI:LUMAXIND

Some Investors May Be Worried About Lumax Industries' (NSE:LUMAXIND) Returns On Capital

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. Having said that, from a first glance at Lumax Industries (NSE:LUMAXIND) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

Return On Capital Employed (ROCE): What is it?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Lumax Industries, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.055 = ₹278m ÷ (₹12b - ₹7.3b) (Based on the trailing twelve months to December 2020).

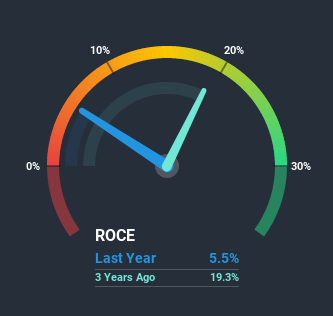

Thus, Lumax Industries has an ROCE of 5.5%. Ultimately, that's a low return and it under-performs the Auto Components industry average of 8.7%.

View our latest analysis for Lumax Industries

Above you can see how the current ROCE for Lumax Industries compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

What Can We Tell From Lumax Industries' ROCE Trend?

On the surface, the trend of ROCE at Lumax Industries doesn't inspire confidence. Over the last five years, returns on capital have decreased to 5.5% from 17% five years ago. Given the business is employing more capital while revenue has slipped, this is a bit concerning. If this were to continue, you might be looking at a company that is trying to reinvest for growth but is actually losing market share since sales haven't increased.

On a separate but related note, it's important to know that Lumax Industries has a current liabilities to total assets ratio of 59%, which we'd consider pretty high. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.

What We Can Learn From Lumax Industries' ROCE

From the above analysis, we find it rather worrisome that returns on capital and sales for Lumax Industries have fallen, meanwhile the business is employing more capital than it was five years ago. Yet despite these poor fundamentals, the stock has gained a huge 306% over the last five years, so investors appear very optimistic. In any case, the current underlying trends don't bode well for long term performance so unless they reverse, we'd start looking elsewhere.

On a final note, we found 3 warning signs for Lumax Industries (1 makes us a bit uncomfortable) you should be aware of.

While Lumax Industries isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

When trading Lumax Industries or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:LUMAXIND

Lumax Industries

Manufactures and sells automotive components for in India.

High growth potential average dividend payer.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026