- India

- /

- Auto Components

- /

- NSEI:HINDCOMPOS

Shareholders May Be More Conservative With Hindustan Composites Limited's (NSE:HINDCOMPOS) CEO Compensation For Now

Key Insights

- Hindustan Composites to hold its Annual General Meeting on 29th of September

- CEO Pawan Choudhary's total compensation includes salary of ₹10.0m

- The total compensation is 35% higher than the average for the industry

- Hindustan Composites' total shareholder return over the past three years was 130% while its EPS grew by 43% over the past three years

Under the guidance of CEO Pawan Choudhary, Hindustan Composites Limited (NSE:HINDCOMPOS) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 29th of September. However, some shareholders will still be cautious of paying the CEO excessively.

Check out our latest analysis for Hindustan Composites

Comparing Hindustan Composites Limited's CEO Compensation With The Industry

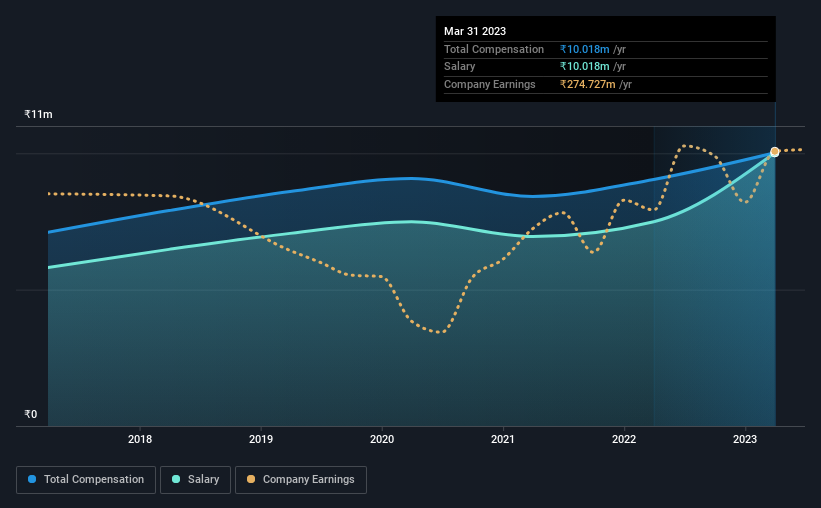

Our data indicates that Hindustan Composites Limited has a market capitalization of ₹6.1b, and total annual CEO compensation was reported as ₹10m for the year to March 2023. Notably, that's an increase of 11% over the year before. Notably, the salary of ₹10m is the entirety of the CEO compensation.

In comparison with other companies in the Indian Auto Components industry with market capitalizations under ₹17b, the reported median total CEO compensation was ₹7.4m. Hence, we can conclude that Pawan Choudhary is remunerated higher than the industry median.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | ₹10m | ₹7.5m | 100% |

| Other | - | ₹1.6m | - |

| Total Compensation | ₹10m | ₹9.0m | 100% |

Talking in terms of the industry, salary represented approximately 76% of total compensation out of all the companies we analyzed, while other remuneration made up 24% of the pie. On a company level, Hindustan Composites prefers to reward its CEO through a salary, opting not to pay Pawan Choudhary through non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Hindustan Composites Limited's Growth Numbers

Hindustan Composites Limited's earnings per share (EPS) grew 43% per year over the last three years. Its revenue is up 11% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Hindustan Composites Limited Been A Good Investment?

Boasting a total shareholder return of 130% over three years, Hindustan Composites Limited has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Hindustan Composites rewards its CEO solely through a salary, ignoring non-salary benefits completely. Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 2 warning signs for Hindustan Composites that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if Hindustan Composites might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HINDCOMPOS

Hindustan Composites

Develops, manufactures, and markets fibre-based friction materials in India.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success