- India

- /

- Auto Components

- /

- NSEI:DYNAMATECH

We Think Dynamatic Technologies (NSE:DYNAMATECH) Is Taking Some Risk With Its Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Dynamatic Technologies Limited (NSE:DYNAMATECH) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Dynamatic Technologies

What Is Dynamatic Technologies's Net Debt?

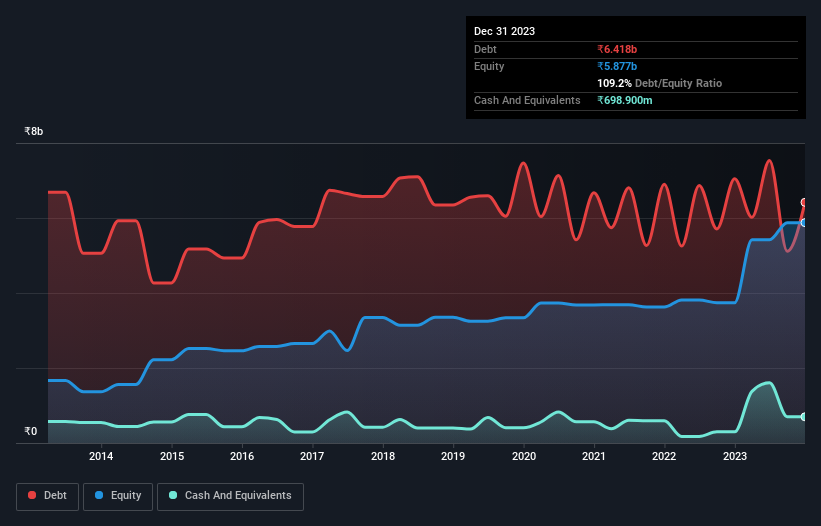

The image below, which you can click on for greater detail, shows that Dynamatic Technologies had debt of ₹6.42b at the end of September 2023, a reduction from ₹7.04b over a year. On the flip side, it has ₹698.9m in cash leading to net debt of about ₹5.72b.

How Strong Is Dynamatic Technologies' Balance Sheet?

According to the last reported balance sheet, Dynamatic Technologies had liabilities of ₹5.56b due within 12 months, and liabilities of ₹3.86b due beyond 12 months. Offsetting these obligations, it had cash of ₹698.9m as well as receivables valued at ₹2.27b due within 12 months. So its liabilities total ₹6.45b more than the combination of its cash and short-term receivables.

Of course, Dynamatic Technologies has a market capitalization of ₹45.1b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While we wouldn't worry about Dynamatic Technologies's net debt to EBITDA ratio of 4.4, we think its super-low interest cover of 2.0 times is a sign of high leverage. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. More concerning, Dynamatic Technologies saw its EBIT drop by 5.3% in the last twelve months. If it keeps going like that paying off its debt will be like running on a treadmill -- a lot of effort for not much advancement. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Dynamatic Technologies will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. Looking at the most recent three years, Dynamatic Technologies recorded free cash flow of 47% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

Both Dynamatic Technologies's interest cover and its net debt to EBITDA were discouraging. At least its level of total liabilities gives us reason to be optimistic. Taking the abovementioned factors together we do think Dynamatic Technologies's debt poses some risks to the business. While that debt can boost returns, we think the company has enough leverage now. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for Dynamatic Technologies (of which 1 is a bit unpleasant!) you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DYNAMATECH

Dynamatic Technologies

Manufactures and sells engineered products to the aerospace, automotive, and hydraulic industries in India, the United States, the United Kingdom, rest of Europe, Canada, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Alphabet Inc. (GOOG): The Gemini Era – Consolidating AI Dominance in 2026.

Meta Platforms Inc (META): The AI Infrastructure Pivot – Monetizing the Next Frontier in 2026.

Enlight Renewable Energy Ltd. (ENLT): Scaling the Global Green Grid – A 2026 Powerhouse.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Nu holdings will continue to disrupt the South American banking market