- India

- /

- Auto Components

- /

- NSEI:DYNAMATECH

This Is Why Dynamatic Technologies Limited's (NSE:DYNAMATECH) CEO Can Expect A Bump Up In Their Pay Packet

Key Insights

- Dynamatic Technologies' Annual General Meeting to take place on 30th of September

- CEO Udayant Malhoutra's total compensation includes salary of ₹14.4m

- The overall pay is 42% below the industry average

- Dynamatic Technologies' total shareholder return over the past three years was 213% while its EPS grew by 4.8% over the past three years

Shareholders will be pleased by the robust performance of Dynamatic Technologies Limited (NSE:DYNAMATECH) recently and this will be kept in mind in the upcoming AGM on 30th of September. They will probably be more interested in hearing the board discuss future initiatives to further improve the business as they vote on resolutions such as executive remuneration. In our analysis below, we discuss why we think the CEO compensation looks acceptable and the case for a raise.

Check out our latest analysis for Dynamatic Technologies

How Does Total Compensation For Udayant Malhoutra Compare With Other Companies In The Industry?

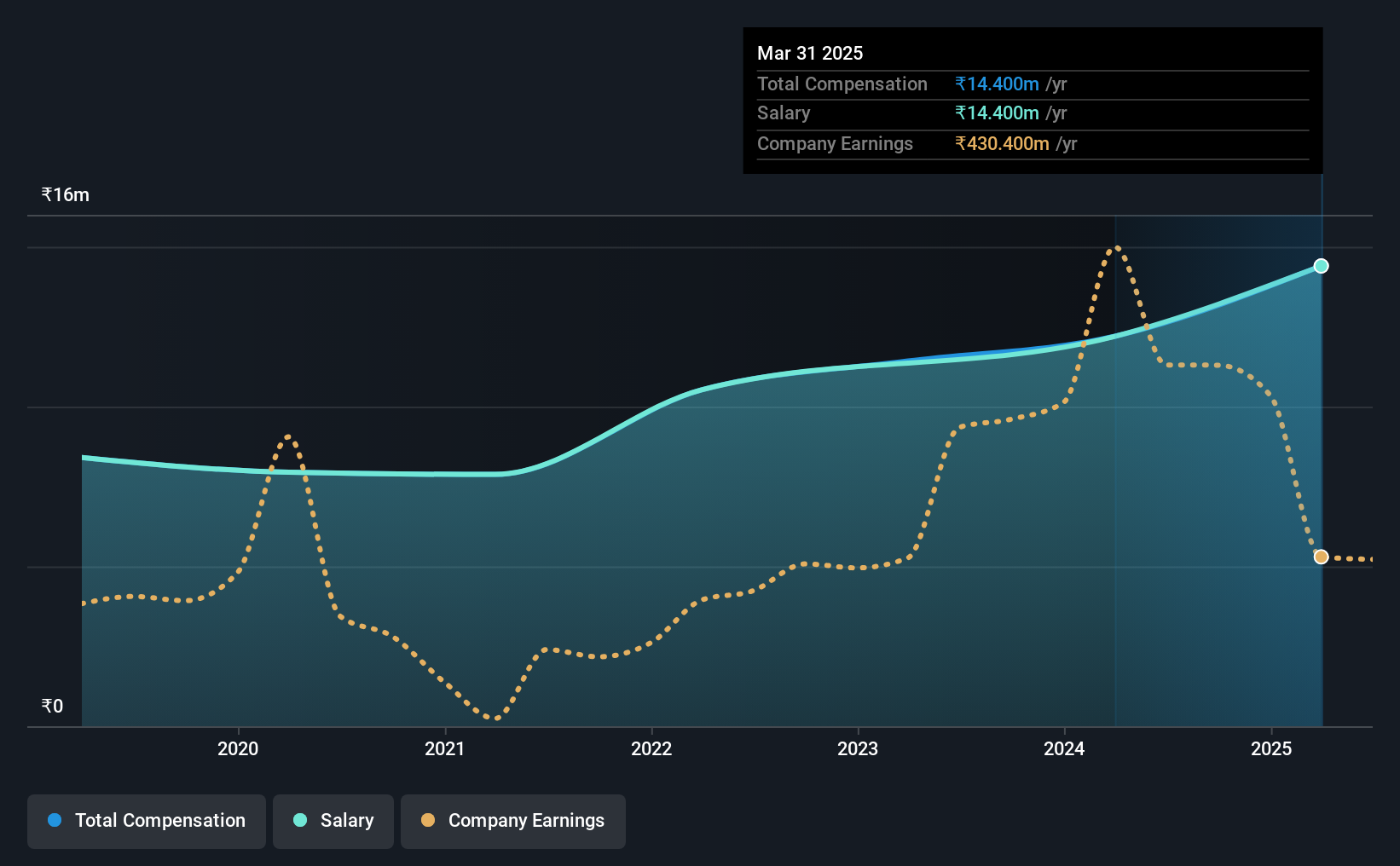

According to our data, Dynamatic Technologies Limited has a market capitalization of ₹48b, and paid its CEO total annual compensation worth ₹14m over the year to March 2025. Notably, that's an increase of 18% over the year before. Notably, the salary of ₹14m is the entirety of the CEO compensation.

In comparison with other companies in the Indian Auto Components industry with market capitalizations ranging from ₹18b to ₹71b, the reported median CEO total compensation was ₹25m. In other words, Dynamatic Technologies pays its CEO lower than the industry median. Furthermore, Udayant Malhoutra directly owns ₹3.7b worth of shares in the company, implying that they are deeply invested in the company's success.

Speaking on an industry level, nearly 78% of total compensation represents salary, while the remainder of 22% is other remuneration. At the company level, Dynamatic Technologies pays Udayant Malhoutra solely through a salary, preferring to go down a conventional route. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Dynamatic Technologies Limited's Growth

Dynamatic Technologies Limited has seen its earnings per share (EPS) increase by 4.8% a year over the past three years. It achieved revenue growth of 1.1% over the last year.

We would argue that the improvement in revenue is good, but isn't particularly impressive, but it is good to see modest EPS growth. Considering these factors we'd say performance has been pretty decent, though not amazing. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Dynamatic Technologies Limited Been A Good Investment?

Most shareholders would probably be pleased with Dynamatic Technologies Limited for providing a total return of 213% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Dynamatic Technologies rewards its CEO solely through a salary, ignoring non-salary benefits completely. Overall, the company hasn't done too poorly performance-wise, but we would like to see some improvement. If it continues on the same road, shareholders might feel even more confident about their investment, and have little to no objections concerning CEO pay. Rather, investors would more likely want to engage on discussions related to key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 2 warning signs for Dynamatic Technologies (of which 1 makes us a bit uncomfortable!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DYNAMATECH

Dynamatic Technologies

Manufactures and sells engineered products to the aerospace, automotive, and hydraulic industries in India, the United States, the United Kingdom, rest of Europe, Canada, and internationally.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Why EnSilica is Worth Possibly 13x its Current Price

Inotiv NAMs Test Center

Credo Technology Group (CRDO): High-Speed Growth Meets Margin Compression in 2026.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks