- India

- /

- Auto Components

- /

- NSEI:BANCOINDIA

These 4 Measures Indicate That Banco Products (India) (NSE:BANCOINDIA) Is Using Debt Reasonably Well

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Banco Products (India) Limited (NSE:BANCOINDIA) does carry debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Banco Products (India)

How Much Debt Does Banco Products (India) Carry?

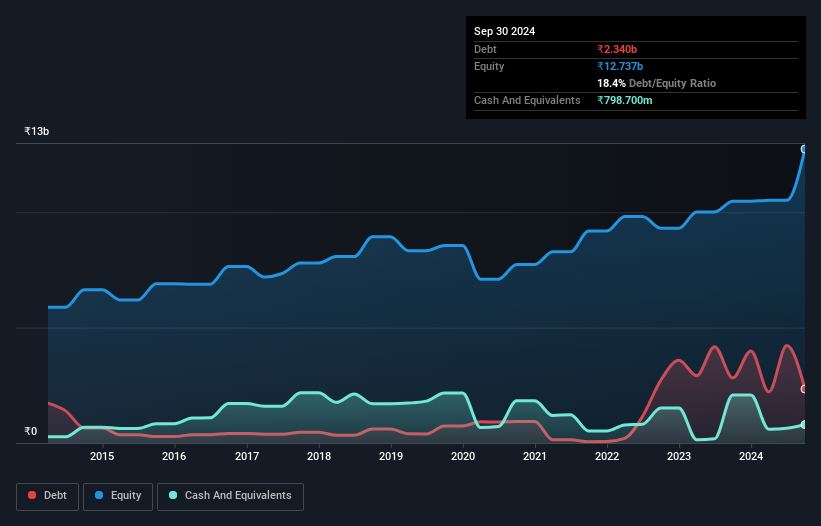

The image below, which you can click on for greater detail, shows that Banco Products (India) had debt of ₹2.34b at the end of September 2024, a reduction from ₹2.82b over a year. However, it also had ₹798.7m in cash, and so its net debt is ₹1.54b.

How Strong Is Banco Products (India)'s Balance Sheet?

According to the last reported balance sheet, Banco Products (India) had liabilities of ₹7.55b due within 12 months, and liabilities of ₹3.13b due beyond 12 months. Offsetting these obligations, it had cash of ₹798.7m as well as receivables valued at ₹6.87b due within 12 months. So it has liabilities totalling ₹3.02b more than its cash and near-term receivables, combined.

Given Banco Products (India) has a market capitalization of ₹58.6b, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Banco Products (India) has a low net debt to EBITDA ratio of only 0.30. And its EBIT covers its interest expense a whopping 31.6 times over. So we're pretty relaxed about its super-conservative use of debt. And we also note warmly that Banco Products (India) grew its EBIT by 17% last year, making its debt load easier to handle. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Banco Products (India)'s earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Looking at the most recent three years, Banco Products (India) recorded free cash flow of 22% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

Happily, Banco Products (India)'s impressive interest cover implies it has the upper hand on its debt. But truth be told we feel its conversion of EBIT to free cash flow does undermine this impression a bit. When we consider the range of factors above, it looks like Banco Products (India) is pretty sensible with its use of debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 2 warning signs we've spotted with Banco Products (India) (including 1 which shouldn't be ignored) .

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Banco Products (India) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BANCOINDIA

Banco Products (India)

Engages in the manufacture and sale of heat exchangers/cooling systems in India and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success