- India

- /

- Auto Components

- /

- NSEI:BANCOINDIA

Banco Products (India) (NSE:BANCOINDIA) Seems To Use Debt Quite Sensibly

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Banco Products (India) Limited (NSE:BANCOINDIA) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Banco Products (India)

What Is Banco Products (India)'s Net Debt?

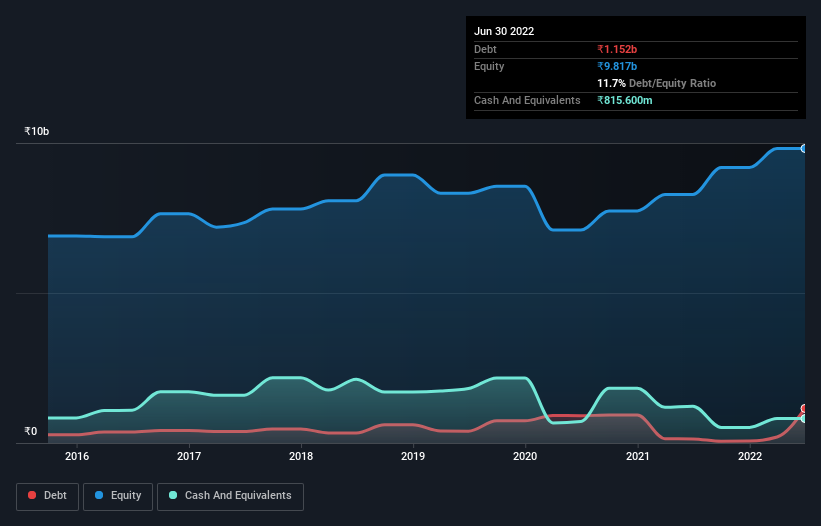

You can click the graphic below for the historical numbers, but it shows that as of March 2022 Banco Products (India) had ₹1.15b of debt, an increase on ₹137.2m, over one year. However, because it has a cash reserve of ₹815.6m, its net debt is less, at about ₹336.5m.

How Strong Is Banco Products (India)'s Balance Sheet?

We can see from the most recent balance sheet that Banco Products (India) had liabilities of ₹3.66b falling due within a year, and liabilities of ₹1.84b due beyond that. Offsetting this, it had ₹815.6m in cash and ₹3.24b in receivables that were due within 12 months. So its liabilities total ₹1.44b more than the combination of its cash and short-term receivables.

Given Banco Products (India) has a market capitalization of ₹14.9b, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Banco Products (India)'s net debt is only 0.13 times its EBITDA. And its EBIT covers its interest expense a whopping 34.4 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. And we also note warmly that Banco Products (India) grew its EBIT by 14% last year, making its debt load easier to handle. There's no doubt that we learn most about debt from the balance sheet. But it is Banco Products (India)'s earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. In the last three years, Banco Products (India)'s free cash flow amounted to 22% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

The good news is that Banco Products (India)'s demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. But truth be told we feel its conversion of EBIT to free cash flow does undermine this impression a bit. When we consider the range of factors above, it looks like Banco Products (India) is pretty sensible with its use of debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 2 warning signs with Banco Products (India) (at least 1 which is a bit concerning) , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Banco Products (India) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BANCOINDIA

Banco Products (India)

Engages in the manufacture and sale of heat exchangers/cooling systems in India and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives