Bajaj Auto Limited's (NSE:BAJAJ-AUTO) Business Is Yet to Catch Up With Its Share Price

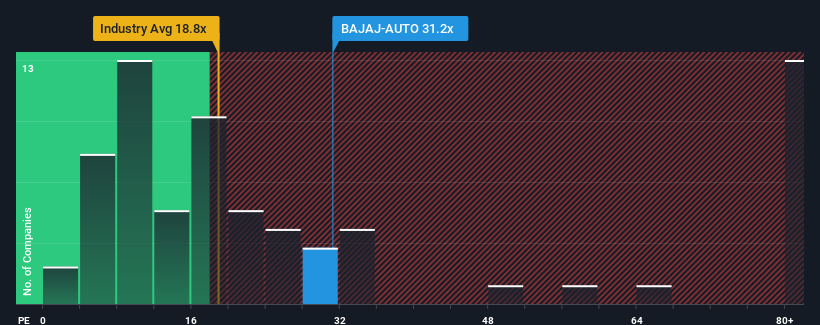

Bajaj Auto Limited's (NSE:BAJAJ-AUTO) price-to-earnings (or "P/E") ratio of 31.2x might make it look like a sell right now compared to the market in India, where around half of the companies have P/E ratios below 25x and even P/E's below 15x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

With earnings growth that's inferior to most other companies of late, Bajaj Auto has been relatively sluggish. It might be that many expect the uninspiring earnings performance to recover significantly, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Bajaj Auto

Does Growth Match The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Bajaj Auto's to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 2.7% last year. The solid recent performance means it was also able to grow EPS by 26% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 18% each year during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to expand by 19% each year, which is not materially different.

With this information, we find it interesting that Bajaj Auto is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Bajaj Auto currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Having said that, be aware Bajaj Auto is showing 1 warning sign in our investment analysis, you should know about.

Of course, you might also be able to find a better stock than Bajaj Auto. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Bajaj Auto might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BAJAJ-AUTO

Bajaj Auto

Engages in the development, manufacture, and distribution of automobiles in India and internationally.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives