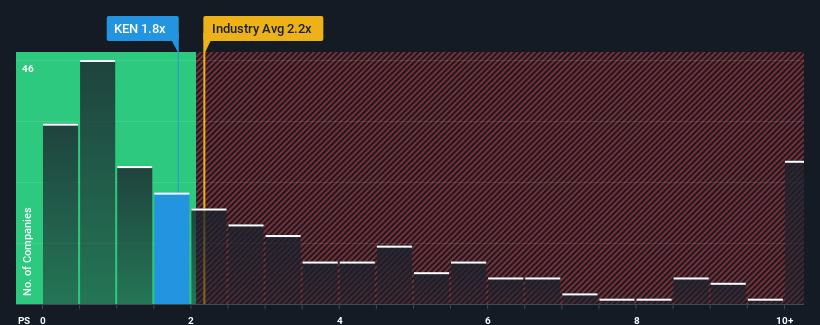

When close to half the companies in the Renewable Energy industry in Israel have price-to-sales ratios (or "P/S") above 8.1x, you may consider Kenon Holdings Ltd. (TLV:KEN) as a highly attractive investment with its 1.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Kenon Holdings

How Kenon Holdings Has Been Performing

Kenon Holdings has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Kenon Holdings will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Kenon Holdings?

In order to justify its P/S ratio, Kenon Holdings would need to produce anemic growth that's substantially trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 25%. The latest three year period has also seen an excellent 74% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 16% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we find it odd that Kenon Holdings is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

What Does Kenon Holdings' P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We're very surprised to see Kenon Holdings currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Kenon Holdings, and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Kenon Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:KEN

Kenon Holdings

Through its subsidiaries, operates as an owner, developer, and operator of power generation facilities in Israel and the United States.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives