How El Al Israel Airlines' Mixed Q3 Results Could Influence Shareholder Value (TASE:ELAL)

Reviewed by Sasha Jovanovic

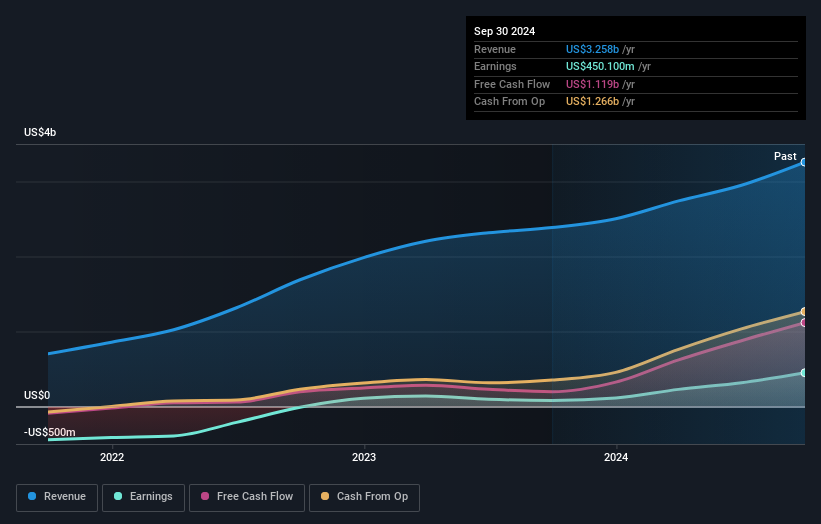

- El Al Israel Airlines recently reported its third quarter 2025 results, highlighting quarterly sales of US$1.07 billion and net income of US$198.6 million, both higher compared to last year.

- Despite growth in overall revenue and profit, the company saw a year-on-year decline in earnings per share, signaling shifts in profitability for shareholders.

- We’ll examine how the drop in earnings per share shapes El Al’s investment narrative after the release of its quarterly results.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

What Is El Al Israel Airlines' Investment Narrative?

The investment case for El Al Israel Airlines has centered on value, resilient revenue, and a strong recent return relative to both the Israeli market and airline peers. While this latest quarter delivered healthy year-on-year growth in sales and net income, the continued decline in earnings per share stands out, tempering the recent streak of improving profitability and suggesting shareholders might need to recalibrate expectations on per-share performance. The core catalysts that many investors have focused on, namely operational efficiency, low price-to-earnings ratio, inclusion in major indices, and strong return on equity, still stand, but with the latest EPS decline, questions around margin stability and potential dilution move to the forefront in the short term. At the same time, long-standing risks, such as the auditors’ going concern qualifications, persist and seem more relevant, particularly as profit growth slows from the exceptional rates seen in past years. Recent price action around results shows only moderate movement, hinting that the news may have been reasonably anticipated, but it remains crucial to watch whether future quarters address or exacerbate these shifting trends.

But despite top-line gains, persistent doubts about margin stability are something every investor should note. Despite retreating, El Al Israel Airlines' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 3 other fair value estimates on El Al Israel Airlines - why the stock might be worth over 3x more than the current price!

Build Your Own El Al Israel Airlines Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your El Al Israel Airlines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free El Al Israel Airlines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate El Al Israel Airlines' overall financial health at a glance.

No Opportunity In El Al Israel Airlines?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if El Al Israel Airlines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ELAL

El Al Israel Airlines

Provides passenger and cargo transportation services.

Flawless balance sheet and good value.

Market Insights

Community Narratives