- Israel

- /

- Electronic Equipment and Components

- /

- TASE:UNIT

Unitronics (1989) (RG)'s (TLV:UNIT) 36% CAGR outpaced the company's earnings growth over the same five-year period

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on a lighter note, a good company can see its share price rise well over 100%. For instance, the price of Unitronics (1989) (R"G) Ltd (TLV:UNIT) stock is up an impressive 221% over the last five years. Also pleasing for shareholders was the 24% gain in the last three months. But this move may well have been assisted by the reasonably buoyant market (up 10.0% in 90 days).

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

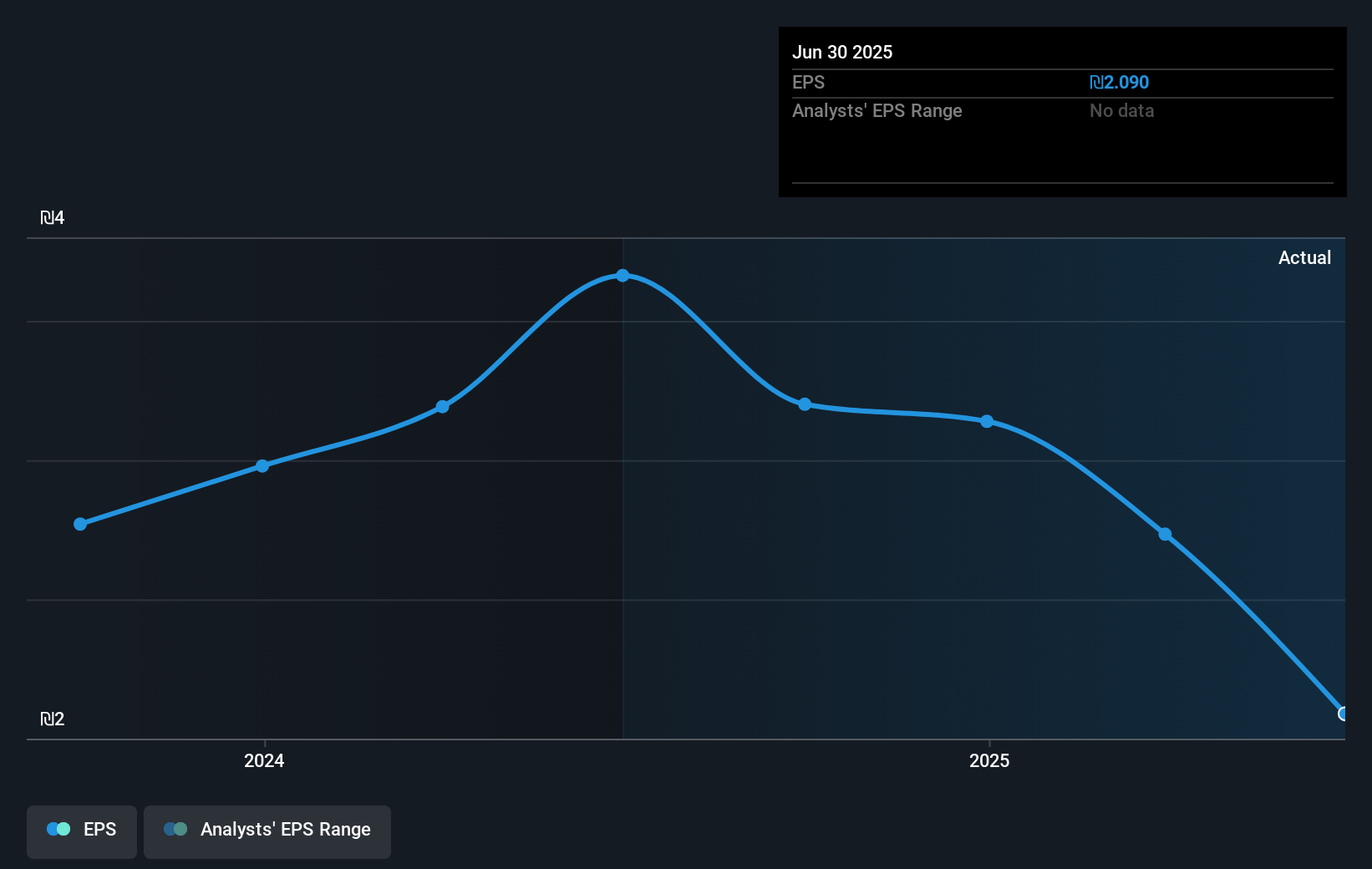

During five years of share price growth, Unitronics (1989) (RG) achieved compound earnings per share (EPS) growth of 25% per year. This EPS growth is remarkably close to the 26% average annual increase in the share price. Therefore one could conclude that sentiment towards the shares hasn't morphed very much. Indeed, it would appear the share price is reacting to the EPS.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into Unitronics (1989) (RG)'s key metrics by checking this interactive graph of Unitronics (1989) (RG)'s earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Unitronics (1989) (RG)'s TSR for the last 5 years was 364%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market gained around 56% in the last year, Unitronics (1989) (RG) shareholders lost 9.6% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 36%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Unitronics (1989) (RG) better, we need to consider many other factors. For example, we've discovered 1 warning sign for Unitronics (1989) (RG) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Israeli exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:UNIT

Unitronics (1989) (RG)

Designs, develops, produces, markets, and sells, and supports programmable logic controllers (PLC) and other automation products in Israel, Europe, the United States, and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives