- Israel

- /

- Electronic Equipment and Components

- /

- TASE:PCBT

P.C.B. Technologies Ltd's (TLV:PCBT) Share Price Boosted 28% But Its Business Prospects Need A Lift Too

P.C.B. Technologies Ltd (TLV:PCBT) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 56% in the last year.

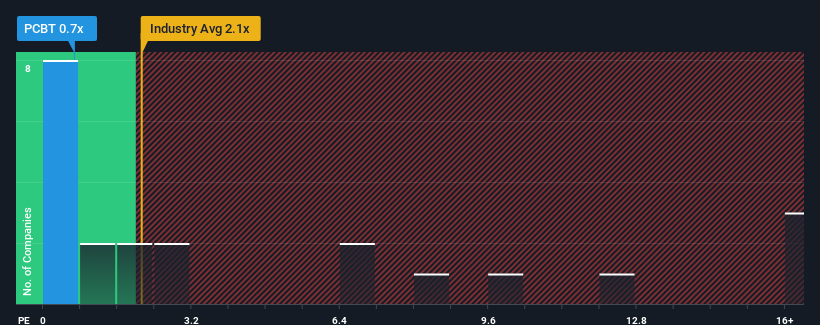

In spite of the firm bounce in price, P.C.B. Technologies may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.7x, considering almost half of all companies in the Electronic industry in Israel have P/S ratios greater than 2.1x and even P/S higher than 9x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for P.C.B. Technologies

How P.C.B. Technologies Has Been Performing

P.C.B. Technologies has been doing a decent job lately as it's been growing revenue at a reasonable pace. Perhaps the market believes the recent revenue performance might fall short of industry figures in the near future, leading to a reduced P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for P.C.B. Technologies, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For P.C.B. Technologies?

There's an inherent assumption that a company should underperform the industry for P/S ratios like P.C.B. Technologies' to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 4.1%. Revenue has also lifted 15% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 19% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in consideration, it's easy to understand why P.C.B. Technologies' P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From P.C.B. Technologies' P/S?

P.C.B. Technologies' stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

In line with expectations, P.C.B. Technologies maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 4 warning signs for P.C.B. Technologies (of which 1 makes us a bit uncomfortable!) you should know about.

If these risks are making you reconsider your opinion on P.C.B. Technologies, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:PCBT

P.C.B. Technologies

Engages in the production, sale, marketing, and repair of printed circuit boards (PCB) and beddings in Israel and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives