- Israel

- /

- Electronic Equipment and Components

- /

- TASE:NXSN

Earnings Tell The Story For NextVision Stabilized Systems, Ltd. (TLV:NXSN) As Its Stock Soars 26%

NextVision Stabilized Systems, Ltd. (TLV:NXSN) shares have continued their recent momentum with a 26% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 91% in the last year.

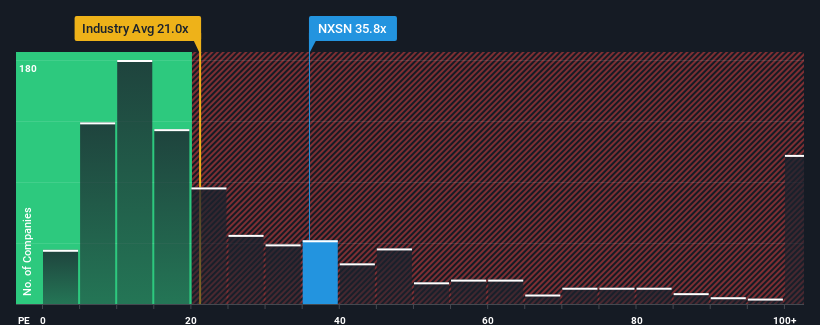

Following the firm bounce in price, NextVision Stabilized Systems' price-to-earnings (or "P/E") ratio of 35.8x might make it look like a strong sell right now compared to the market in Israel, where around half of the companies have P/E ratios below 14x and even P/E's below 9x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

We've discovered 1 warning sign about NextVision Stabilized Systems. View them for free.NextVision Stabilized Systems certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for NextVision Stabilized Systems

Is There Enough Growth For NextVision Stabilized Systems?

There's an inherent assumption that a company should far outperform the market for P/E ratios like NextVision Stabilized Systems' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 139% gain to the company's bottom line. The latest three year period has also seen an excellent 1,016% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 7.7% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why NextVision Stabilized Systems is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Key Takeaway

The strong share price surge has got NextVision Stabilized Systems' P/E rushing to great heights as well. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that NextVision Stabilized Systems maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware NextVision Stabilized Systems is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on NextVision Stabilized Systems, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if NextVision Stabilized Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:NXSN

NextVision Stabilized Systems

Develops, manufactures, and markets a stabilized day and night photography solution for ground and aerial vehicles in Israel and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success