Tectona Ltd's (TLV:TECT) CEO Compensation Is Looking A Bit Stretched At The Moment

Key Insights

- Tectona to hold its Annual General Meeting on 7th of July

- Total pay for CEO Yossi Barnea includes US$305.0k salary

- The overall pay is 61% above the industry average

- Tectona's EPS grew by 95% over the past three years while total shareholder loss over the past three years was 58%

In the past three years, the share price of Tectona Ltd (TLV:TECT) has struggled to grow and now shareholders are sitting on a loss. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 7th of July. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

View our latest analysis for Tectona

How Does Total Compensation For Yossi Barnea Compare With Other Companies In The Industry?

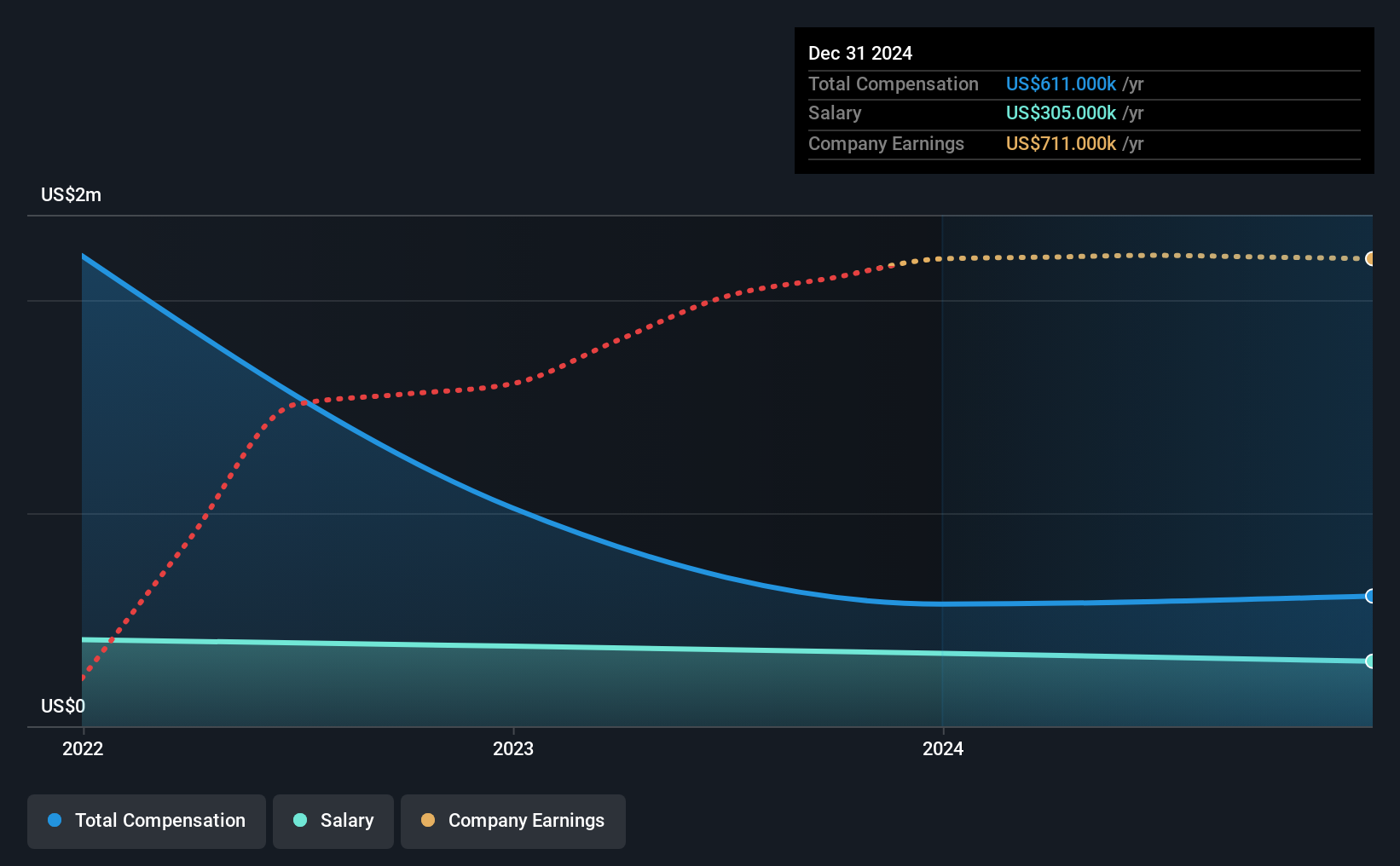

Our data indicates that Tectona Ltd has a market capitalization of ₪67m, and total annual CEO compensation was reported as US$611k for the year to December 2024. That's a fairly small increase of 6.6% over the previous year. While we always look at total compensation first, our analysis shows that the salary component is less, at US$305k.

On comparing similar-sized companies in the Israel Software industry with market capitalizations below ₪674m, we found that the median total CEO compensation was US$381k. Accordingly, our analysis reveals that Tectona Ltd pays Yossi Barnea north of the industry median.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | US$305k | US$342k | 50% |

| Other | US$306k | US$231k | 50% |

| Total Compensation | US$611k | US$573k | 100% |

On an industry level, around 77% of total compensation represents salary and 23% is other remuneration. Tectona pays a modest slice of remuneration through salary, as compared to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Tectona Ltd's Growth

Over the past three years, Tectona Ltd has seen its earnings per share (EPS) grow by 95% per year. It achieved revenue growth of 45% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Tectona Ltd Been A Good Investment?

Few Tectona Ltd shareholders would feel satisfied with the return of -58% over three years. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Despite the growth in its earnings, the share price decline in the past three years is certainly concerning. The fact that the stock price hasn't grown along with earnings may indicate that other issues may be affecting that stock. If there are some unknown variables that are influencing the stock's price, surely shareholders would have some concerns. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 4 warning signs for Tectona (of which 1 makes us a bit uncomfortable!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Tectona might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:TECT

Tectona

Focuses on the digital asset, cryptographic currencies, and blockchain technology businesses.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives