Middle Eastern Market Gems: Al Waha Capital PJSC Among 3 Noteworthy Penny Stocks

Reviewed by Simply Wall St

The Middle Eastern stock markets have shown resilience, with most Gulf indices experiencing slight gains despite concerns over a potential U.S. government shutdown affecting global economic data releases. For investors seeking opportunities in smaller or newer companies, penny stocks—though an older term—remain relevant due to their potential for growth and affordability. This article will explore three noteworthy penny stocks that stand out for their financial strength and possible long-term prospects in the region.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Maharah for Human Resources (SASE:1831) | SAR4.81 | SAR2.16B | ✅ 2 ⚠️ 3 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.75 | SAR1.5B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.984 | ₪354.91M | ✅ 3 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.06 | AED2.14B | ✅ 5 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.30 | AED683.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.30 | AED381.15M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.03 | AED12.84B | ✅ 2 ⚠️ 3 View Analysis > |

| Al Dhafra Insurance Company P.S.C (ADX:DHAFRA) | AED4.86 | AED486M | ✅ 1 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.82 | AED498.77M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.76 | ₪216.66M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 80 stocks from our Middle Eastern Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Al Waha Capital PJSC (ADX:WAHA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Al Waha Capital PJSC is a private equity firm managing assets in sectors such as financial services, fintech, healthcare, energy, infrastructure, industrial real estate and capital markets with a market cap of AED2.94 billion.

Operations: The company generates revenue primarily from its segment of Private Investments (Excluding Waha Land), amounting to AED52.97 million.

Market Cap: AED2.94B

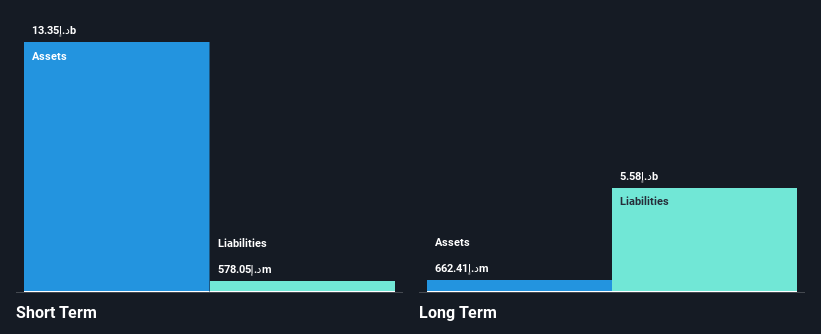

Al Waha Capital PJSC, with a market cap of AED2.94 billion, has shown significant revenue growth in recent quarters, reporting AED381.32 million for Q2 2025 compared to AED155.75 million the previous year. Despite this growth, the company faces challenges such as negative earnings growth over the past year and a dividend not well covered by free cash flows. However, its short-term assets significantly surpass both short and long-term liabilities, and it maintains more cash than debt, suggesting financial stability amidst volatility concerns. The management team is experienced with an average tenure of 2.8 years.

- Dive into the specifics of Al Waha Capital PJSC here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Al Waha Capital PJSC's track record.

Fitaihi Holding Group (SASE:4180)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fitaihi Holding Group operates in Saudi Arabia, offering gold, jewelry, and luxury products, with a market cap of SAR913 million.

Operations: The group's revenue segment is primarily derived from operations in Saudi Arabia, totaling SAR42.67 million.

Market Cap: SAR913M

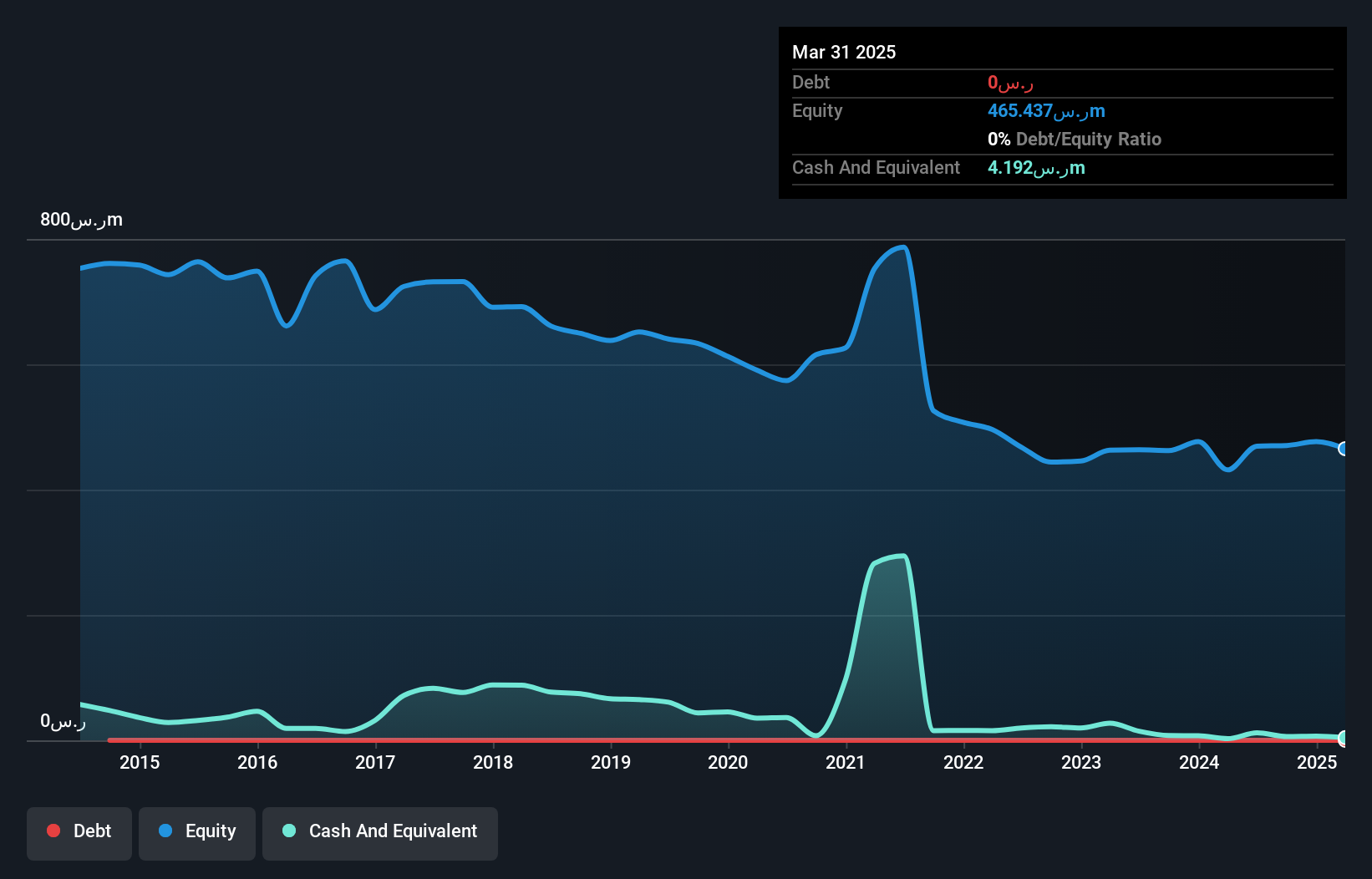

Fitaihi Holding Group, with a market cap of SAR913 million, operates debt-free and maintains strong financial stability as its short-term assets (SAR113.3 million) exceed both short and long-term liabilities. Despite a recent decline in net profit margins from 28.9% to 25.1%, the company has achieved profitability over the past five years with earnings growth accelerating slightly last year by 1.1%. The board is experienced, but management's tenure data is insufficient for assessment. While it hasn't outpaced industry growth, Fitaihi's stable weekly volatility and high-quality earnings provide some investment appeal amidst mixed performance indicators.

- Unlock comprehensive insights into our analysis of Fitaihi Holding Group stock in this financial health report.

- Assess Fitaihi Holding Group's previous results with our detailed historical performance reports.

Tectona (TASE:TECT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tectona Ltd operates in the digital asset, cryptographic currencies, and blockchain technology sectors, with a market cap of ₪80.06 million.

Operations: The company generates revenue primarily from the blockchain and digital assets sector, amounting to $3.54 million.

Market Cap: ₪80.06M

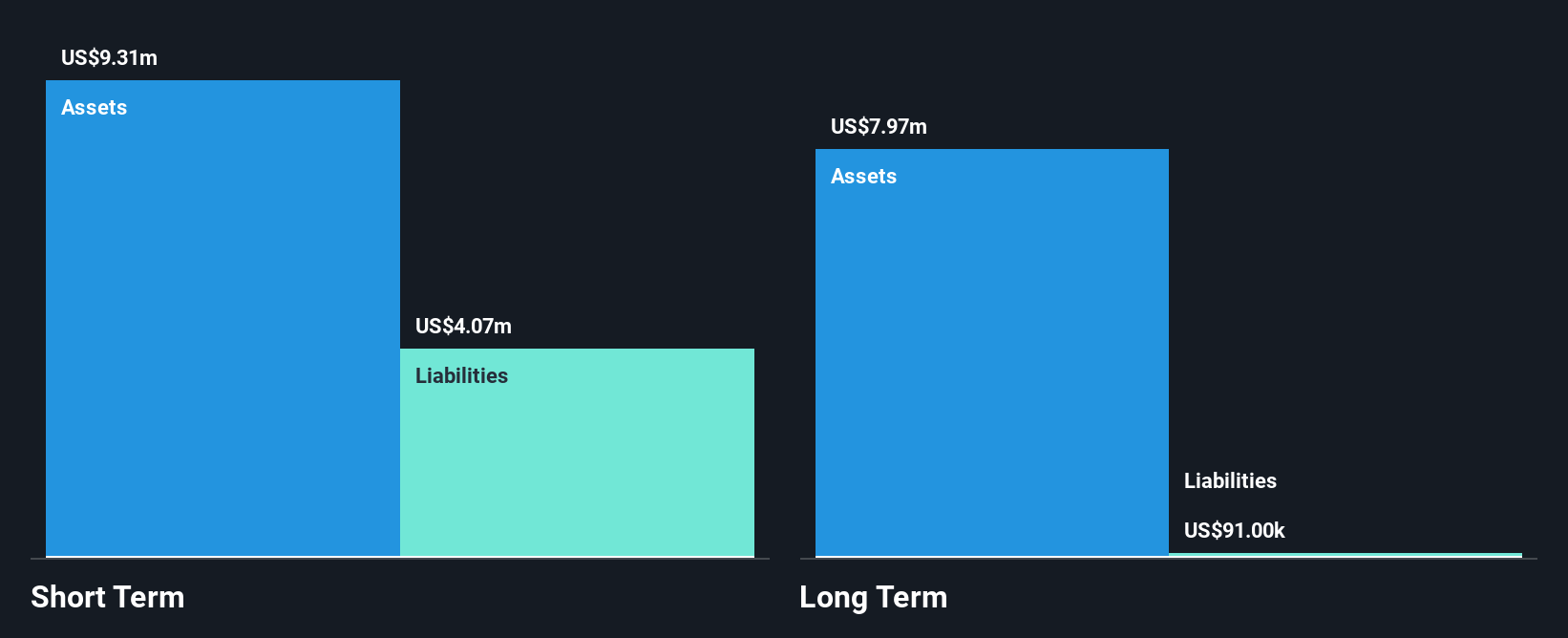

Tectona Ltd, with a market cap of ₪80.06 million, operates in the digital asset sector but remains pre-revenue with sales of US$0.717 million for the first half of 2025, down from US$3.03 million a year earlier. The company is unprofitable, reporting a net loss of US$2.67 million for the period and showing high volatility compared to most Israeli stocks. Despite this, Tectona's short-term assets significantly exceed its liabilities and it operates debt-free, offering some financial resilience amidst operational challenges and an experienced board averaging 4.3 years tenure supports governance stability.

- Click here and access our complete financial health analysis report to understand the dynamics of Tectona.

- Examine Tectona's past performance report to understand how it has performed in prior years.

Turning Ideas Into Actions

- Click here to access our complete index of 80 Middle Eastern Penny Stocks.

- Searching for a Fresh Perspective? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tectona might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:TECT

Tectona

Focuses on the digital asset, cryptographic currencies, and blockchain technology businesses.

Adequate balance sheet with low risk.

Market Insights

Community Narratives