Synel M.L.L Payway (TLV:SNEL) Is Achieving High Returns On Its Capital

To find a multi-bagger stock, what are the underlying trends we should look for in a business? Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. With that in mind, the ROCE of Synel M.L.L Payway (TLV:SNEL) looks great, so lets see what the trend can tell us.

Return On Capital Employed (ROCE): What Is It?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for Synel M.L.L Payway:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.20 = ₪16m ÷ (₪108m - ₪29m) (Based on the trailing twelve months to September 2023).

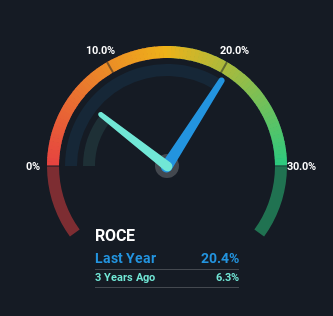

Thus, Synel M.L.L Payway has an ROCE of 20%. That's a fantastic return and not only that, it outpaces the average of 11% earned by companies in a similar industry.

View our latest analysis for Synel M.L.L Payway

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings , check out these free graphs detailing revenue and cash flow performance of Synel M.L.L Payway.

So How Is Synel M.L.L Payway's ROCE Trending?

We're pretty happy with how the ROCE has been trending at Synel M.L.L Payway. The data shows that returns on capital have increased by 194% over the trailing five years. That's a very favorable trend because this means that the company is earning more per dollar of capital that's being employed. Speaking of capital employed, the company is actually utilizing 88% less than it was five years ago, which can be indicative of a business that's improving its efficiency. Synel M.L.L Payway may be selling some assets so it's worth investigating if the business has plans for future investments to increase returns further still.

On a side note, we noticed that the improvement in ROCE appears to be partly fueled by an increase in current liabilities. Essentially the business now has suppliers or short-term creditors funding about 27% of its operations, which isn't ideal. It's worth keeping an eye on this because as the percentage of current liabilities to total assets increases, some aspects of risk also increase.

In Conclusion...

In the end, Synel M.L.L Payway has proven it's capital allocation skills are good with those higher returns from less amount of capital. And with the stock having performed exceptionally well over the last five years, these patterns are being accounted for by investors. With that being said, we still think the promising fundamentals mean the company deserves some further due diligence.

If you'd like to know more about Synel M.L.L Payway, we've spotted 4 warning signs, and 2 of them are a bit concerning.

If you want to search for more stocks that have been earning high returns, check out this free list of stocks with solid balance sheets that are also earning high returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:SNEL

Synel M.L.L Payway

Provides software integrated hardware solutions for workforce management in organizations in Israel and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives