- Israel

- /

- Diversified Financial

- /

- TASE:SHVA

Should Automatic Bank Services (TLV:SHVA) Be Disappointed With Their 49% Profit?

Passive investing in index funds can generate returns that roughly match the overall market. But investors can boost returns by picking market-beating companies to own shares in. For example, the Automatic Bank Services Limited (TLV:SHVA) share price is up 49% in the last year, clearly besting the market decline of around 1.8% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! Automatic Bank Services hasn't been listed for long, so it's still not clear if it is a long term winner.

See our latest analysis for Automatic Bank Services

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year, Automatic Bank Services actually saw its earnings per share drop 9.3%.

Given the share price gain, we doubt the market is measuring progress with EPS. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

However the year on year revenue growth of 4.0% would help. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

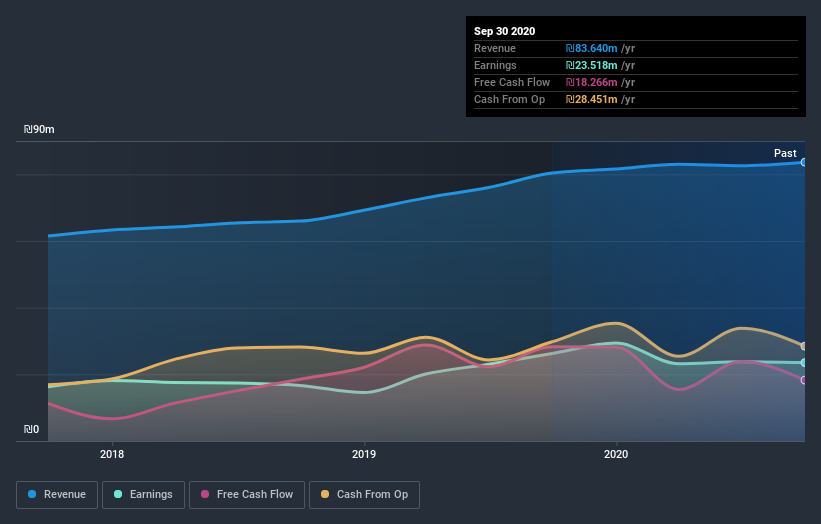

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Automatic Bank Services boasts a total shareholder return of 49% for the last year. A substantial portion of that gain has come in the last three months, with the stock up 21% in that time. This suggests the company is continuing to win over new investors. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 1 warning sign we've spotted with Automatic Bank Services .

Of course Automatic Bank Services may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IL exchanges.

If you decide to trade Automatic Bank Services, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:SHVA

Automatic Bank Services

Operates payment systems for international debit cards in Israel.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives