Is Arad Investment & Industrial Development (TLV:ARAD) A Risky Investment?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Arad Investment & Industrial Development Ltd. (TLV:ARAD) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Arad Investment & Industrial Development

What Is Arad Investment & Industrial Development's Debt?

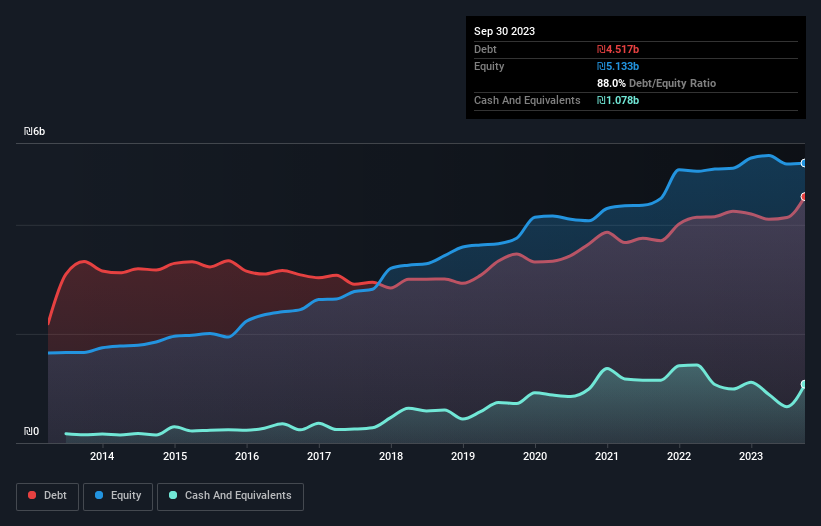

The image below, which you can click on for greater detail, shows that at September 2023 Arad Investment & Industrial Development had debt of ₪4.52b, up from ₪4.25b in one year. However, it does have ₪1.08b in cash offsetting this, leading to net debt of about ₪3.44b.

How Healthy Is Arad Investment & Industrial Development's Balance Sheet?

The latest balance sheet data shows that Arad Investment & Industrial Development had liabilities of ₪1.65b due within a year, and liabilities of ₪4.63b falling due after that. Offsetting this, it had ₪1.08b in cash and ₪960.8m in receivables that were due within 12 months. So it has liabilities totalling ₪4.24b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the ₪618.2m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Arad Investment & Industrial Development would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Arad Investment & Industrial Development has a rather high debt to EBITDA ratio of 5.3 which suggests a meaningful debt load. However, its interest coverage of 2.8 is reasonably strong, which is a good sign. The good news is that Arad Investment & Industrial Development improved its EBIT by 2.4% over the last twelve months, thus gradually reducing its debt levels relative to its earnings. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Arad Investment & Industrial Development will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Happily for any shareholders, Arad Investment & Industrial Development actually produced more free cash flow than EBIT over the last three years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

To be frank both Arad Investment & Industrial Development's net debt to EBITDA and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Looking at the bigger picture, it seems clear to us that Arad Investment & Industrial Development's use of debt is creating risks for the company. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 5 warning signs we've spotted with Arad Investment & Industrial Development (including 2 which shouldn't be ignored) .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:MLTH

Malam-Team Holdings

Provides computer services in the field of information technology in Israel.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success