There's Reason For Concern Over Alarum Technologies Ltd.'s (TLV:ALAR) Massive 38% Price Jump

The Alarum Technologies Ltd. (TLV:ALAR) share price has done very well over the last month, posting an excellent gain of 38%. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 73% share price drop in the last twelve months.

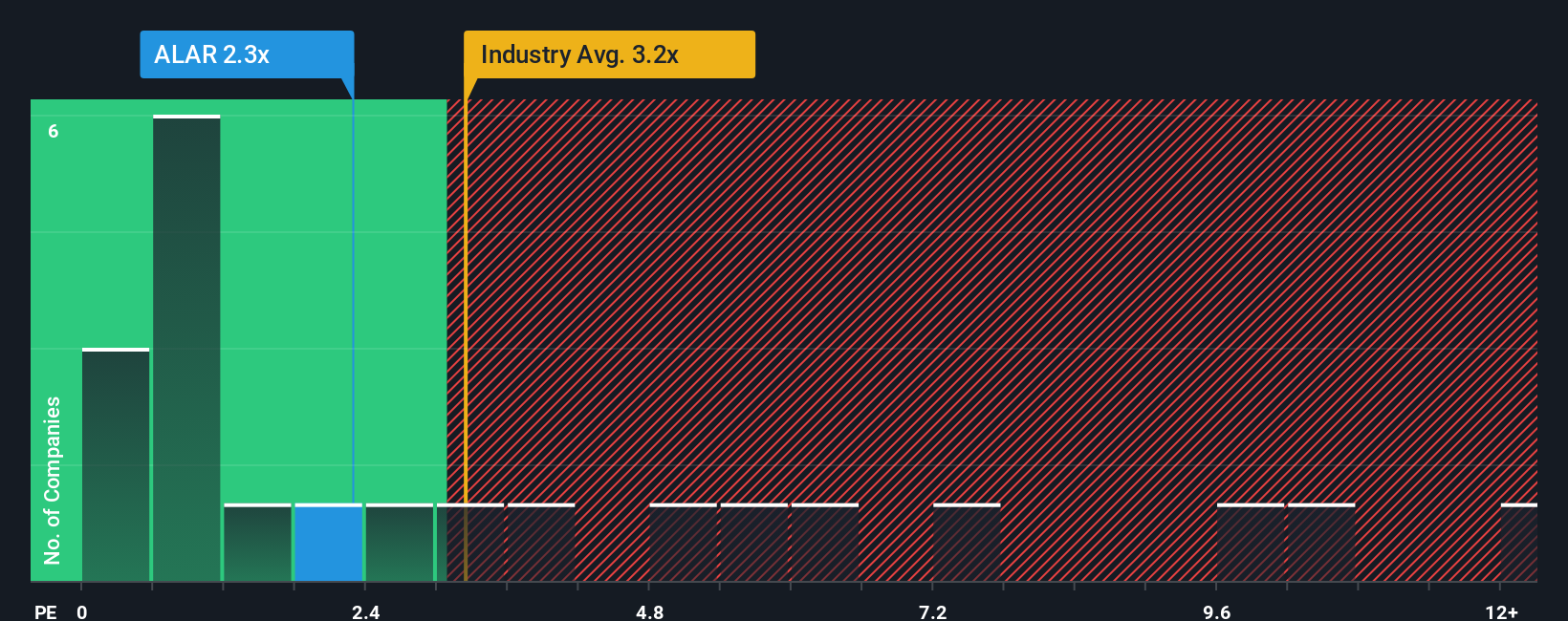

Since its price has surged higher, you could be forgiven for thinking Alarum Technologies is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.3x, considering almost half the companies in Israel's Software industry have P/S ratios below 1.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Alarum Technologies

How Alarum Technologies Has Been Performing

Recent times haven't been great for Alarum Technologies as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Alarum Technologies.What Are Revenue Growth Metrics Telling Us About The High P/S?

Alarum Technologies' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 4.7%. This was backed up an excellent period prior to see revenue up by 136% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 15% during the coming year according to the dual analysts following the company. That's shaping up to be materially lower than the 21% growth forecast for the broader industry.

With this information, we find it concerning that Alarum Technologies is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Alarum Technologies' P/S

Alarum Technologies shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've concluded that Alarum Technologies currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

Before you settle on your opinion, we've discovered 2 warning signs for Alarum Technologies (1 is significant!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:ALAR

Alarum Technologies

Provides web data collection solutions in North, South, and Central America, Europe, Southeast Asia, the Middle East, and Africa.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives