Stock Analysis

- United States

- /

- Banks

- /

- NasdaqGS:IBTX

Insider Confidence Shines in These June 2024 High Ownership Growth Stocks

Reviewed by Simply Wall St

As global markets continue to navigate through a complex landscape marked by fluctuating retail sales and robust industrial output, investors are keenly observing trends that might indicate sustainable growth. In this context, stocks with high insider ownership can be particularly compelling, as significant insider stakes often reflect confidence in the company's future prospects amidst current market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

| Medley (TSE:4480) | 34% | 28.7% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

| Gaming Innovation Group (OB:GIG) | 25.7% | 36.9% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| Vow (OB:VOW) | 31.8% | 97.6% |

| Adocia (ENXTPA:ADOC) | 12.1% | 104.5% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 79.3% |

We're going to check out a few of the best picks from our screener tool.

Independent Bank Group (NasdaqGS:IBTX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Independent Bank Group, Inc. operates as a commercial bank serving businesses, professionals, and individuals in the United States, with a market capitalization of approximately $1.81 billion.

Operations: The company generates its revenue primarily through banking activities, totaling approximately $482.38 million.

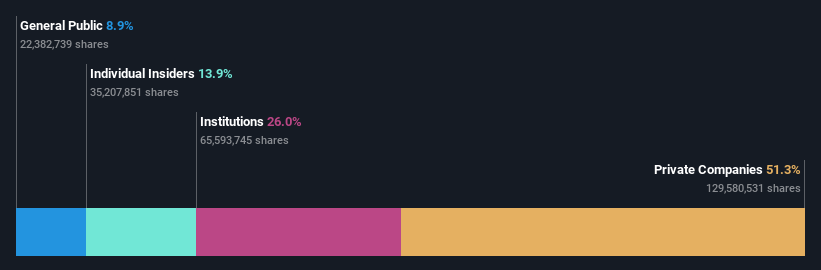

Insider Ownership: 13.4%

Independent Bank Group, Inc., a company with high insider ownership, is set to merge with SouthState Corporation in a deal worth US$2.1 billion, expected to close by Q1 2025. This strategic move follows a significant recovery in earnings, with net income reaching US$24.15 million in Q1 2024 from a loss the previous year. Analysts predict robust annual earnings growth for IBTX at 29% per year, outpacing the market forecast of 14.8%. Despite these positives, revenue growth projections are moderate at 13.1% annually.

- Click to explore a detailed breakdown of our findings in Independent Bank Group's earnings growth report.

- According our valuation report, there's an indication that Independent Bank Group's share price might be on the expensive side.

Belships (OB:BELCO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Belships ASA is a global operator of dry bulk ships, with a market capitalization of approximately NOK 6.39 billion.

Operations: The company generates revenue primarily through two segments: Belships, which contributes approximately $185.36 million, and Lighthouse Navigation, contributing about $243.27 million.

Insider Ownership: 13.9%

Belships ASA, characterized by high insider ownership, has demonstrated a mixed financial performance with its latest quarterly revenue reaching US$113.52 million and a net income of US$13.6 million, reflecting a decrease from the previous year. The company is actively expanding its fleet, adding two new Ultramax bulk carriers for delivery in 2028 without impacting cash reserves or dividend capacity. Despite trading at 55.2% below its estimated fair value and having an unsteady dividend coverage, analysts anticipate a potential price increase of 22.9%. Belships' revenue and earnings growth forecasts are modest but exceed local market averages, with projected annual earnings growth near 19.3%.

- Delve into the full analysis future growth report here for a deeper understanding of Belships.

- The valuation report we've compiled suggests that Belships' current price could be quite moderate.

Alarum Technologies (TASE:ALAR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alarum Technologies Ltd. operates globally, offering internet access and web data collection solutions across North, South, and Central America, Europe, Southeast Asia, the Middle East, and Africa with a market capitalization of approximately ₪942.18 million.

Operations: The firm operates in various global regions, providing internet access and web data collection solutions.

Insider Ownership: 13.6%

Alarum Technologies, a growth company with high insider ownership, has shown promising financial trends despite some challenges. Recently at the MicroCap Rodeo Conference, leadership highlighted a robust first quarter in 2024 with revenues exceeding US$8.3 million, up nearly 50% year-over-year. However, the company's share price has been highly volatile recently. Looking ahead, Alarum is expected to become profitable within three years with earnings forecasted to grow substantially annually. Despite these prospects, shareholder dilution over the past year remains a concern.

- Unlock comprehensive insights into our analysis of Alarum Technologies stock in this growth report.

- The valuation report we've compiled suggests that Alarum Technologies' current price could be inflated.

Taking Advantage

- Delve into our full catalog of 1450 Fast Growing Companies With High Insider Ownership here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Independent Bank Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IBTX

Independent Bank Group

Through its subsidiary, Independent Bank provides various commercial banking products and services to businesses, professionals, and individuals in the United States.

Flawless balance sheet with reasonable growth potential and pays a dividend.