- Israel

- /

- Real Estate

- /

- TASE:MVNE

Mivne Real Estate (K.D) (TLV:MVNE) Takes On Some Risk With Its Use Of Debt

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Mivne Real Estate (K.D) Ltd (TLV:MVNE) does use debt in its business. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Mivne Real Estate (K.D)

How Much Debt Does Mivne Real Estate (K.D) Carry?

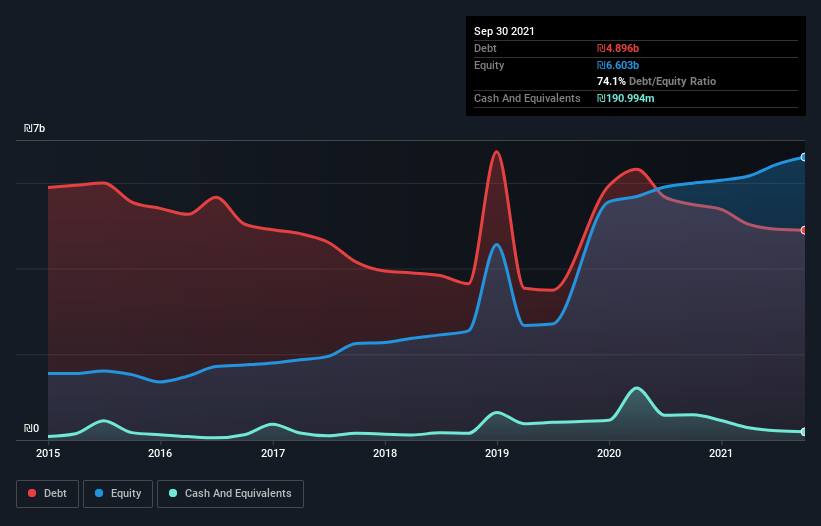

You can click the graphic below for the historical numbers, but it shows that Mivne Real Estate (K.D) had ₪4.90b of debt in September 2021, down from ₪5.49b, one year before. However, it does have ₪191.0m in cash offsetting this, leading to net debt of about ₪4.70b.

How Healthy Is Mivne Real Estate (K.D)'s Balance Sheet?

According to the last reported balance sheet, Mivne Real Estate (K.D) had liabilities of ₪868.4m due within 12 months, and liabilities of ₪5.82b due beyond 12 months. Offsetting this, it had ₪191.0m in cash and ₪149.2m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₪6.35b.

This is a mountain of leverage relative to its market capitalization of ₪10.3b. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

With a net debt to EBITDA ratio of 7.6, it's fair to say Mivne Real Estate (K.D) does have a significant amount of debt. However, its interest coverage of 4.6 is reasonably strong, which is a good sign. Sadly, Mivne Real Estate (K.D)'s EBIT actually dropped 8.7% in the last year. If earnings continue on that decline then managing that debt will be difficult like delivering hot soup on a unicycle. When analysing debt levels, the balance sheet is the obvious place to start. But it is Mivne Real Estate (K.D)'s earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the most recent three years, Mivne Real Estate (K.D) recorded free cash flow worth 69% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

Mivne Real Estate (K.D)'s net debt to EBITDA was a real negative on this analysis, although the other factors we considered cast it in a significantly better light. For example its conversion of EBIT to free cash flow was refreshing. When we consider all the factors discussed, it seems to us that Mivne Real Estate (K.D) is taking some risks with its use of debt. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 3 warning signs for Mivne Real Estate (K.D) (1 is a bit unpleasant) you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:MVNE

Mivne Real Estate (K.D)

Operates as a real estate development company in Israel, Switzerland, Ukraine, North America, and France.

Acceptable track record with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success