- Israel

- /

- Real Estate

- /

- TASE:MDPR

If You Had Bought Medipower (Overseas) (TLV:MDPR) Stock Three Years Ago, You Could Pocket A 25% Gain Today

Vanguard founder Jack Bogle helped spearhead the low-cost index fund, putting average returns within reach of every investor. But you can make superior returns by picking better-than average stocks. For example, the Medipower (Overseas) Public Co. Limited (TLV:MDPR) share price is up 25% in the last three years, slightly above the market return. In contrast, the stock is actually down 3.3% in the last year, suggesting a lack of positive momentum.

View our latest analysis for Medipower (Overseas)

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

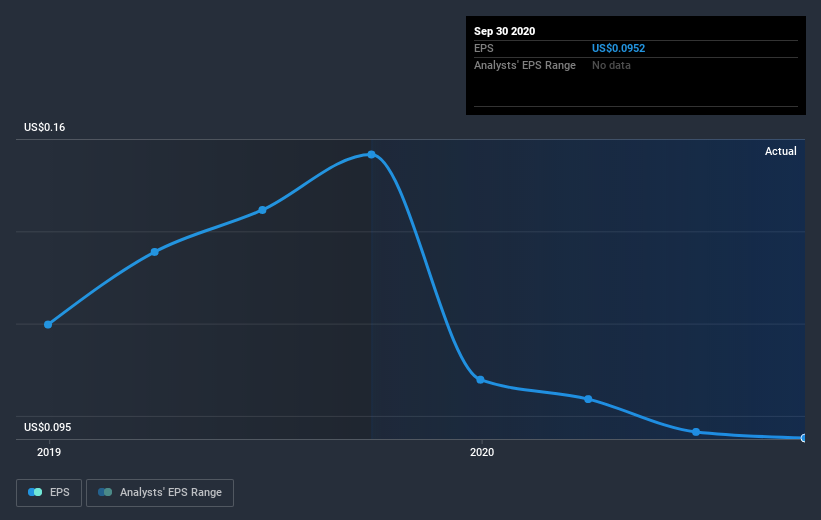

During three years of share price growth, Medipower (Overseas) achieved compound earnings per share growth of 5.4% per year. This EPS growth is lower than the 8% average annual increase in the share price. This suggests that, as the business progressed over the last few years, it gained the confidence of market participants. It is quite common to see investors become enamoured with a business, after a few years of solid progress.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

This free interactive report on Medipower (Overseas)'s earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Medipower (Overseas)'s total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Medipower (Overseas)'s TSR of 28% over the last 3 years is better than the share price return.

A Different Perspective

Over the last year, Medipower (Overseas) shareholders took a loss of 3.3%. In contrast the market gained about 4.0%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Investors are up over three years, booking 9% per year, much better than the more recent returns. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for Medipower (Overseas) (1 is a bit concerning) that you should be aware of.

We will like Medipower (Overseas) better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IL exchanges.

When trading Medipower (Overseas) or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:MDPR

Medipower (Overseas)

Operates as a commercial real estate company in the United States, Canada, and Bulgaria.

Good value with acceptable track record.

Market Insights

Community Narratives