Stock Analysis

- Israel

- /

- Real Estate

- /

- TASE:SMT

Summit Real Estate Holdings (TLV:SMT) shareholders are still up 45% over 5 years despite pulling back 5.5% in the past week

When we invest, we're generally looking for stocks that outperform the market average. And in our experience, buying the right stocks can give your wealth a significant boost. To wit, the Summit Real Estate Holdings share price has climbed 43% in five years, easily topping the market return of 20% (ignoring dividends).

In light of the stock dropping 5.5% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

Check out our latest analysis for Summit Real Estate Holdings

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Summit Real Estate Holdings' earnings per share are down 28% per year, despite strong share price performance over five years. This was, in part, due to extraordinary items impacting earning in the last twelve months.

This means it's unlikely the market is judging the company based on earnings growth. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

The modest 0.4% dividend yield is unlikely to be propping up the share price. On the other hand, Summit Real Estate Holdings' revenue is growing nicely, at a compound rate of 15% over the last five years. In that case, the company may be sacrificing current earnings per share to drive growth.

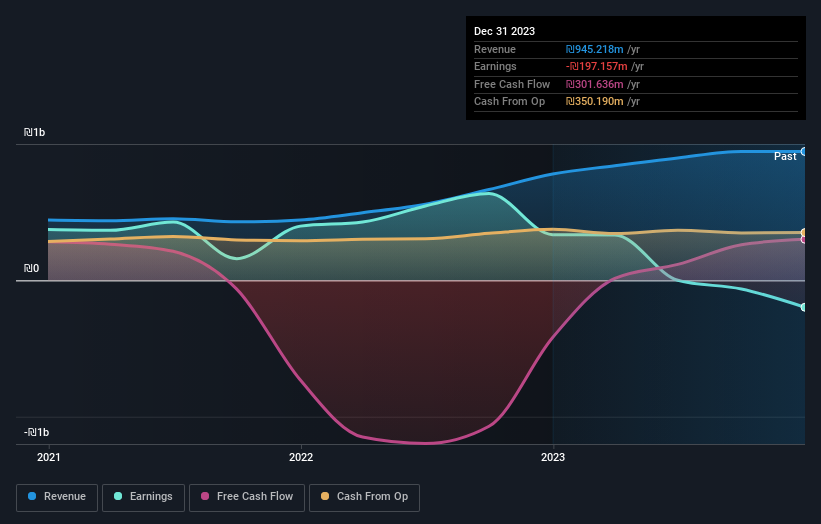

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Summit Real Estate Holdings stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Summit Real Estate Holdings' TSR for the last 5 years was 45%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Summit Real Estate Holdings shareholders are down 2.1% for the year (even including dividends), but the market itself is up 5.4%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 8% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Summit Real Estate Holdings that you should be aware of before investing here.

Of course Summit Real Estate Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Israeli exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Summit Real Estate Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:SMT

Summit Real Estate Holdings

A real estate investment firm specializing in the purchase and operation of office buildings and commercial assets, which are leased to numerous commercial and industrial tenants.

Slightly overvalued with imperfect balance sheet.