- Israel

- /

- Real Estate

- /

- TASE:KARE

Is Kardan Real Estate Enterprise and Development (TLV:KARE) A Risky Investment?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Kardan Real Estate Enterprise and Development Ltd (TLV:KARE) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Kardan Real Estate Enterprise and Development

What Is Kardan Real Estate Enterprise and Development's Debt?

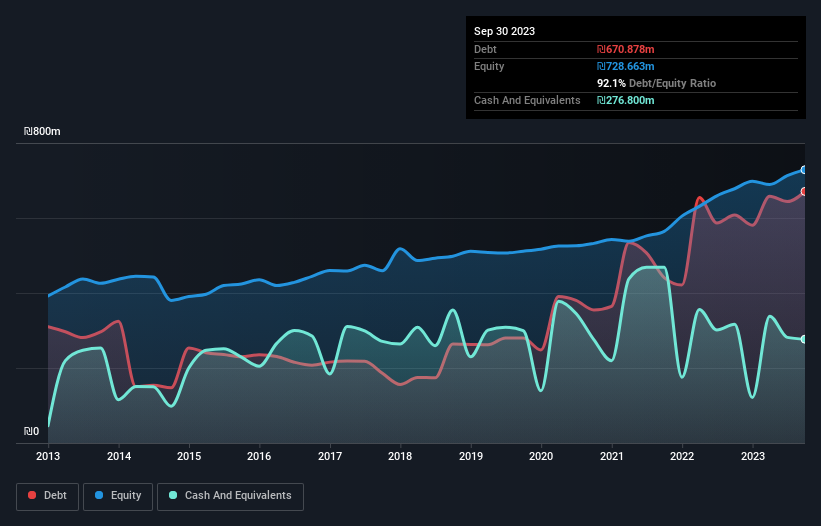

The image below, which you can click on for greater detail, shows that at September 2023 Kardan Real Estate Enterprise and Development had debt of ₪670.9m, up from ₪607.7m in one year. However, because it has a cash reserve of ₪276.8m, its net debt is less, at about ₪394.1m.

How Strong Is Kardan Real Estate Enterprise and Development's Balance Sheet?

The latest balance sheet data shows that Kardan Real Estate Enterprise and Development had liabilities of ₪352.8m due within a year, and liabilities of ₪668.0m falling due after that. Offsetting this, it had ₪276.8m in cash and ₪242.3m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₪501.7m.

This is a mountain of leverage relative to its market capitalization of ₪779.9m. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Kardan Real Estate Enterprise and Development has a rather high debt to EBITDA ratio of 5.9 which suggests a meaningful debt load. But the good news is that it boasts fairly comforting interest cover of 4.2 times, suggesting it can responsibly service its obligations. Worse, Kardan Real Estate Enterprise and Development's EBIT was down 64% over the last year. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. When analysing debt levels, the balance sheet is the obvious place to start. But it is Kardan Real Estate Enterprise and Development's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Kardan Real Estate Enterprise and Development recorded negative free cash flow, in total. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

On the face of it, Kardan Real Estate Enterprise and Development's net debt to EBITDA left us tentative about the stock, and its EBIT growth rate was no more enticing than the one empty restaurant on the busiest night of the year. And even its level of total liabilities fails to inspire much confidence. Taking into account all the aforementioned factors, it looks like Kardan Real Estate Enterprise and Development has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 4 warning signs we've spotted with Kardan Real Estate Enterprise and Development (including 1 which makes us a bit uncomfortable) .

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Kardan Real Estate Enterprise and Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:KARE

Kardan Real Estate Enterprise and Development

Plans, constructs, develops, builds, and manages residential building and income-producing properties in Israel.

Moderate risk with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives