- Israel

- /

- Real Estate

- /

- TASE:AURA

Aura Investments (TASE:AURA): Assessing Valuation Following Mixed Third Quarter and Nine-Month Results

Reviewed by Simply Wall St

Aura Investments (TASE:AURA) just unveiled its third quarter results, posting strong year-over-year growth in quarterly revenue and net income. However, the nine-month figures tell a different story, as they reveal declines compared to last year.

See our latest analysis for Aura Investments.

Aura Investments has seen some ups and downs this year: after a strong third quarter, the share price recently closed at ₪21.6. While the one-year share price return has dipped slightly year-to-date, long-term investors have enjoyed a robust 17.15% total shareholder return over twelve months. The company also delivered a remarkable 261% gain over three years, suggesting the bigger picture remains positive despite near-term fluctuations.

If Aura's resilience has you thinking bigger, there are plenty of other fast-growing stocks with strong insider backing to discover. Broaden your perspective with our fast growing stocks with high insider ownership.

With shares trading at a 13% discount to intrinsic value, Aura's mixed results raise a key question for investors: Is this a rare entry point, or has the market already accounted for future performance?

Price-to-Earnings of 21.6x: Is it justified?

With Aura Investments trading at a price-to-earnings ratio of 21.6x, investors are paying nearly double the peer group average for every shekel of reported earnings. At the last close of ₪21.6, Aura’s valuation stands above both the Israeli real estate industry average and that of its closest competitors.

The price-to-earnings ratio (P/E) is a popular metric that shows how much investors are willing to pay for each unit of current earnings. For property developers like Aura, this ratio can reflect anticipated profit growth, sector prospects, or the unique circumstances driving recent results.

However, Aura’s multiple is notably higher than the industry average of 14.5x and the peer average of just 11.3x. This signals the market sees either greater potential or is possibly overestimating future earnings, especially in light of a significant one-off gain and negative earnings growth over the last year. With no fair ratio available for additional context, it is clear the premium valuation depends heavily on expectations that may be difficult to sustain.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 21.6x (OVERVALUED)

However, slowing earnings growth or market volatility could quickly challenge Aura’s premium valuation and test investor confidence in the months ahead.

Find out about the key risks to this Aura Investments narrative.

Another View: What Does Discounted Cash Flow Say?

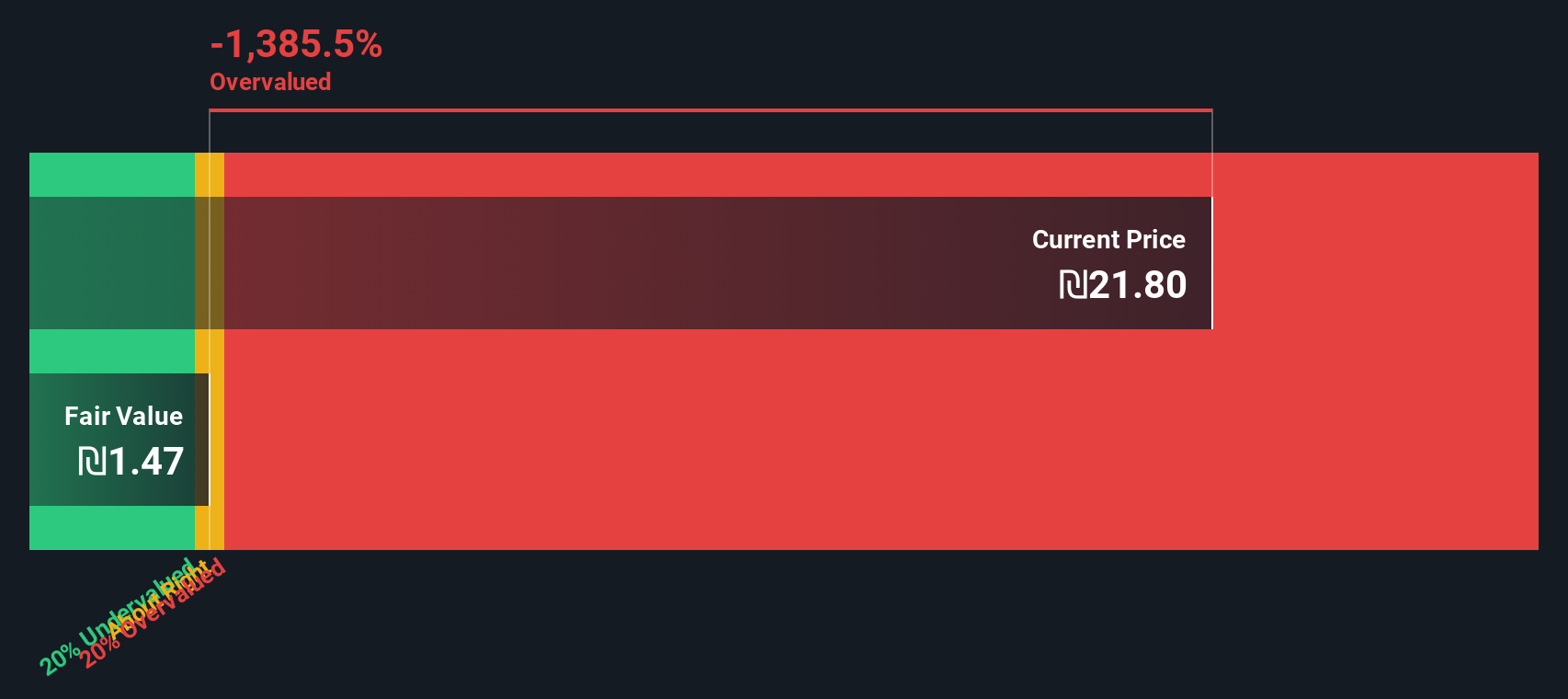

To challenge the current multiples-based assessment, let’s look at the SWS DCF model, which estimates what Aura Investments’ shares might be worth based on projected future cash flows. According to this model, Aura is trading above our estimate of fair value. This suggests the shares could be overvalued under this lens. This poses a big question: can the company’s fundamentals support the current premium, or is there downside risk ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aura Investments for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 936 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aura Investments Narrative

If you have a different perspective or want to dive deeper on your own, you can quickly explore the numbers and build your personal outlook on Aura Investments. Just give it a try: Do it your way.

A great starting point for your Aura Investments research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for one opportunity when there’s a world of growth potential available. Use these handpicked lists to spot your next winner and avoid missing opportunities that others might find first.

- Tap into strong passive income opportunities by reviewing these 14 dividend stocks with yields > 3% that consistently deliver yields above 3%, enhancing your portfolio's stability and returns.

- Ride the wave of groundbreaking healthcare technologies by seeing these 30 healthcare AI stocks that are transforming patient care and medical innovation through artificial intelligence.

- Capitalize on market mispricings by checking these 936 undervalued stocks based on cash flows that currently trade below their estimated cash flow value, giving you a potential edge over the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:AURA

Aura Investments

Together with its subsidiaries engages in locating, initiating, planning, and construction of residential real estate projects in Israel and internationally.

Adequate balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success