- Israel

- /

- Real Estate

- /

- TASE:AFRE

Africa Israel Residences (TASE:AFRE) Net Margin Drops 10pts, Challenging Bullish Profitability Narratives

Reviewed by Simply Wall St

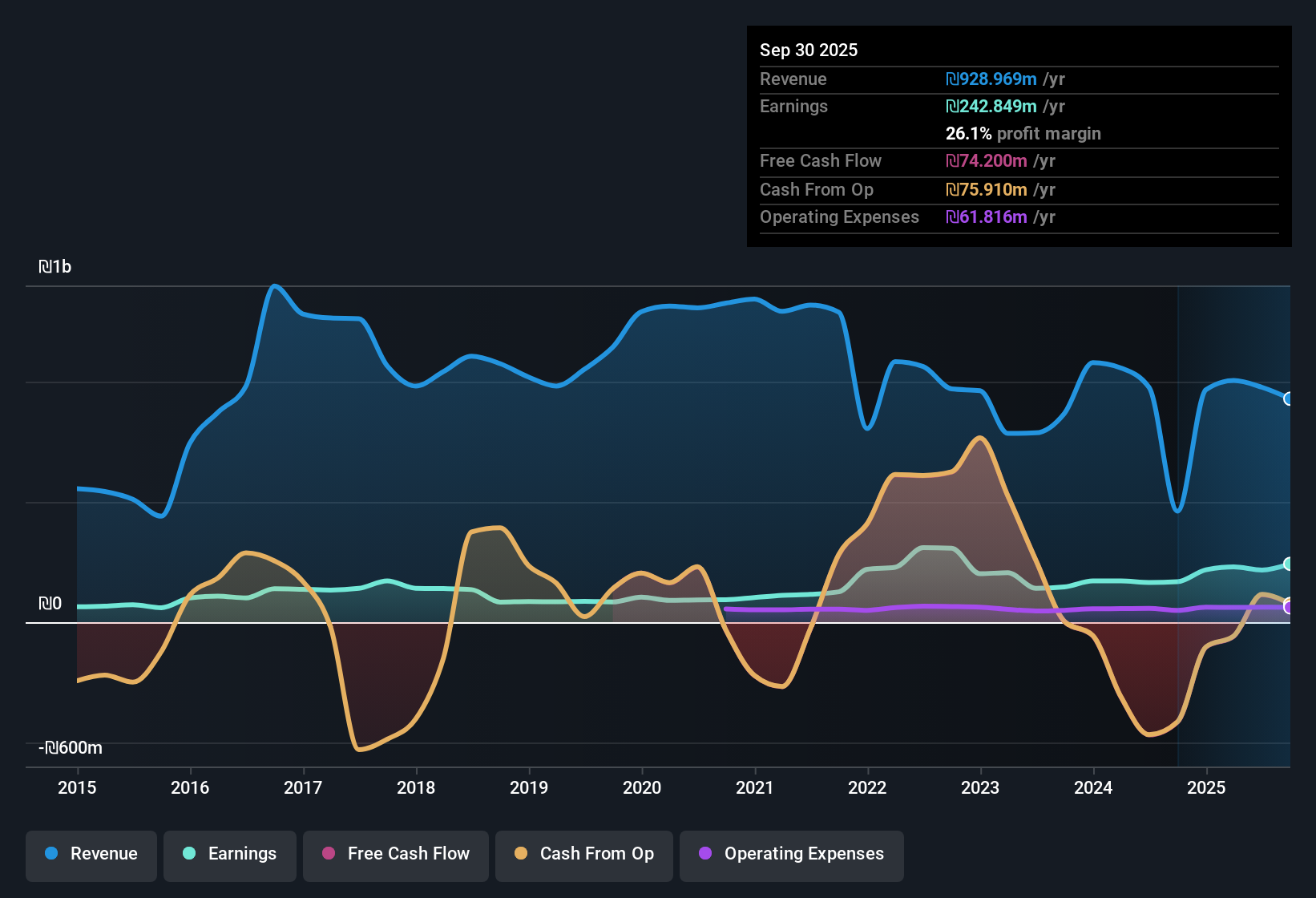

Africa Israel Residences (TASE:AFRE) just posted its Q3 2025 numbers, reporting revenue of ₪209.8 million and EPS of ₪4.90. Looking at the trend, quarterly revenue has shifted from ₪257.5 million in Q3 2024 to ₪256.4 million in Q4 2024, and then to ₪246.6 million in Q1 2025, before landing at this latest figure. Investors watching margins may note that while the company’s numbers have moved around, profitability appears to be coming under some pressure this quarter.

See our full analysis for Africa Israel Residences.Next up, we’ll look at how these headline results measure up to the key narratives tracked by the market. This will help indicate where conclusions hold up and where surprises emerge.

Curious how numbers become stories that shape markets? Explore Community Narratives

44% Annual Earnings Growth Outpaces Long-Term Trend

- Africa Israel Residences achieved 44.5% earnings growth over the last twelve months, far above its five-year average of 8.8% per year.

- This robust pace sets a strong foundation for the view that the company’s brand and vertical integration enable it to capture ongoing demand in Israel’s residential property market.

- Steep earnings growth, at almost five times the historical norm, highlights both successful project execution and market strength.

- However, analysts tracking the company’s financials note that a large one-off gain of ₪131.1 million inflated results, and the recurring profitability trend may be somewhat lower when this is excluded.

- The analysts' consensus view suggests the momentum in earnings outperformance, even with one-off gains, continues to reflect the core drivers of urbanization and project pipeline delivery. This reinforces long-term demand while cautioning that investors should assess underlying trends beyond headline growth figures. 📊 Read the full Africa Israel Residences Consensus Narrative.

Net Margin Compression Offsets Headline Strength

- Net profit margin for the period is 26.1%, a drop from 36.4% in the previous year, even as net income on a trailing twelve-month basis reached ₪242.8 million.

- What is surprising is that, despite accelerating profit at the net income line, the margin compression raises questions about earnings quality and cost pressures:

- Critics highlight that this decline in margin partly tracks higher costs and the distorting effects of irregular income, making the apparent top-line strength more nuanced.

- Investors focused on long-term stability will want to see whether this margin pressure becomes a trend or is resolved as one-time items subside in future quarters.

Valuation Undercuts Industry Average Despite Risks

- Africa Israel Residences trades on a trailing P/E of 14.5x, below both the IL real estate industry average of 14.9x and peer group P/E of 22.2x. The current share price stands at ₪277.90 versus a DCF fair value of ₪84.29.

- Consensus narrative notes that this relatively low P/E, despite the recent share price volatility and clear debt coverage challenges, may signal that investors still value robust earnings momentum and sector exposure:

- The dividend yield of 2.22% highlights some reward, but its lack of coverage by free cash flow means the payout may not be sustainable if operating pressures persist.

- Balance sheet risk, where operating cash flow is not covering debt, remains a central focus for skeptics even as the company’s valuation offers a relative cushion compared to peers.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Africa Israel Residences's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite robust earnings growth, Africa Israel Residences faces persistent margin compression and ongoing concerns over its balance sheet strength and debt coverage.

If you want to prioritize companies with healthier financial foundations, check out solid balance sheet and fundamentals stocks screener (1942 results) to discover businesses that combine solid fundamentals with less balance sheet risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:AFRE

Africa Israel Residences

Develops and sells residential units under the Savyonim brand in Israel.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026