- Israel

- /

- Real Estate

- /

- TASE:AFPR

A Look at AFI Properties (TASE:AFPR) Valuation Following Strong Revenue and Net Income Growth

Reviewed by Simply Wall St

AFI Properties (TASE:AFPR) has posted its latest earnings for the third quarter and first nine months of 2025, revealing clear gains in both sales and net income compared to the previous year.

See our latest analysis for AFI Properties.

AFI Properties’ strong quarterly earnings have come amid a year of steady momentum, with the share price climbing 22.8% year-to-date and delivering a total shareholder return of 27.1% over the past twelve months. Longer-term investors have also enjoyed robust value growth, as the stock’s gains reflect growing confidence in the company’s financial trajectory and ability to deliver consistent results.

If this performance has you thinking about what else is out there, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

But with such a strong run already behind it, is AFI Properties’ current share price leaving room for further upside, or are investors already factoring in all the future growth? Is there still a buying opportunity here?

Price-to-Earnings of 10.7x: Is it justified?

AFI Properties trades at a price-to-earnings (P/E) ratio of 10.7x, well below both the industry and peer group averages. This suggests that the market is assigning a lower value to its earnings than competitors.

The P/E ratio compares a company's current share price to its per-share earnings. It provides insight into how much investors are willing to pay for each shekel of earnings. For real estate firms, it is a useful barometer because earnings can be more stable than revenue, reflecting ongoing property income and cost management.

A P/E of 10.7x means AFI Properties appears attractively priced relative to the Israeli real estate industry average of 14x and the peer average of 36.3x. The notable discount indicates that either the market is underestimating AFI Properties’ future growth or is pricing in possible one-time items or risks. If the stock’s fair ratio is indeed higher, this could signal room for upward re-rating as sentiment improves.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 10.7x (UNDERVALUED)

However, potential risks such as changes in property market conditions or regulatory shifts could challenge AFI Properties’ current momentum and influence its valuation outlook.

Find out about the key risks to this AFI Properties narrative.

Another View: Discounted Cash Flow Valuation

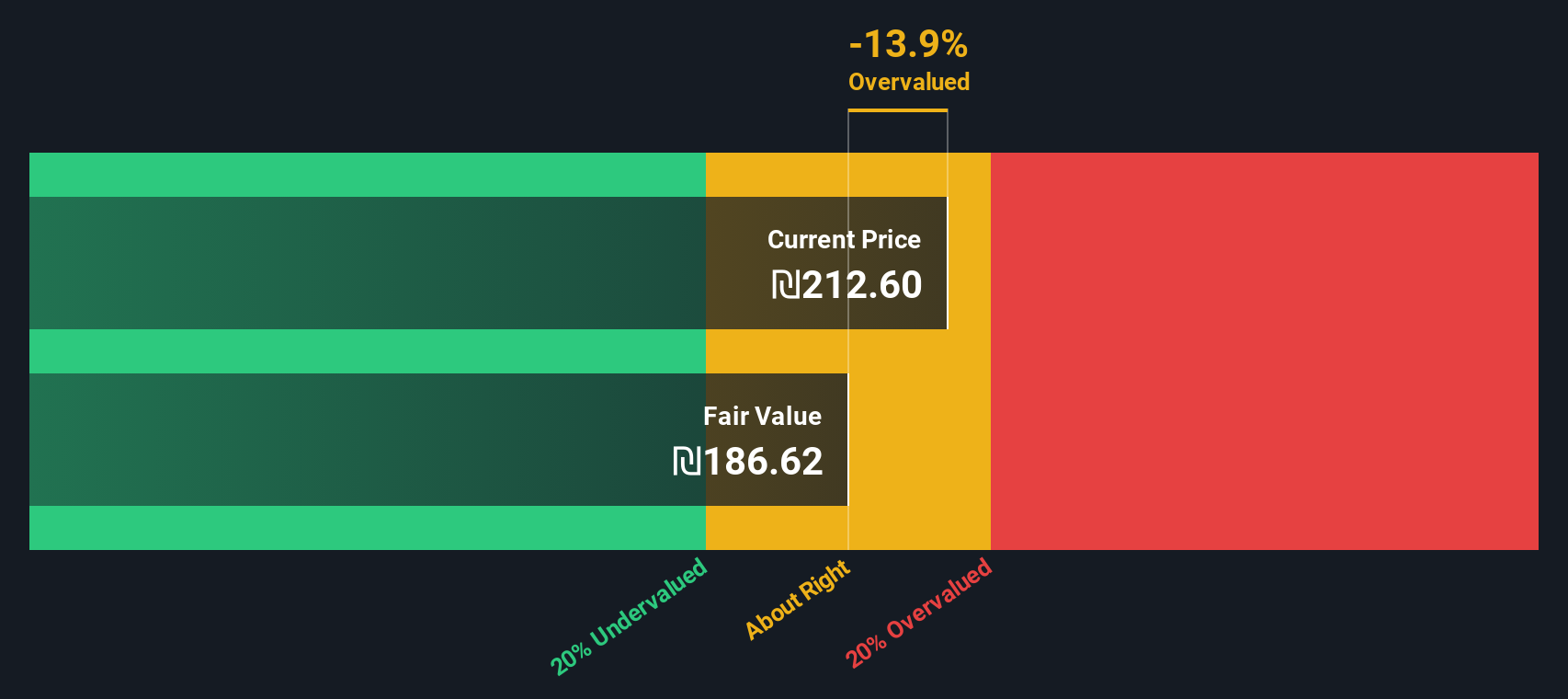

Looking from another angle, the SWS DCF model suggests AFI Properties could be overvalued, with shares trading about 14% higher than its current estimated fair value of ₪186.62. This method takes future cash flows into account and offers a longer-term perspective compared to earnings ratios.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AFI Properties for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 923 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AFI Properties Narrative

If you have a different perspective or want to investigate the numbers on your own terms, you can easily craft your own AFI Properties narrative in just a few minutes, and even Do it your way.

A great starting point for your AFI Properties research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Opportunities?

Missed gains are hard to ignore when there’s so much potential waiting. Strengthen your portfolio by checking out these carefully curated investment avenues making waves this year:

- Jump on innovations redefining medicine and capitalize on rapid breakthroughs through these 30 healthcare AI stocks shaping future healthcare solutions.

- Unlock strong, reliable returns by tapping into these 16 dividend stocks with yields > 3%, designed for consistency and impressive yield potential above 3%.

- Position yourself early in the tech race by joining these 25 AI penny stocks, which are changing how industries harness artificial intelligence, from automation to insights.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:AFPR

Proven track record and slightly overvalued.

Market Insights

Community Narratives