As global markets navigate the aftermath of the longest U.S. government shutdown in history, investors are observing mixed performances across major indices, with small-cap stocks particularly underperforming due to heightened sensitivity to interest rate movements and ongoing concerns about elevated valuations. In this environment, identifying high-growth tech stocks requires a focus on companies that can demonstrate resilience and adaptability amid economic uncertainties and shifting market dynamics.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 33.47% | 39.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Gold Circuit Electronics | 25.79% | 31.13% | ★★★★★★ |

| Pharma Mar | 22.94% | 42.63% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| eWeLLLtd | 25.08% | 25.14% | ★★★★★★ |

| CD Projekt | 35.69% | 51.01% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Sensirion Holding (SWX:SENS)

Simply Wall St Growth Rating: ★★★★☆☆

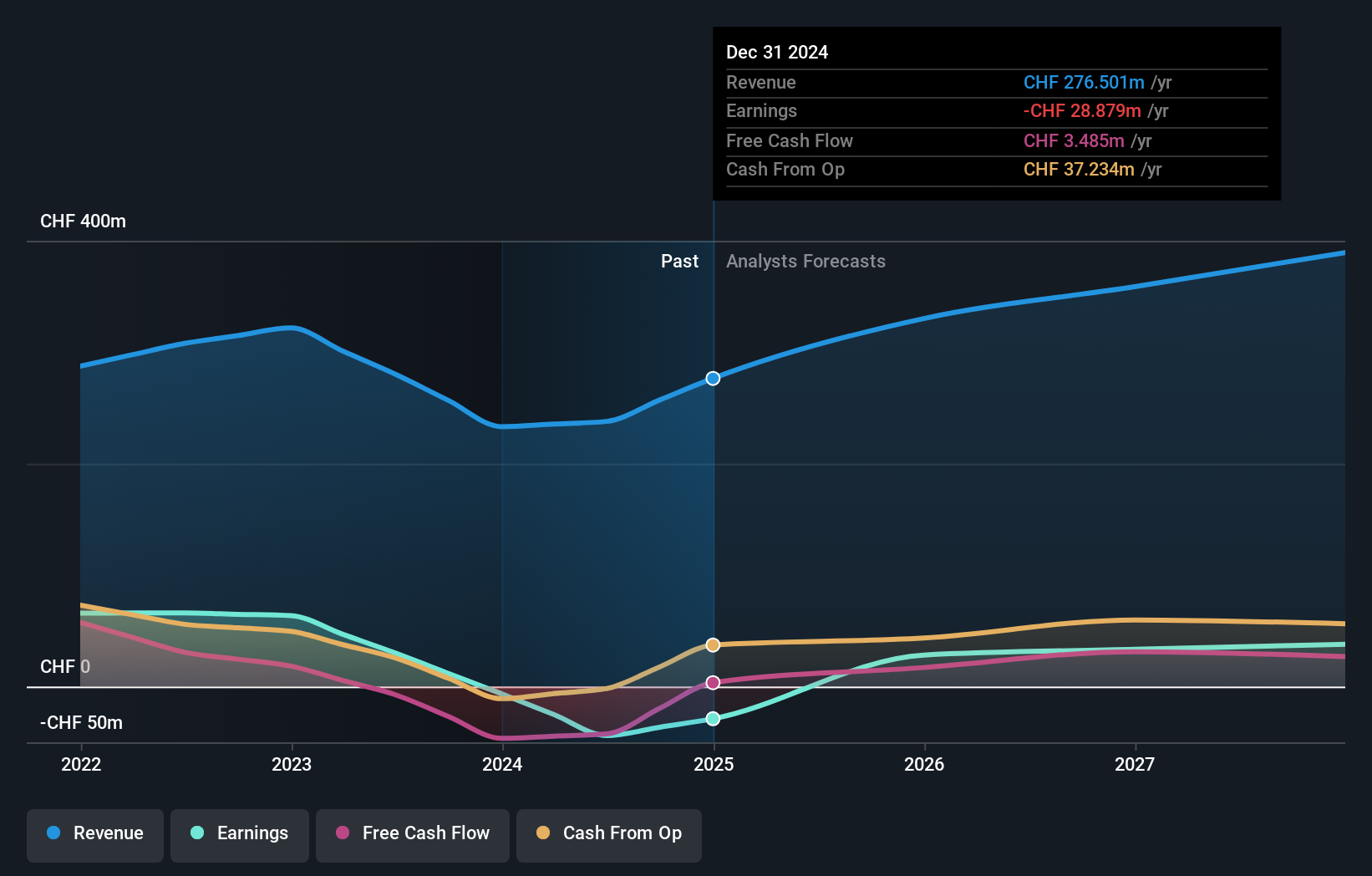

Overview: Sensirion Holding AG is involved in the development, production, sale, and servicing of sensor systems, modules, and components across various regions including Asia Pacific, Europe, the Middle East, Africa, and the Americas with a market cap of CHF830.40 million.

Operations: The company generates revenue of CHF333.08 million from its sensor systems, modules, and components business across multiple regions.

Sensirion Holding AG's strategic expansions and product innovations highlight its robust positioning in the high-tech sensor market. The company's recent groundbreaking for a new production facility in Stafa, designed to meet advanced cleanroom standards, underscores its commitment to long-term growth and technological advancement. This move is set to secure over 800 jobs and enhance production capabilities significantly. Additionally, the launch of the SGM5304 gas meter module showcases Sensirion’s focus on future-ready, energy-efficient solutions that cater to global needs with a lifespan of up to 25 years. With revenue expected to grow by 7.4% annually and earnings projected at an impressive rate of 27.4% per year, Sensirion is not just expanding physically but also financially, outpacing average market growth rates significantly.

Kamada (TASE:KMDA)

Simply Wall St Growth Rating: ★★★★☆☆

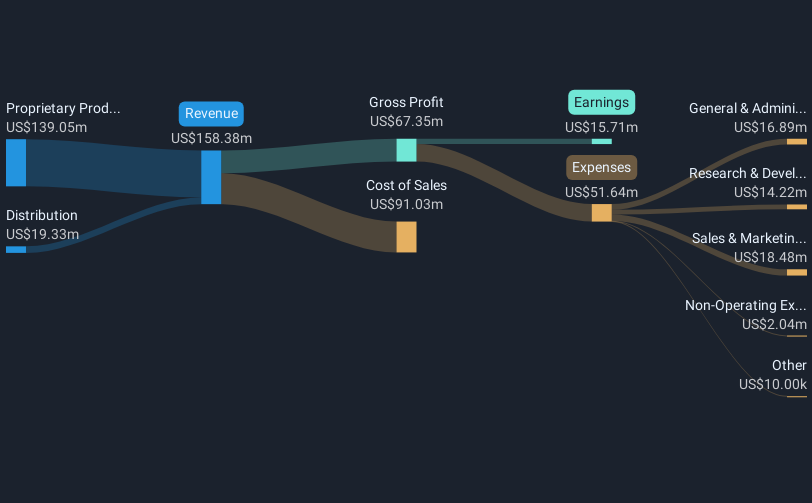

Overview: Kamada Ltd. focuses on the manufacturing and sale of plasma-derived protein therapeutics, with a market capitalization of ₪1.33 billion.

Operations: Kamada Ltd. generates revenue primarily through its Proprietary Products segment, contributing $149.39 million, while the Distribution segment adds $25.40 million.

Kamada Ltd. has demonstrated robust financial performance with a notable 30.1% earnings growth over the past year, outpacing the Biotechs industry's modest 0.7% increase. This growth trajectory is supported by an aggressive R&D investment strategy, aligning with its revenue expansion at an annual rate of 11.5%. Recent endeavors include initiating a clinical trial for CYTOGAM® to address CMV infections in transplant recipients, highlighting their focus on addressing critical unmet medical needs. With projected earnings growth of 21.7% annually, Kamada is strategically positioning itself to leverage scientific innovation and market dynamics to enhance its competitive edge in biotechnology.

- Unlock comprehensive insights into our analysis of Kamada stock in this health report.

Evaluate Kamada's historical performance by accessing our past performance report.

Docebo (TSX:DCBO)

Simply Wall St Growth Rating: ★★★★★☆

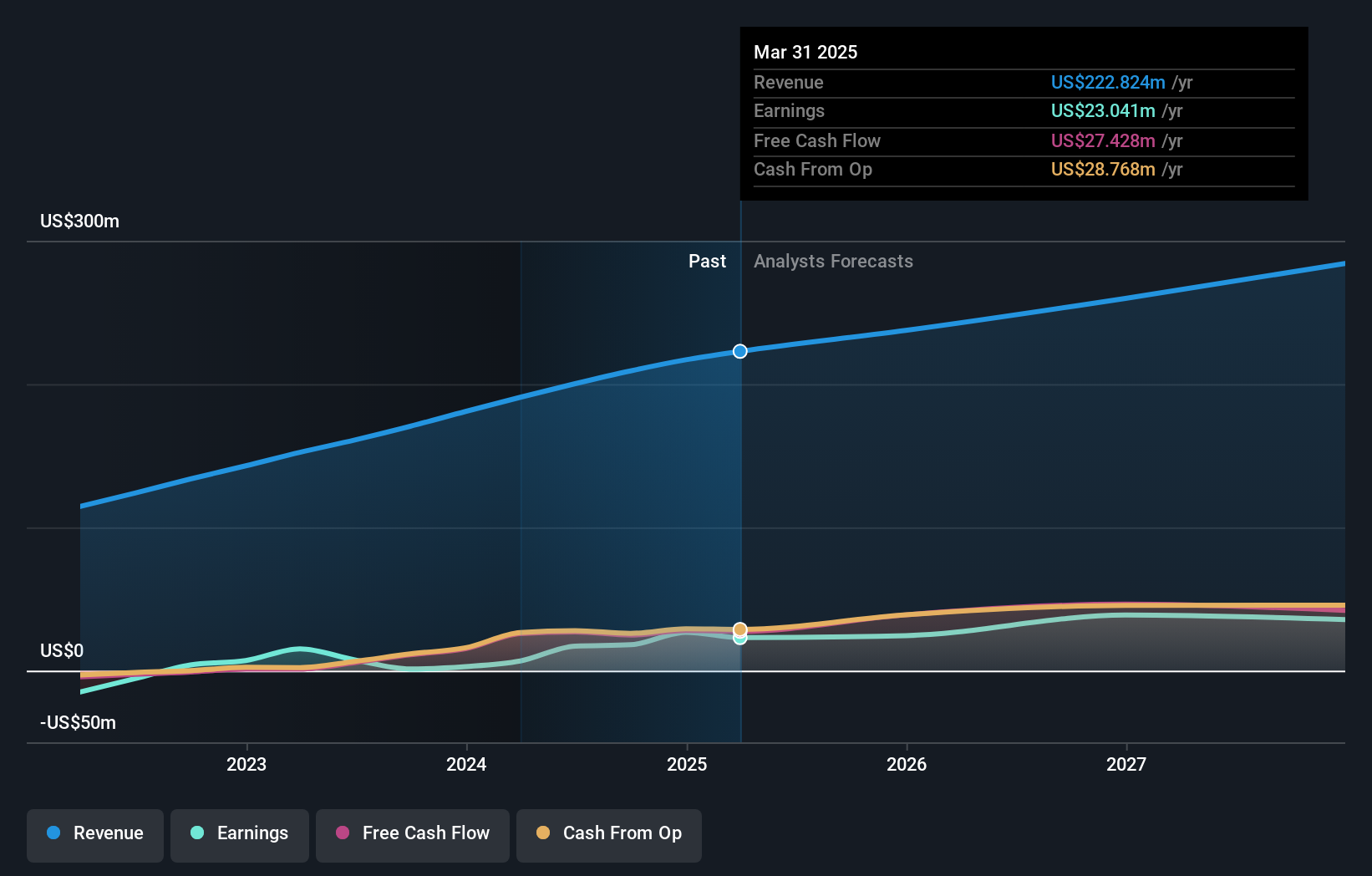

Overview: Docebo Inc. develops and provides a learning management platform for training across North America and internationally, with a market cap of CA$831.30 million.

Operations: The company generates revenue primarily from its educational software segment, which accounts for $236.69 million.

Docebo's recent financial performance underscores its robust position in the tech sector, with third-quarter sales rising to $61.62 million from $55.43 million year-over-year and net income increasing to $6.11 million from $4.96 million. This growth is part of a broader trend, with annual revenue expected to climb by 11.4%. Notably, Docebo's commitment to innovation is evident in its R&D spending, crucial for sustaining its competitive edge in a rapidly evolving e-learning market. The company's strategic focus on scalable software solutions through SaaS models exemplifies how it leverages technology trends to enhance user engagement and client outcomes, positioning it well for anticipated future growth amid dynamic market demands.

- Click here and access our complete health analysis report to understand the dynamics of Docebo.

Explore historical data to track Docebo's performance over time in our Past section.

Key Takeaways

- Unlock more gems! Our Global High Growth Tech and AI Stocks screener has unearthed 243 more companies for you to explore.Click here to unveil our expertly curated list of 246 Global High Growth Tech and AI Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SENS

Sensirion Holding

Engages in the development, production, sale, and servicing of sensor systems, modules, and components in the Asia Pacific, Europe, the Middle East, Africa, and the Americas.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives