Turpaz Industries (TASE:TRPZ): Assessing Valuation After Strong Q3 and Nine-Month Earnings Growth

Reviewed by Simply Wall St

Turpaz Industries (TASE:TRPZ) released its third quarter and nine-month 2025 earnings, highlighting strong year-over-year sales growth and higher net income. Both of these factors caught the attention of investors looking for business expansion signals.

See our latest analysis for Turpaz Industries.

Turpaz Industries’ strong 2025 earnings have kept momentum on its side, with the share price surging 13.8% in the past month and delivering a staggering 199% year-to-date share price return. The three-year total shareholder return of 258% underscores sustained investor confidence, as recent results seem to fuel optimism about the company’s growth prospects.

If Turpaz’s rapid rise has you thinking about where the next wave of growth could come from, now is the perfect time to discover fast growing stocks with high insider ownership

With such remarkable returns and robust financials on display, the key question emerges: is Turpaz Industries still undervalued, or has the market already priced in most of its future growth potential?

Price-to-Earnings of 117.9x: Is it justified?

Turpaz Industries is currently trading with a price-to-earnings (P/E) ratio of 117.9x, far above its local peers. The last close price of ₪57.76 reflects a significant market premium relative to both peer companies and the industry average.

The price-to-earnings ratio measures how much investors are willing to pay today for a shekel of earnings. For chemicals companies, this metric offers a snapshot of market expectations for future growth and profitability, especially in a sector where earnings can be cyclical or tied to global trends.

With Turpaz’s P/E ratio at 117.9x, investors are paying about five times more for each shekel of earnings than the average peer, which sits at 14.5x. This premium signals the market’s high confidence in Turpaz’s future growth prospects or reflects high expectations for earnings expansion. Compared to the Asian Chemicals industry average of 22.5x, Turpaz is even more expensive versus the broader sector. Without further context, such a multiple can be hard to justify for most companies in this space.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 117.9x (OVERVALUED)

However, continued share price gains could stall if net income growth slows or if market sentiment shifts away from high-valuation stocks like Turpaz.

Find out about the key risks to this Turpaz Industries narrative.

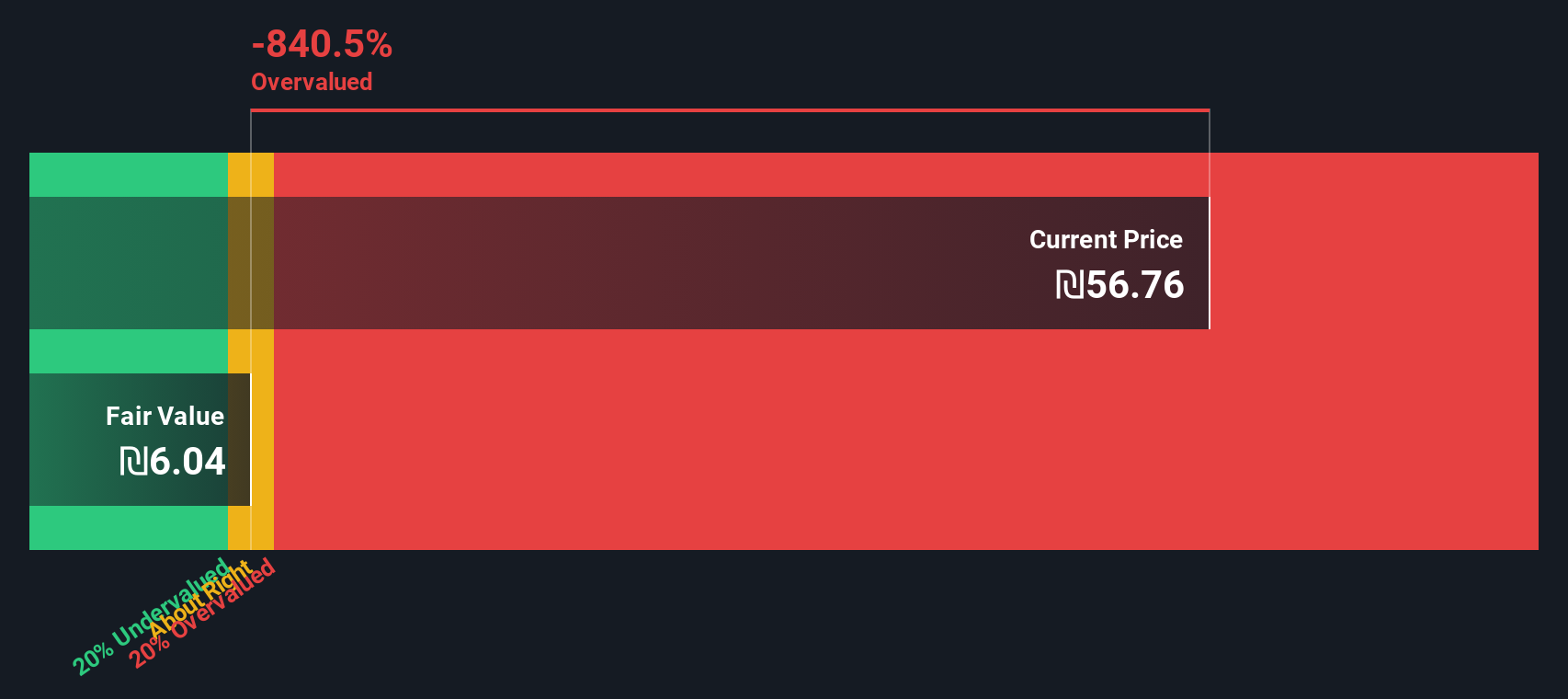

Another View: Discounted Cash Flow Analysis

Taking a different angle, our SWS DCF model estimates Turpaz Industries' fair value at ₪6.06 per share, a huge gap from the current price of ₪57.76. This suggests the market could be significantly overvaluing the company, or there may be more to the growth story than current models capture.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Turpaz Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Turpaz Industries Narrative

If you see things differently or want to dig into the numbers yourself, you can put together your own view in just a few minutes, so why not Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Turpaz Industries.

Looking for more investment ideas?

Expand your watchlist and take action now. Countless opportunities are out there, and you do not want to miss the next standout performer.

- Snap up early-stage value by uncovering hidden gems among these 3599 penny stocks with strong financials with rock-solid financials and untapped growth potential.

- Position yourself in industries set for disruption as you track leading innovators in artificial intelligence through these 25 AI penny stocks.

- Boost your dividend income by targeting companies with strong yields and financial stability connected through these 16 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Turpaz Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:TRPZ

Turpaz Industries

Engages in the development, production, marketing, and sale of scents in Israel, the Middle East, North America, Europe, Africa, Asia, and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives